Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

Avalanche (Avax) has been one of the extraordinary artists in recent weeks, increasing by over 53% from March 11 while Bulls tries to start a wider recovery rally. The strong rebound follows a brutal correction in which Avax has lost over 72% of its value since mid -December 2024, triggering the capitulation and fear spread throughout the market. Now, with an action of the prices that shows signs of strength, investors are cautiously optimistic, but uncertainty remains.

Reading Reading

While the recent event brought some relief, many analysts believe that the market can enter a consolidation phase. Avax is currently struggling to retain the $ 22 brand, a key resistance level that could determine whether the insight tendency continues or detaches itself. Several technical signals flash flashing when the momentum begins to slow down.

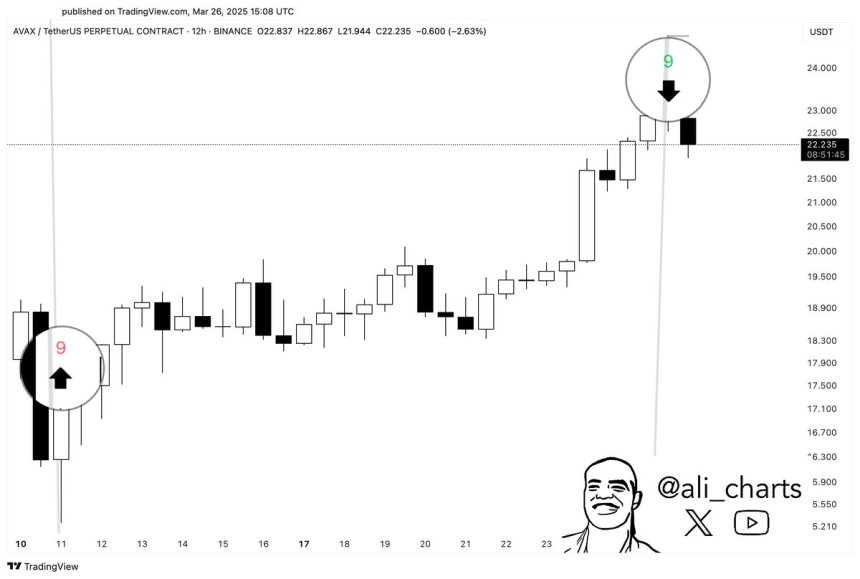

The high -level analyst Ali Martinez has shared insights on X, underlining that the TD sequential indicator is now presenting a new sales signal. This suggests that Avax may be due for short -term pullback or a lateral movement period. With the wider market still under pressure, the traders are looking closely to see if Avalanche can maintain its earnings or losing momentum.

The avalanche wakes up but has to face serious risks

The avalanche is showing signs of life after suffering months of intense sales pressure. Like many Altcoin, Avax has been strongly influenced by macroeconomic volatility, losing over 70% of its value from mid -December 2024. Now, while the upward momentum begins to return through selected altcoins, Avalanche is trying to stage a recovery manifestation. The recent 53% increase from 11 March has revived the hopes that Avax can be ready to burst, but the contrary winds remain.

The largest market environment continues to be modeled by uncertainty. The fears of the commercial war and unstable macroeconomic signals have maintained the pressure on risk activities, including cryptocurrencies. Many investors remain cautious and are still downloading positions near current levels, worried about the long -term direction of the market. While the momentum is returning to some sectors, the path to the avalanche is far from clear.

The high -level analyst Ali Martinez recently highlighted a technical development using the TD sequential indicator. After thoroughly called the recent fund and a 50% rally in Avax, the indicator is now flashing a sales signal. This suggests that the avalanche could be due for a short -term portrait or a consolidation period before any further movement.

The $ 22 level remains a crucial resistance area for Avax. A temporary temporary here can be healthy: to give the bulls the time to group before trying a breakout. If Avax is able to maintain key support and reset after the current rally, it could build a stronger base for a decisive thrust above $ 22 in the weeks to come. For now, all eyes are in action on prices while the sales of the avalanches between correction and continuation in a market are still blurred by uncertainty.

Reading Reading

Avax struggles are below $ 22 because the bulls aim at $ 30 breakouts

Avalanche (Avax) is currently exchanged at $ 21.80 after briefly reached $ 23.40 only two days ago. The recent Pullback reflects the momentum of cooling while the bulls struggle to maintain pressure near the short -term resistance. However, the trend remains intact – for now. To support the recovery rally, the bulls must defend the current levels and push towards the recovery of the sign of $ 30, which aligns with the 200 -day mobile average (but) and the exponential mobile of 200 days (EMA). A positive success above this area would be a strong upward signal and could mark the beginning of a bigger trend.

However, failure to comply with $ 20 in the next few days would be a warning sign. A break below this level could trigger an increase in sales pressure and send Avax to the $ 17 area, a key support area of the previous consolidations. While Avalanche continues to trade in a volatile interval, the next sessions will be crucial to determine the short -term direction.

Reading Reading

With the market still under macroeconomic pressure, the bulls must act quickly to maintain the momentum. A decisive move above $ 30 remains the goal, but keeping the level of $ 20 is equally important to avoid a deeper portrait and a renewed bearish feeling.

First floor image from Dall-E, TradingView chart