Cryptocurrency New Year is here, and the biggest cryptocurrency stories of 2024 are back in the spotlight along with VanEck’s cryptocurrency predictions for 2025.

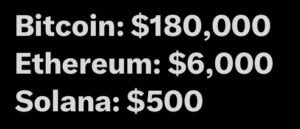

US investment firm VanEck just released its conservative cryptocurrency forecast for 2025. Thoughts?

If the destination is 2025, 2024 was the year cryptocurrencies peaked. Bitcoin and Ethereum Spot ETFs became a reality, the Halvening collapsed like clockwork, and a crypto-friendly US government took power. Oh, and a squirrel named Peanut inspired a meme coin frenzy. It’s been a year of absolute mania, the kind you can’t write down.

So maybe VanEck’s cryptocurrency predictions for 2025 aren’t so unrealistic after all?

Let’s take a trip down memory lane. Here are the top cryptocurrency stories of 2024.

The Bitcoin halvening is about to explode cryptocurrencies

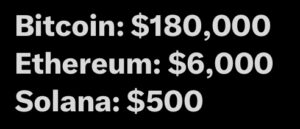

I got into Bitcoin in 2019, and when the 2020 Halving happened, I didn’t really know what to expect: was my BTC going up, sideways, or down?

Well, I’m glad I held: Bitcoin slowed sharply after the halving, gaining a meager +6% despite the main event, but my holding behavior was rewarded when the price then exploded 548% to to reach new historic highs.

We are about to see a similar trend in 2025. Despite Bitcoin’s 2024 halvening in April and Bitcoin surpassing $100,000, sentiment is still mixed. Looking at today’s market, especially the X cryptocurrency market, there is a lot of FUD (fear, uncertainty, doubt) circulating – this is expected.

Bitcoin Halving implements a reduction in the block reward given to Bitcoin miners. In 2024, mining rewards will be reduced from 6.25 BTC to 3.125 newly minted bitcoins.

This process gradually increases Bitcoin’s price floor over time – with a 50% reduction in new supply – which can maintain price action for up to 14 months. Fasten your seat belt; we are still in the range for a BTC supply shock.

The biggest story of the year

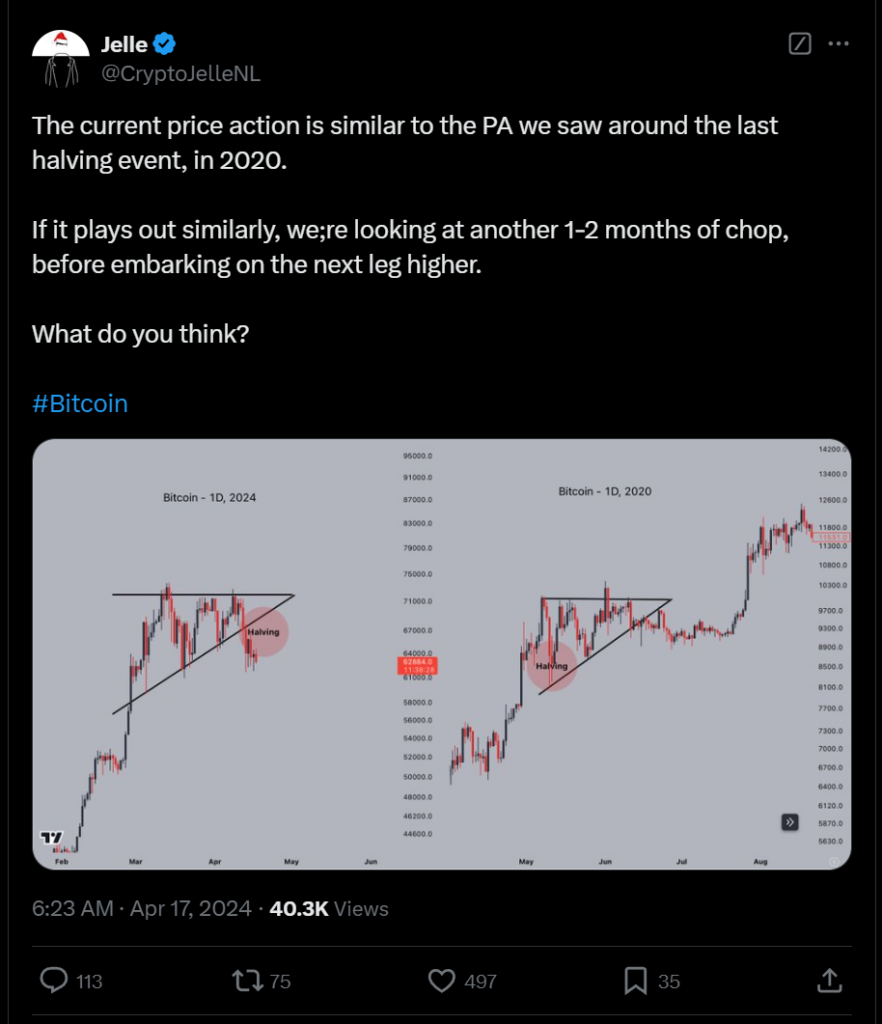

Moving forward a little, the biggest news of the year is undoubtedly the return of President-elect Donald Trump from the political graveyard.

Think about it:

- They falsely persecuted him for Russian collusion (Steele Dossier failed)

- They tried to impeach him for collusion with Ukraine (appeal to Zelensky)

- They chased him again and failed to take political documents (something every president has done)

- They shot him

- They called him Hitler

And Trump still won. Not only that, but he is now the first pro-Bitcoin president and holds the most pro-crypto congress in American history.

If Trump can create a BTC strategic reserve, free Silk Road creator Ross Ulbricht, and make America the world’s crypto hub, then $100,000 BTC will be the only beginning.

Microsoft Rejects Bitcoin Investments

And finally, Microsoft doesn’t bite. While flashy names like Tesla and MicroStrategy bet on cryptocurrency, the tech giant has maintained its steadfast approach. A proposal from the National Center for Public Policy Research (NCPPR) and Michael Saylor presented Bitcoin as a hedge against inflation, but Microsoft seemed unimpressed.

With $78 billion in cash and marketable securities, the NCPPR suggested allocating 1% (a relatively small portion) to Bitcoin to explore the potential for higher returns.

It would always have been unexpected if Microsoft had bought. Low risk characterizes Microsoft, and that’s why it’s still here. Bitcoin could skyrocket above $200,000 and Microsoft wouldn’t back down. This company is Warren Buffett in a pillow factory. When they finally enter the world of cryptocurrencies, expect them to stick around for decades.

That said, it was never about convincing Microsoft to buy Bitcoin. It’s about sending a message. In the next cycle, they may think differently once they realize the lost earnings.

EXPLORE: The 18 best new cryptocurrencies to invest in 2024

MicroStrategy’s executive chairman, Michael Saylor, is trying to get these companies to trade billions of worthless fiat that banks continue to print for literal gold (which is scarce).

It sees at least 20 years into the future and seeks to bring others, such as Microsoft, with it. No bank will betray this man and no government will seize his digital gold as it did in 1930. However, the board has remained steadfast, highlighting the risks associated with Bitcoin’s infamous price instability, which makes it less suitable for long-term business strategies term. It’s a fitting conclusion for 2024.

This year ends with a sense of momentum: what we’ve accomplished matters, but the bigger fight is still out there.

EXPLORE: Nvidia gets hit with class action lawsuit over cryptocurrency miner sales after Supreme Court denies appeal

Join the 99Bitcoins News Discord here for the latest market updates

The post The Biggest Cryptocurrency Stories of 2024: Crypto Year in Review appeared first on 99Bitcoins.