Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Bitcoin is browsing a highly volatile environment, as growing conflicts in the Middle East and intensifying the macroeconomic risks dominate global titles. Despite the growing uncertainties, BTC continues to keep a company above the $ 104k level, reporting a strong interest of the buyer in the key support areas. The bulls remain in control for now, but the macro hawl conditions, such as high yields of the American treasure, persistent concerns of inflation and geopolitical ridges, which can be made serious risks that could guide BTC below the critical sign of $ 100k.

Reading Reading

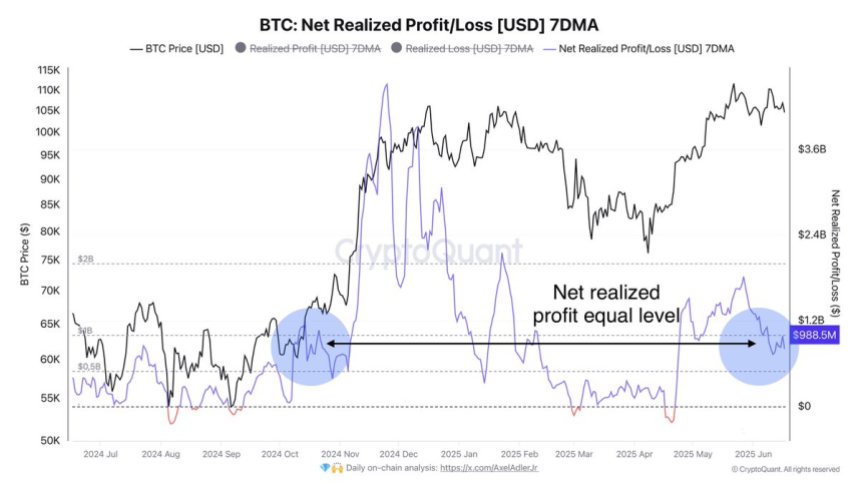

The market is divided on what will come later. Some analysts indicate strong foundations and institutional adoption as a fuel for a massive bull race, while others warn a deeper correction before any continuation upwards. The Top Darkfost analyst underlined the importance of monitoring of chain behavior during such periods of uncertainty. According to cryptoqual data, the profits made on Bitcoin (7 -day mobile media) do not show important warning signals. The current profit acquisition activity remains below $ 1 billion, similar to the levels observed after the correction of October 2024, indicating that investors are neither panic nor excessively euphoric.

This awareness of profit could be a sign that long -term owners are still confident in the wider trend, preparing the foundations for a possible breakout once the macro conditions are stabilized.

Metric On-China Signs Calm Bitcoin Consolida

As the conflict between Israel and Iran intensifies, the fears of a wider war – and the possibility of US intervention – continue to weigh heavily on global markets. Investors remain at the limit, with the increase in oil prices and the weakening of the economic trust that feeds on macro uncertainty. Still, Bitcoin seems largely embarrassed. Despite the increased geopolitical tension, BTC continues to consolidate just below the historic maximum, showing the resilience that both bulls and bears secondly wearing their next move.

Basically, Bitcoin remains strong. The institutional adoption is constantly increasing and the exchange of exchange continues to decrease, reflecting a tendency towards the accumulation of long -term detention and exchange. In many ways, BTC seems to thrive in this environment of volatility and uncertainty.

According to the data in the chain shared by Darkfost, made profits on Bitcoin, measured by the 7 -day mobile average (7Dma), Non Show does not show important warning signals. The current profit levels remain lower than $ 1 billion, an interval is not seen since the end of the correction of October 2024. Also during the recent wave of ATH, the profits made remained well below the peak of January 2025. This lack of assumption of aggressive profits suggests that most of the investors are still strong, nor in panic or hasty.

That detained behavior is playing a key role in the consolidation during Bitcoin. Without a wave of realization of the profit, there is little pressure to force the market, but no catalyst quite strong even to push it much higher. The monitoring of these chain signals will be fundamental in the next few days. If Spike or Exchange Infussions are made, it can marry the beginning of a new phase.

Reading Reading

BTC technical analysis: tested key support

The 12 -hour graph of Bitcoin (BTC/USD) shows the activity currently exchanged at $ 104,292, just above a level of crucial support at $ 103,600. This area, which corresponds to the previous set of all times at the end of 2024, has become a key battlefield for bulls and bears. BTC is repeatedly bounced from this level in the last few weeks and its ability to retain could determine the direction of the next main move.

BTC was unable to break through the resistance of $ 109,300, forming a series of lower maximums since it touched the level of $ 112,000. This suggests an weakened bullish momentum and highlights the importance of the current action of prices around the SMA of 50 periods, which now acts as a short -term dynamic resistance.

The volume remained relatively stable but showed slight increases during recent Pullbacks, mentioning cautious sale rather than full -blown capitulation. The SMAs of 100 and 200 periods, currently sitting at $ 104,065 and $ 94,617, offer respectively additional support under the current interval, with the 100 SMA now directly aligned with the horizontal level of $ 103,600.

Reading Reading

If BTC breaks and closes below this area of demand with confirmation of the volume, it could trigger a move towards $ 100k psychological support. On the contrary, a strong rebound from here would strengthen the current consolidation and would keep the open path for another $ 109,300 test.

First floor image from Dall-E, TradingView chart