Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

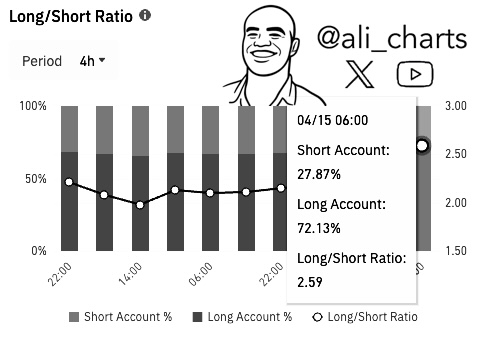

A new instantaneous of the Binance’s futures market data shows that Dogecoin attracts a significantly bullish position among traders. According to a graph shared by Ali Martinez (@ali_charts) on X, 72.13% of binance users with open dogecoin positions are currently long, leaving only 27.87% on the short side. “72.13% of traders on Binance with the open positions of Dogecoin Doge is currently long!” Martinez wrote, underlining how distorted the feeling is towards a price move upwards.

What does this mean for the dogecoin price?

What does a vast majority of long majority for Dogecoin prospects actually mean? In many cases, an imbalance pronounced like this suggests that most of the market participants expect the price to continue to rise, at least in the short term. When so many traders bet on earnings, optimism often reflects – or even excitement – about the token momentum. Dogecoin has repeatedly shown his ability to inspire the fervor between retail investors and great speculators, therefore the peaks of bullish interest are difficult to surprise.

Reading Reading

This type of data can be interpreted as a potential sign of force for dogecoin. If the market aligns with a bullish narrative, the continuous purchase pressure can materialize and the prices can push higher. However, it’s not always that simple. When a huge piece of the market tilts on the one hand, the risk increases that a sudden decrease can trigger a wave of forced liquidations between those long positions. If the wider cryptocurrency market renounces – or if dogecoin faces any unexpected obstacle, the traditionists who have skipped waiting for a quick profit could end up running for the exits, amplifying the moves down.

However, the figure “72.13%” is unequivocally high, which is sufficient to attract anyone’s attention. A long/short ratio that high does not guarantee a continuous rally; Instead, he paints a picture of the current sentiment between a specific subset of traders. It is a snapshot over time, taken from the activity of one of the busiest cryptographic exchanges in the world. Even so, it is a solid reminder that, at this moment, a large number of dogecoin traders on Binance believe that the path of the lower resistance is up.

Reading Reading

Of course, market conditions can move quickly. Some merchants will keep an eye on the overall liquidity, Bitcoin behavior and any tariff news from the President of the United States Donald Trump. Dogecoin is known for sudden increases in prices, stimulated by the hum of social media or by the shoulders by influential figures, therefore also the decisive data such as this long/short relationship do not completely foresee what will come later. But it gives us a vision as a job to how the participants in the Binance are positioning themselves and, in doing so, prepares the soil for the short -term intrigue of Dogecoin.

For now, the pure domain of long positions seems to say: the traders remain bullish and are willing to support that feeling with open contracts. It could be a sign of trust in the resilience of Dogecoin, or it could be a configuration for unexpected volatility if the feeling launches. Whatever the way it takes place, Martinez’s ranking sheds light on how the enthusiasm for this resource inspired by the meme continues to run in some corners of the cryptocurrency market.

At the time of the press, Dogecoin was exchanging just under his multi -year trend line, following a refusal at the level of retracing fibonacci of about $ 0.167. A renewed drop in the red support area near $ 0.14 could be on the table if Doge closes below the trend line. The downside, FIB 0.786 remains the most critical level of resistance, followed by a potential channel test near $ 0.18.

First floor image created with Dall.e, graphic designer by tradingview.com