Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

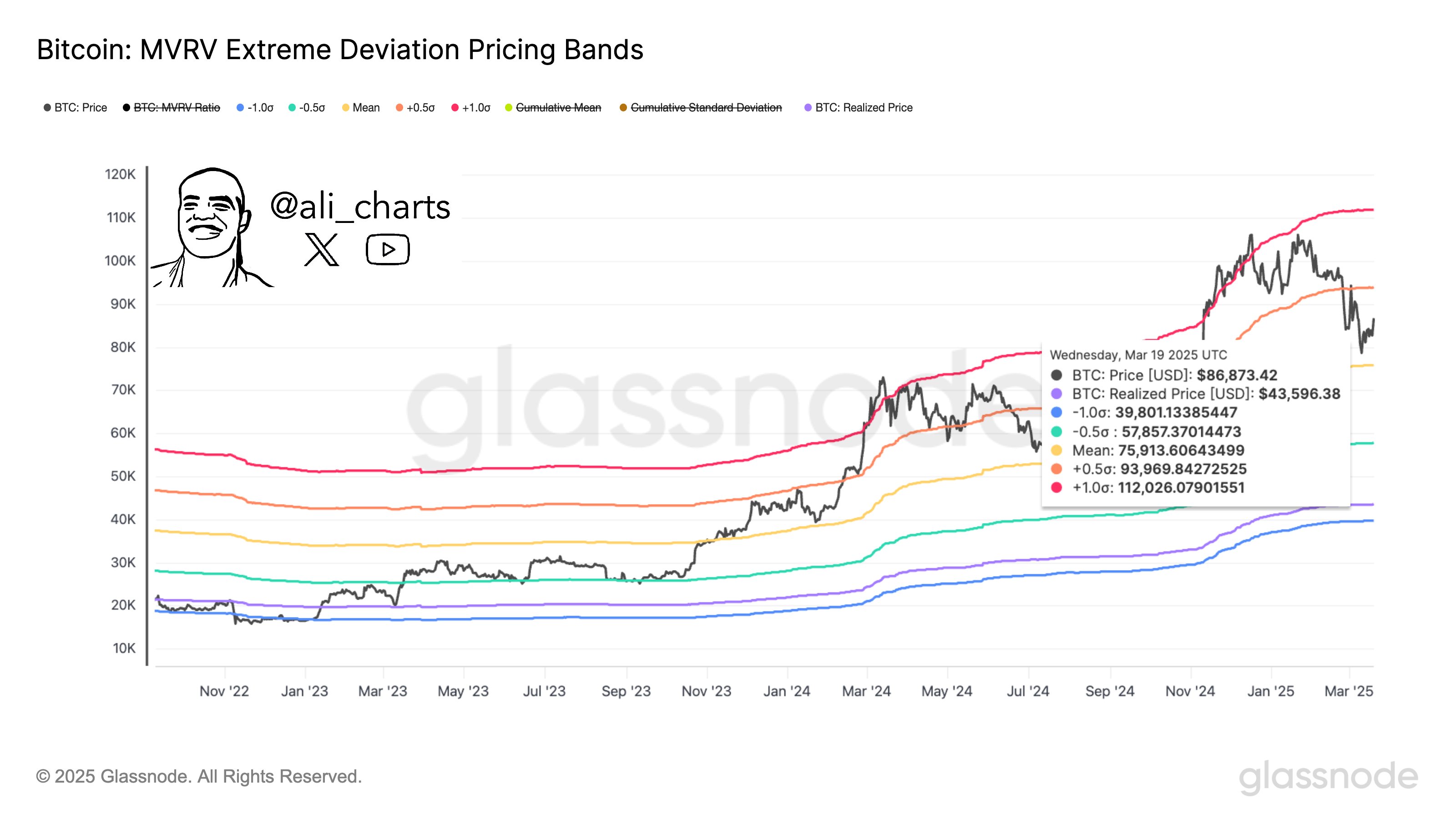

In an X send Published yesterday, the cryptocurrency analyst Ali Martinez stressed that, based on the analysis of the price band, Bitcoin (BTC) could increase to $ 112,000 if it breaks and holds a key level.

The analyst outlines the level of key bitcoin

Following a slight increase after the Federal Reserve announcement (Fed) of the Federal Reserve to slow down the rhythm of its budget, Bitcoin is currently exchanged in the low price range of $ 80,000. However, according to Martinez, the main cryptocurrency could reach a new maximum of all time (ATH), subject to certain conditions.

Reading Reading

Using the market value for the prices of extreme deviation price of the value made (MVRV), Martinez indicated two crucial price levels that could determine the next important move of Bitcoin. According to the analyst, if BTC breaks and holds over $ 94,000, he has a “high probability” of $ 112,000 gathering.

On the other hand, if BTC falls Below $ 76,000, it risks falling to $ 58,000 – or even $ 44,000 – if market conditions become bearish. In particular, BTC previously reached $ 76,606 on March 10 before bouncing at its current interval in the low $ 80,000.

For the not started bands, MVRV Extreme Deviation Prices show if an asset, such as Bitcoin, has too high or too low price compared to past middle school. It helps to identify when the market could be hyper -computer – potential potential market purchasing opportunities – or hyper -time.

According to Martinez’s graph, BTC is currently exchanged between the average average – the yellow band – and the standard deviation +0.5 – orange band. A prolonged breakout above or under these gangs could indicate the next significant direction of the Bitcoin price.

The colleague Crypto Rekt Capital has observed that Bitcoin is again testing the $ 84,000 crucial support level. A successful suspension at this price could set BTC to challenge the resistance of $ 94,000, potentially opening the way to a new ATH. The analyst said:

BTC has produced long wicks below this level before, the reason why a daily closure greater than $ 84k is essential to be successful this test.

Will BTC attend a short narrow?

In a separated post X, Crypto Trader Merlijn the trader suggested it Widespread pessimism Around the recent action of BTC’s prices could feed a powerful short compression. According to the analyst, there could be about $ 2 billion short positions liquidated If BTC reaches $ 87,000, potentially guiding the price even higher.

Reading Reading

Adding to the upright perspective, the entrepreneur crypt Arthur Hayes suggested The drop of 10 March of BTC at $ 77,000 may have scored the bottom of this market cycle. At the time of writing, BTC is exchanged at $ 84,043, down 2% in the last 24 hours.

In the foreground image from Usplash, X and TradingView.com graphics