Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Arthur Hayes has never been shy towards large numbers, but his last essay, the signature of the time, frames those goals within a large macro thesis: a boom in war -style US credit which – if it takes place as expected – could send the Bitcoin and Crypto markets in their biggest bubble ever.

Writing on 22 July, the Bitmex co -founder claims that financial markets, such as dancers, must keep time with the “kick drum” of credit creation. “If we are out of time, we lose money,” he warns, before identifying the rhythm that he believes that traders must follow today: US industrial policy in war time or what calls a transition to economic “fascism”.

Hayes hits his argument on the newly announced agreement of the Pentagon with the MP materials, according to which the United States Defense Department will become the largest shareholder of the miner, guarantees a floor price for critical elements of rare earth at the double market rate in China and suspended a bank loan of $ 1 billion to build a Nevada transformation system. The structure, writes, is the model for “QE 4 poor”, a credit multiplier that expands the offer of money without formal congress approval.

Reading Reading

In his schematic example, a single commercial loan for MP materials “Create $ 1,000 of New Fiat Wampum”, therefore it is rippled outwards as wages, deposits and discounted treasure loans. “The money multiplier is> 1 and this production in war time leads to an increase in economic activity, which is explained as” growth “, observes Hayes. The result, says, is an inevitable inflation, but also” profits managed by the government “for banks and industry.

Because Bitcoin and Crypto are the bubble of choice

Hayes’ historical analogy is the boom in the property of the 90s -2020 of China, where an expansion of five thousand percent of forced families M2 in apartments, inflating the values of the land and the coffers of the local government. In the United States, he claims, the socially acceptable pressure valve will be digital resources.

Two political shifts underlying this call. First of all, the pension plans – a pool of $ 8.7 trillion – can now allocate the crypt under a recent executive order. Secondly, the floating proposal of the Trump campaign to eliminate the capital tax -Gains on digital activities could, in the words of Hayes, provide “crazy growth of credit guided by the war” without “no fucking taxes”. The largest attraction for politicians, he claims, is demographic: the younger and different investors have cryptocurrencies in greater proportions than those who own actions, therefore a bull market “would create a wider series, more diversified of people who are satisfied with the economic platform of the party in power”.

Reading Reading

Even a boom with credits must find an audience for the growing federal deficit. Hayes’ solution is the sector of Stablecoin, which already places most of its activities in custody in the Treasury invoices of the United States. The data on chain, observes, suggest that about nine cents of each new dollar in the market value of total crypto migrate in Stablecoin. “Suppose Trump push the capital of the total market to $ 100 trillion by 2028,” he writes; “This would create about $ 9 trillions of purchasing power t -bill.”

The mechanism recalls the financing of the Second World War, when the treasure diverted the issue to short -term invoices. In Hayes’ opinion, a cycle of car emerges -rinphorzo: the supply in war time feeds the expansion of the credit, the highest credit lifting crypt, the largest demand for the capitalization of cryptocurrency Stablecoin for the demand for T -Bills and those back purchases are further deficits.

Tactics of trading and annual call

Against this background Macro Hayes declares his investment vehicle, Maelstrom, “completely invested” and explains why: “It is quite simple: Maelstrom is completely invested. Because we are Degens, the shit space offers extraordinary opportunities to go overperform Bitcoin, the cryptocurrency reserve resource. […] Ether was the biggest crypt one most hated. No longer; The class of western institutional investors, whose main cheerleader is Tom Lee, loves Ether. Buy first, ask questions later. “

His numerical beliefs are explicit: Bitcoin $ 250,000 and ether $ 10,000 by 31 December 2025. The western credit geyser is, he writes, “a new asshole is about to tear the market”. Yet repeatedly reminds readers that these are personal opinions, not of investment advice.

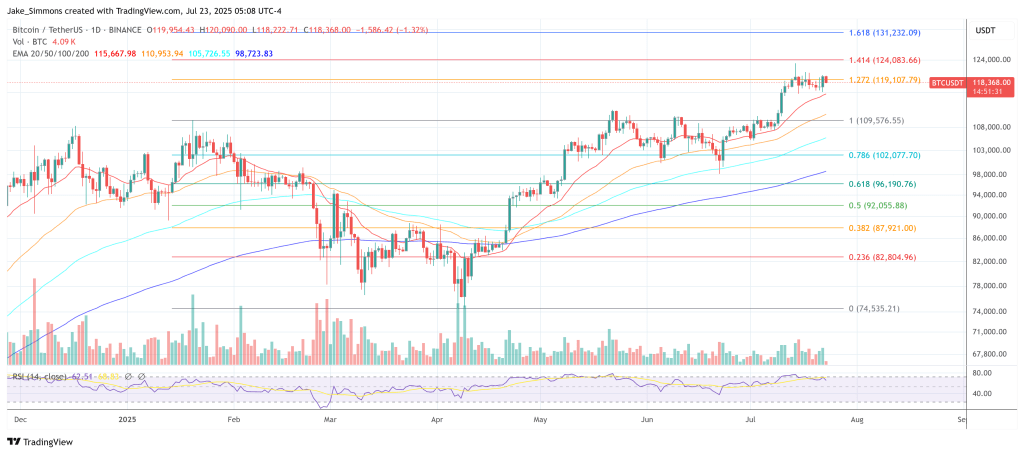

At the time of the press, Bitcoin exchanged $ 118,368.

First floor image created with Dall.e, graphic designer by tradingview.com