Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

Bitcoin is not the only one who has suffered. Investors are worrying since the peak cryptocurrency has followed the recent drop in the ‘Ps & P 500. But if the past performances are indicative, Bitcoin could experience a rebirth.

Reading Reading

The President of the United States Donald Trump has taken on the assignment in November for a second term, but since then the United States stock market has decreased by about 10%. Since the global recession hit the markets in 2009, this is the worst start for an American presidency. Although there are numerous causes for this decline, the uncertainty about the economic strategy and the concerns about inflation have contributed.

In the past, it has often reported imminent volatility when S&P 500 and Bitcoin decrease simultaneously. The 2022 bears market, which saw prolonged losses, was the last time that both markets fell precipitously at the same time. Not all drops, however, lead to prolonged recessions. Some led to a remarkable rebound, above all because the halving cycles of cryptocurrency.

How does the market react to Trump’s second mandate?

Since its return, the S&P 500 has decreased by 9%, marking the worst start of a presidency since 2009.

Then, a recession guided the drop. This time, uncertainty is in the driving place.

We go to the data 🧵👇 pic.twitter.com/a10f0qweb

– Cryptoquant.com (@cryptquant_com) March 12, 2025

Bitcoins and titles move together, for now

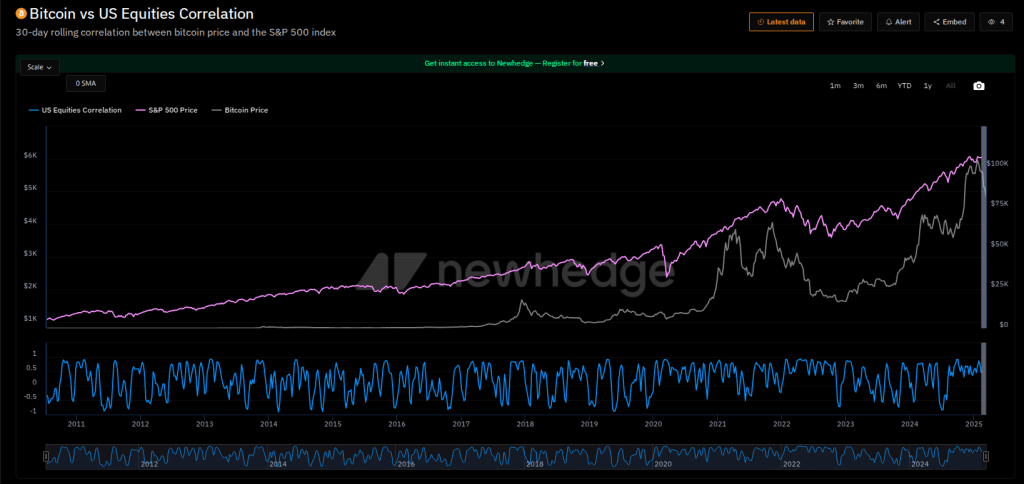

Bitcoin has long been known as “Digital Gold”, but now it works more as a technology stock. According to a cryptoquate research, the Bitcoin price monitored traditional markets, in particular the S&P 500. This model is not new. During the Covid-19 pandemic in March 2020, the crypt and actions fell together before recovering that year later.

But Inthetheblock analysts found that Bitcoin’s relationship with the S&P 500 has fallen essentially zero. This would suggest that, in line with the model of long -term owners, BTC is starting to migrate outside the conventional finance.

If this misunderstanding continues, the movement of the Bitcoin price could make less relying on the variations of the stock market.

Historical trends suggest a recovery

According to Cryptoquant, the previous data show that Bitcoin is often bounced following strong corrections. For example, in 2018, Bitcoin lost about 80% of its value before recovering in 2019. In the same way, after the 2020 accident, Bitcoin reached new maxima of all time in 2021.

Another statistics to keep an eye on is the Premium Coinbase index, which measures the difference in Bitcoin prices between money and binance. When this indicator becomes negative and then returns to a positive territory, he generally indicated a rebound of the imminent price.

Reading Reading

Attention and optimism among analysts

In the meantime, market analysts remain divided. Some warn that Bitcoin’s recession could indicate that the overall increase in the stock market is unsustainable. Tyler Richey, Sevens Report Research co-publisher, said that Bitcoin’s submarine under his January peak could be a warning sign for actions.

In the foreground of Gemini Imagen, TradingView chart