The price of Bitcoin closed last week at $ 115,390, briefly violating the level of resistance of $ 115,500 while pushed over the weekend, just to immerse and close the week right below it. Last week he produced a strong green candle for the Bulls, keeping the momentum upwards this week. The price index of the US producer arrived well below the expectations on Wednesday morning last week, giving Market Hope Bulls for the imminent decision to cut rates by the Federal Reserve. The United States inflation data the following morning were warm, however, as it was recorded at 2.9%, as expected, but higher than the reading of the previous month of 2.7%. The Federal Reserve will have its job for this week during the FOMC meeting on Wednesday, where she has to evaluate the benefits and disadvantages of the cut or not. The market fully expects a cutting of the interest rate of 0.25% (as seen in Polimarca), therefore any hesitation now by the Fed will probably lead to a market correction.

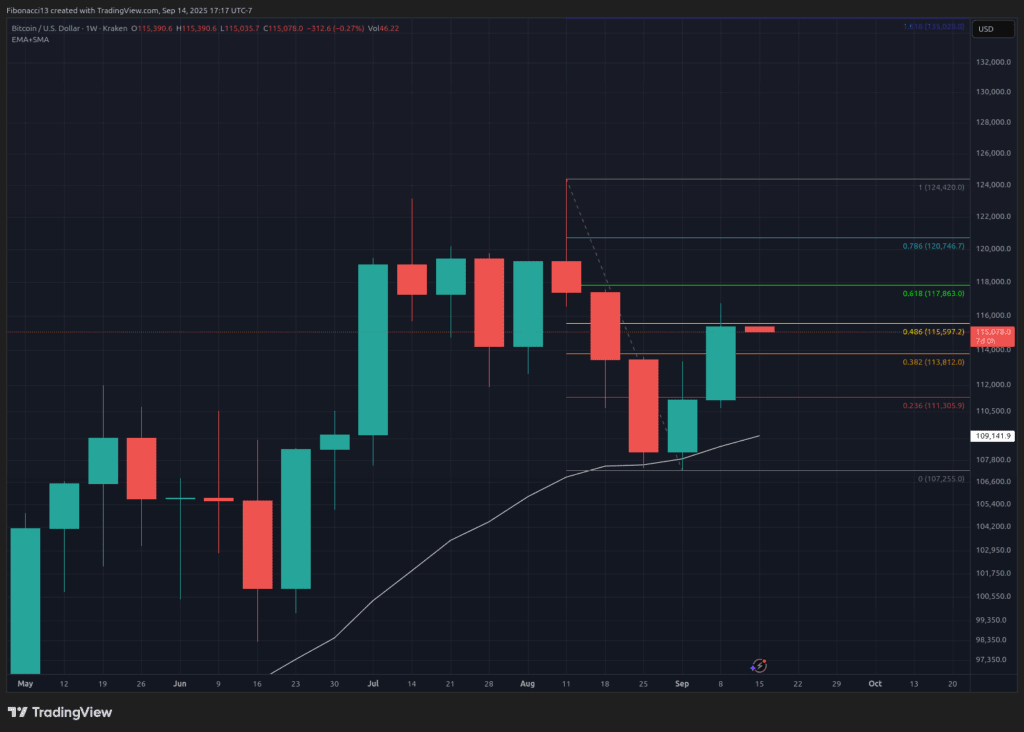

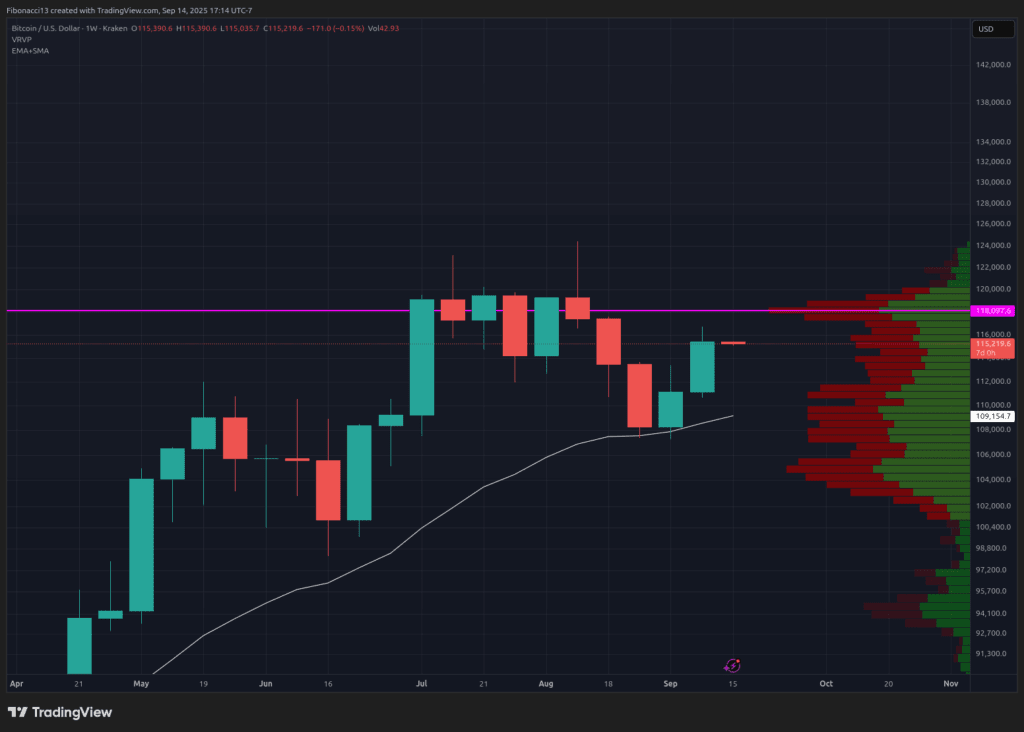

Key support and resistance levels now

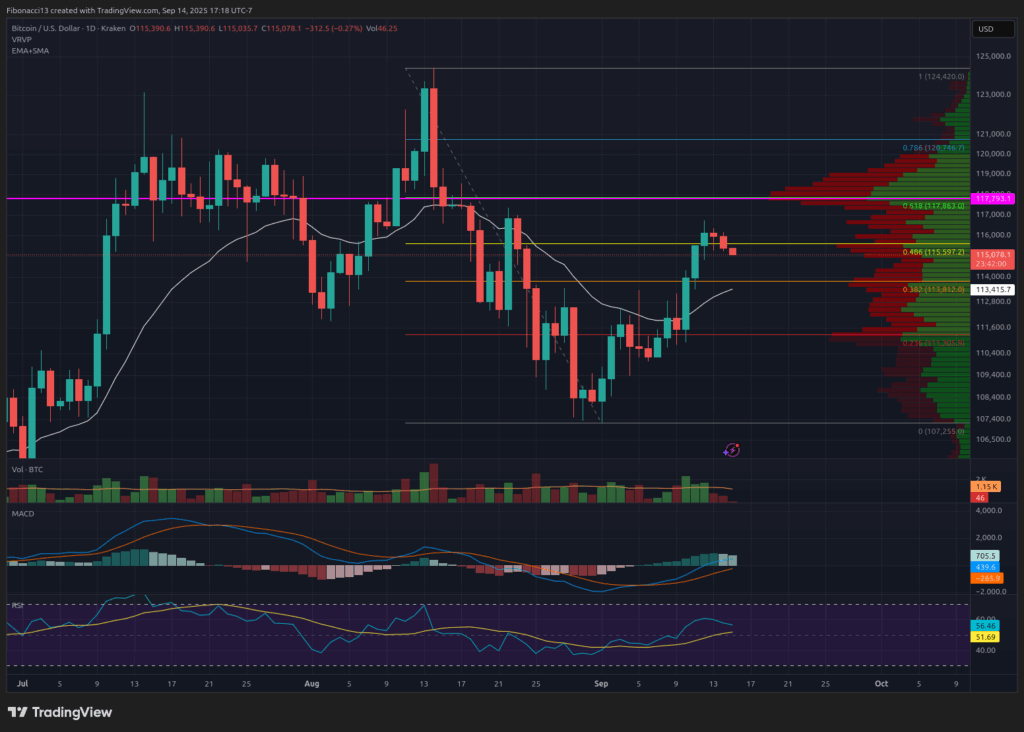

By entering this week, the level of $ 115,500 is the next level of resistance that Bitcoin will try to close above. $ 118,000 will still be above here. If Bitcoin puts in another strong week, it is possible that the price pushes beyond the $ 118,000 intraweek only to close under it on Sunday. We should expect sellers to get strongly there and that the pressure bulls remain some soil.

If Bitcoin sees a weakness this week or a refusal from the level of $ 118,000, we should look down at the level of $ 113,800 for short -term support. Below, we have a weekly support sitting at $ 111,000. The closure below would probably be a minimum of $ 107,000.

Prospects for this week

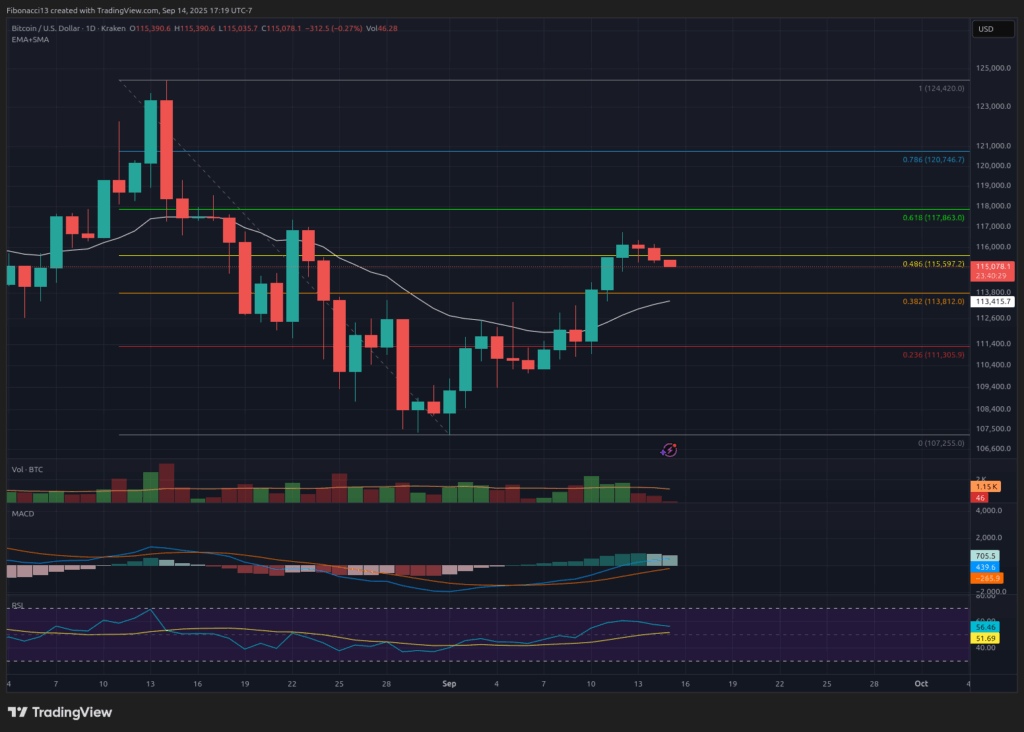

Zoom in the daily ranking, the prejudice is only slightly bearish at the closure of Sunday, after refusing from $ 116,700 last Friday. This could quickly return to a bullish prejudice, however, if the action of the market price of the stock exchange on Monday also resumes its bullish trend. The MacD is currently trying to hold back the zero line and restore it as a support for the upward momentum to be resumed. In the meantime, the RSI is immersion but remains in a bullish posture. It will look for SMA 13 for support if the sale intensifies Tuesday.

All eyes will be on President Powell and Federal Reserve on Wednesday while he speaks at 14:30 Eastern. With something different from an advertisement of the rate of 0.25% at 14:00 will probably cause a significant market volatility that would certainly pour into Bitcoin.

Mood of the market: Ruggrrish, after two green weekly candles in a row, waiting for the level of $ 118,000 to be tested this week.

The next few weeks

Keeping the momentum greater than $ 118,000 will be the key in the coming weeks if Bitcoin can jump on this imminent obstacle in the near future. I would expect Bitcoin it will continue in $ 130,000 if it could establish $ 118,000 as a support once again.

Assuming that the Fed reduces rates this week, the market will not wait for an hour to cut additional interest rate. Therefore, the support market data and continuous cuts will be crucial for the path of Bitcoin prices in the future, fueling a bullish continuation to the new tops.

The downside, any significant bearish events or the Fed that surprises everyone with a decision not to cut on Wednesday, will surely send the Bitcoin price to test the support levels.

Terminology guide:

Bulls/bullish: Buyers or investors expect the price to increase.

Orsi/Bearish: Seller or investors expect the price to drop.

Support or support level: A level to which the price should hold for the activity, at least initially. The more touches on the support, weaker gets, the more likely it is that it does not keep the price.

Level of resistance or resistance: Opposite to the support. The level that will probably refuse the price, at least initially. The more touches to the resistance, weaker gets, the more likely it is that it cannot hold back the price.

SMA: Simple Mobile average. Average price based on closing prices in the specified period. In the case of RSI, it is the average value of the resistance index in the specified period.

Oscillators: Technical indicators that vary over time, but generally remain inside a band between the set levels. Therefore, they oscillate between a low level (generally that represents the conditions of hyper -time) and a high level (generally representing the conditions of the hyper -mp). For example, relative resistance index (RSI) and divergence of average mobile convergence (Macd).

Macd Oscillator: The divergence of medium mobile convergence is a momentor oscillator that subtracts the difference between 2 furniture to indicate the trend and the moment.

RSI oscillator: THE The relative resistance index is a momentum oscillator that moves between 0 and 100. Measure the price speed and the variations of the speed movements speed. When RSI is over 70 years old, he is considered hyper -mp. When RSI is less than 30 years old, it is considered hyper -time.