Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Bitcoin is currently in the balance in a Strictly compressed price Interval after having failed several times to break over $ 110,000 at the beginning of this month. The last few days have been characterized by the main cryptocurrency that exchanges about $ 105,000, without bulls or bears that take control. Despite the general consolidation, a thin but significant signal He is starting to flash under the surface, in particular on the 4 -hour graph, which could send Bitcoin to a new historical maximum.

Return of the rare divergence model on Bitcoin’s 4h graphic designer

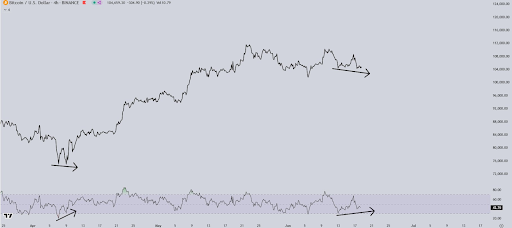

Crypto Analyst Luca (@CrypttTrattrades_) I brought to the social media platform x To share a graph that highlights an important technical development on the period of time of 4 hours of Bitcoin: the return of a bullish divergence. This signal, which previously appeared at the beginning of April, preceded the massive event that catapulted Bitcoin to the maximum of all times of 22 May of $ 111,800. The same divergence is forming again and another Bitcoin price The breakout can be very close.

Reading Reading

As shown in the 4 -hour candlestick table, the divergence is clearly illustrated between the action of prices and the relative resistance index (RSI). The price formed minimal lower, while the RSI printed higher minimal. This discrepancy acts as a first indicator that the sale of momentum is disappearing and that could follow the reversal to rise. The previous request of this model preceded a clear move from a minimum of $ 74,000 in early April to over $ 111,000 in a few weeks.

What does this divergence for the price of Bitcoin mean?

Relzist divergences on graphic graphs in the middle of time as the 4 hours have the reputation of being the first signals of inversion if supported by the increase in the volume. In the current case of Bitcoin, the appearance of this model could mean that the recent portment of $ 111,800 he ran his course. With the RSI who now moves on up even if the presses on slightly lower prices, Bitcoin could attend another storage phase hidden before his subsequent higher leg.

Reading Reading

If the model is faithful to its previous performances in April, the main cryptocurrency could be established for another push towards new levels of all time. Bitcoin is currently not far from a new historical maximum, as it is only about 5.5% from its price peak. On the basis of this, another strong breakout could easily aim beyond the previous $ 111,800 high.

Although Bitcoin’s price is relatively stagnant for now, the presence of this bullish comma is a reminder of how quickly things can change. The previous bullish divergence ended with an increase in prices of 50%. A similar performance from the current price level would be translate into another goal greater than $ 160,000.

At the time of writing, Bitcoin is exchanged at $ 105,700, increasing by 1.4% in the last 24 hours, already showing signs of the upward divergence signal that comes into action.

First floor image from Getty Images, a graphic designer from Tradingview.com