Has bitcoin bulls ended? BTCUSD disrupts less than 80,000 dollars, where sellers control, as they hide Q4 2024 gains. Will BTC Bears dominate in Q2 2024?

There was a harsh shift in Bitcoin and encryption markets. Despite the high optimism and assurances by believers that the last decline is just an ordinary correction and that buyers control, and prices continue to decrease critical support levels.

Bitcoin price analysis

After announcing April 2 by Donald Trump and the beginning of mutual definitions, the bitcoin price temporarily rose to 88,500 dollars before it collided strongly and violated $ 85,000.

Since then, traffic was in one direction, with sellers, forcing the most valuable currency in the world under the psychological 80,000 sign. At this pace, BTC/USD will not only slip Q1 2025 LOWS, but there is a real risk of currency drop to 2021 levels worth $ 74,000, and bounces on some of Best purchase in 2025.

When this happens, the sellers had reflected all the gains in the Q4 2024, and the possibility of another leg will be about $ 50,000 on the table.

Technical candles arrangements on the daily chart BTC/USDT draw a bleak picture. The instant local resistance is $ 90,000, while the region ranges between $ 75,000 and $ 78,000 is a support zone.

In order for the bullish trend to form, buyers must interfere in the current topical prices, and spare BTC with a discount. However, if sellers press today, bitcoin and the broader encryption market may crack, which extends last week as sellers target Fresh 2025 levels.

Was BTC/USD bull operated?

It is a possibility that cannot be rejected directly and may disrupt expectations – especially for some holders Best MEM currencies for purchase.

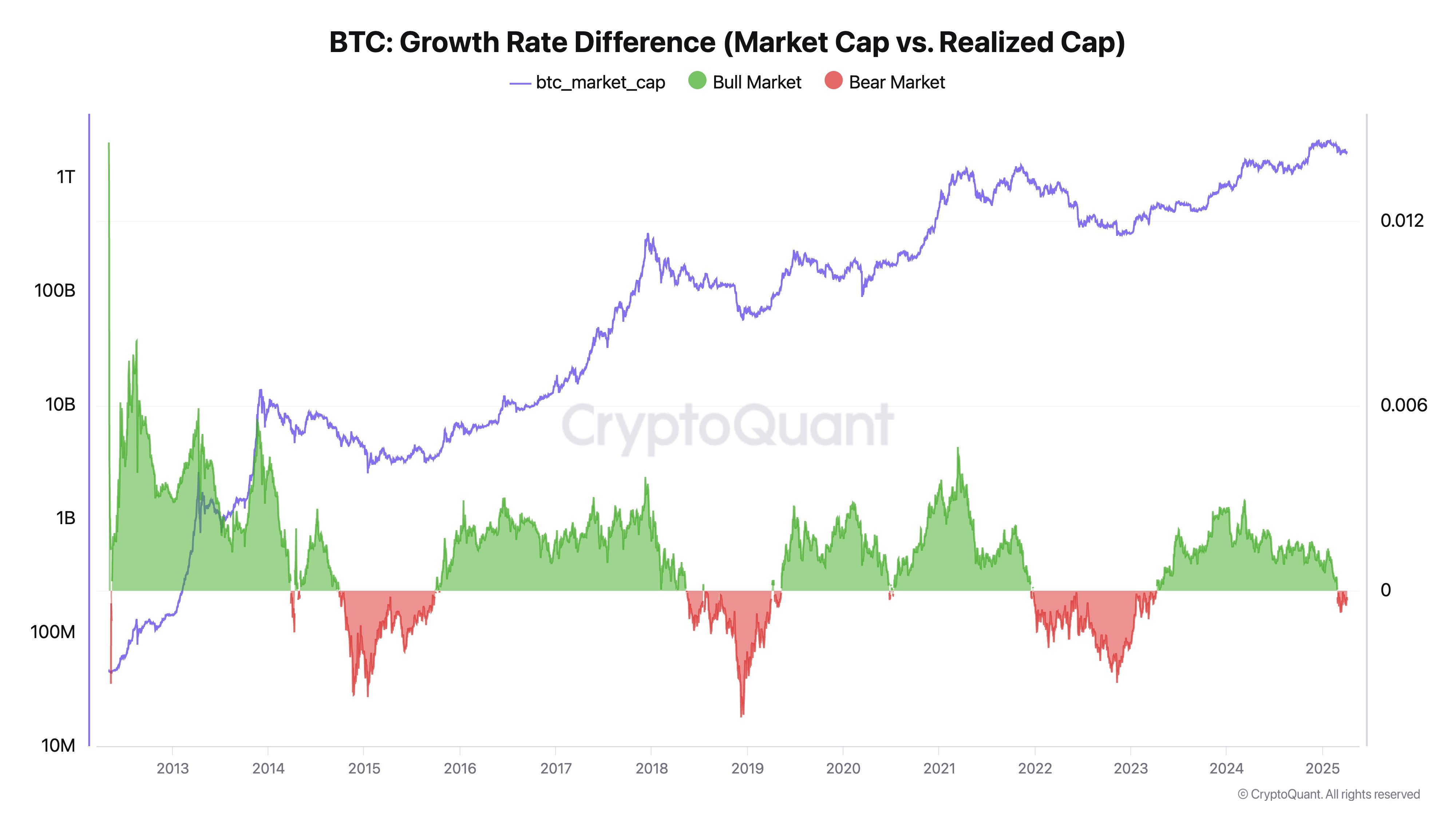

Bitcoin also stumbles on enlarged fears, Ki Jong Go, co -founder of Cryptoquant, to publish On X, Bitcoin Bull Run may now be in the back vision mirror.

Unfortunately, the market tone remains dark at the time of the press, and the current market data is more than just correction.

From JU’s point of view, there are signs that this is the end of the bull cycle that raised assessments to record altitudes in 2024. Given the main data on the series, JU argues that solid evidence shows that Bitcoin Bulls has no chance and that the upper trend has ended.

The basics of its analysis are the main changes in the achieved cover.

Explore: The best new encryption currencies for investment in 2025

The capital flows to Bitcoin, but the prices are stagnant

Unlike the maximum market scale, which doubles the current price of BTC through the circulating offer, the maximum achieved is something else.

It calculates the total price of Bitcoin based on when the coins were transferred again to the chain. Simply put, the maximum achieved the amount of capital that enters the market and is established on the behavior of the wallet.

(source)

Joe said the cover cover is similar to the “thermometer for the real money that is transferred to Bitcoin.”

He added that the maximum achieved is increasing, but the maximum market is stagnant and declined. The new capital enters, but the maximum market does not move, which is a declining signal, it turns out that although buyers intervene, the sale weight is very strong for the market.

In the upscale market, if the maximum achieved is at a height, the maximum market will expand sharply, reflecting the buyer’s interest.

“On the real emerging market, small amounts of capital pay large price movements. When this dynamic is reflected – when the large flow of capital is not able to move the needle – this means that we are already in the bear market,” the analyst pointed out.

Explore: 10 best AI’s Cracks for Investment in 2025

Have Bitcoin crossed the line?

In a separate post, another analyst Add This, based on NUPL (net profit/loss) and SOPR (consuming output rat ratio), real sales pressure usually appears about 800 days after the start of the upscale cycle.

The analyst said: “We have now reached a mark of 800 days,” historically, at the start of the original sale. “

(source)

Interestingly, the analyst added that the pressure pressure may take more than 1000 days to show it during the upscale gatherings without the events of the black swan.

However, the pressure appears to be escalating due to macroeconomic pressure such as definitions and high rates.

The good news is that bitcoin is flexible. Despite the tremors, there was no collapse in the market, partly due to the purchase of companies that settle the market.

For the first time in history, Bitcoin does not move in Lockstep with the stock market. He is now acting like hedge for geopolitical uncertainty. When the stock market decreased through Covid, as well as Bitcoin. This has always been over the past 10 years. But not this time …

– Tyler Winklevoss (Tyler) April 6, 2025

Tyler Winkelvos from Gemini added that Bitcoin also appears as a hedge against political uncertainty.

He discovers: 16 Repeating the next explosion in 2025: predictions and expert analysis in the encrypted currency

Bitcoin Bull runs? BTCUSD price analysis shows the shift in the feeling

- Bitcoin price decreases to less than 80,000 dollars, where sellers are responsible

- Bitcoin Cap

- Technical Analysis BTCUSD: BTC resistance at $ 90,000

- Will Bitcoin buy companies stability and make BTC hedge against political uncertainty?

Post -Bitcoin and Crypto Bull Run officially? BTC appeared less than $ 75,000 first appeared on 99bitcoins.