Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

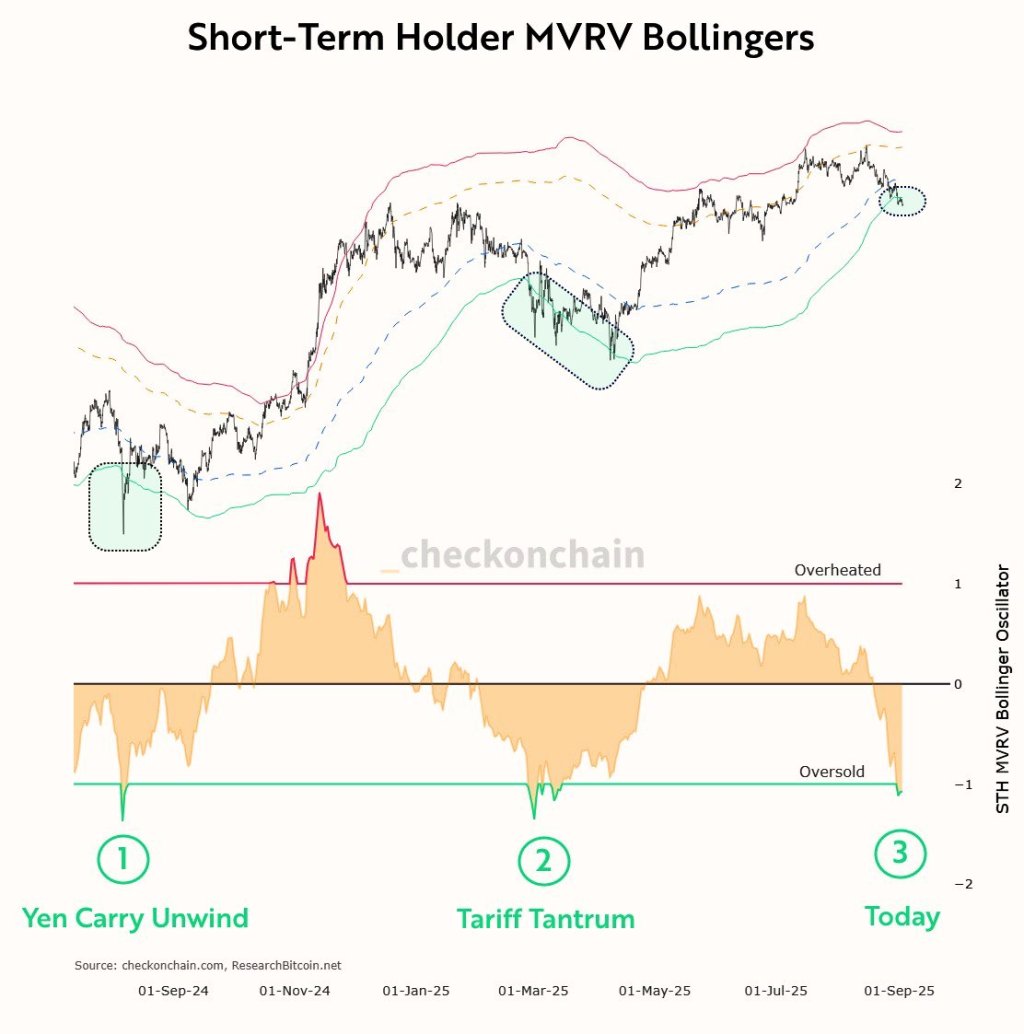

Bitcoin showed a short -term “buy” signal that previously marked the $ 49,000 and $ 74,000 swing minimums, according to the Frank chain analyst (@frankaFetter), a quantum at Vibe Capital Management. “It is officially obtained the hyper-fired print on the gangs of the short-term owner Mvrv Bollinger,” he wrote on X, indicating previous events during the “Yen Carry Unwind” about $ 49,000 and the “Tariff Cantrum” near $ 74,000, adding a third application “today-$ 108k.

The metric in focus merges the market ratio with market value in short-term market value (STH-MVRV) with Bollinger bands to be captured when the most recent coins exchange statistically depressed evaluations compared to their cost bases. In the graphic designer that Frank shared, the STH-MVRV Bollinger oscillator probed the Hypervempi threshold who previously aligned himself with the local exhaustion of the sale.

Reading Reading

Other reasons to be bullish for Bitcoin

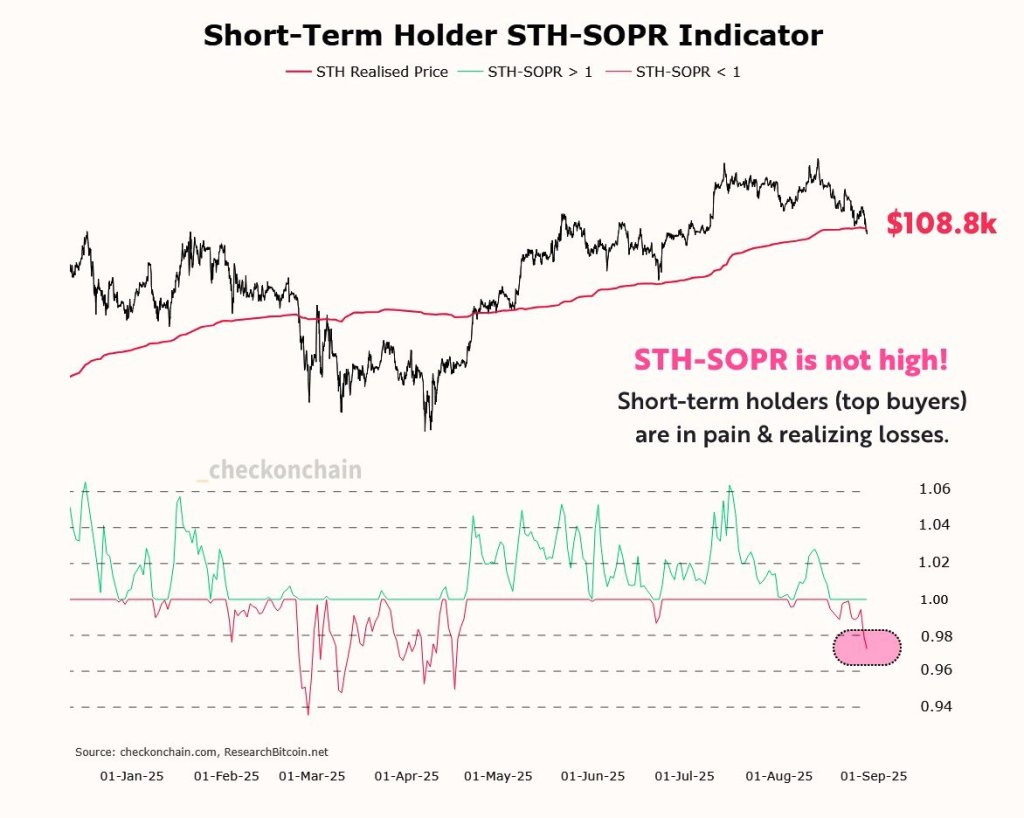

On an accompanying panel, the Sto-Sopr-Approve of Output profit for younger coins of about 155 days-piots below 1.0, indicating that recent buyers are creating losses in the ribbon instead of profits. “The short-term owners (the buyers of the best) are in pain and creating losses”, Observed Frank observed, stressing that “STH-Sopr is not high!”

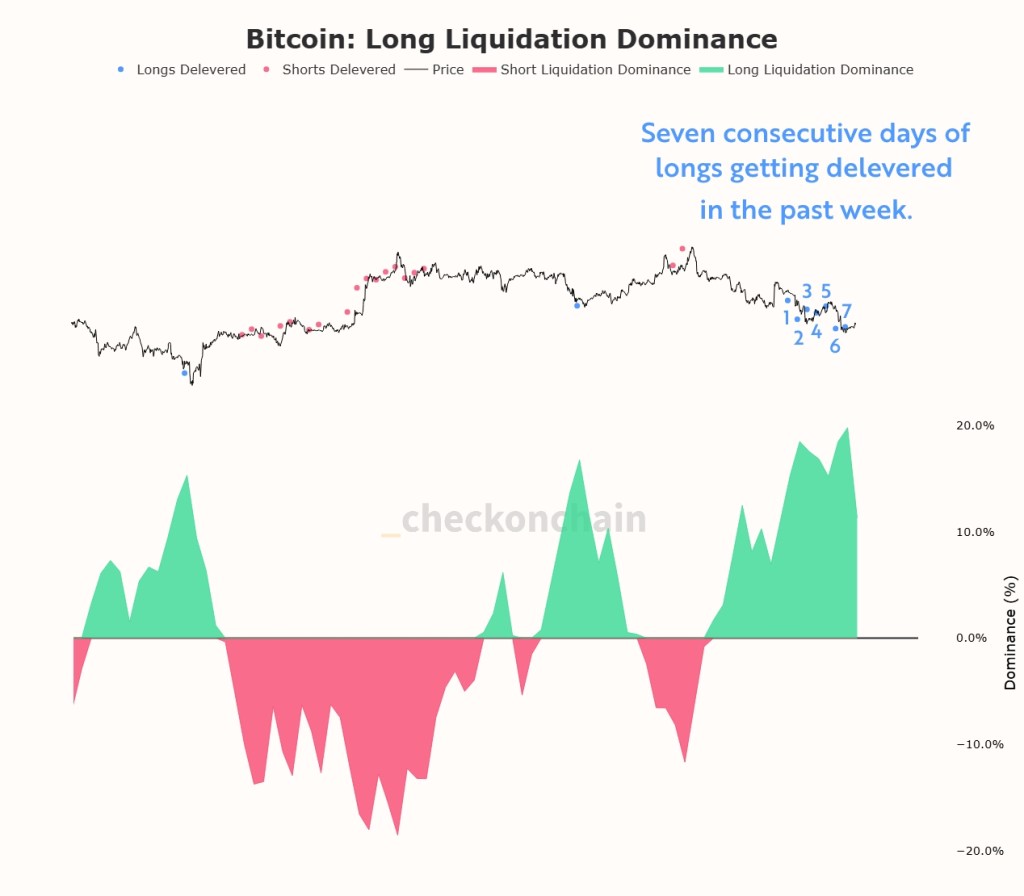

The positioning has also become cleaner in derivatives. “Longs was” delegated “every day last week: they are the seven consecutive days of magical blue points,” he said, describing long persistent liquidations and narrowing of the balance sheet between lever bulls. Now he is “looking for the reversal: when they give up and start short -circuiting with lever (exactly at the wrong time), providing fuel for a potential relief compression”.

The macro context can be an additive, in its opinion. “Gold hit new maximums last week.” Gold Leads, Bitcoin follows. “The yellow metal often looks around the corners and could smell the degradation of degradation directed in 2026 while the administration feeds the economy for the mid-term,” he wrote, suggesting a potential recovery dynamic if Bitcoin delays the move in ingots.

Reading Reading

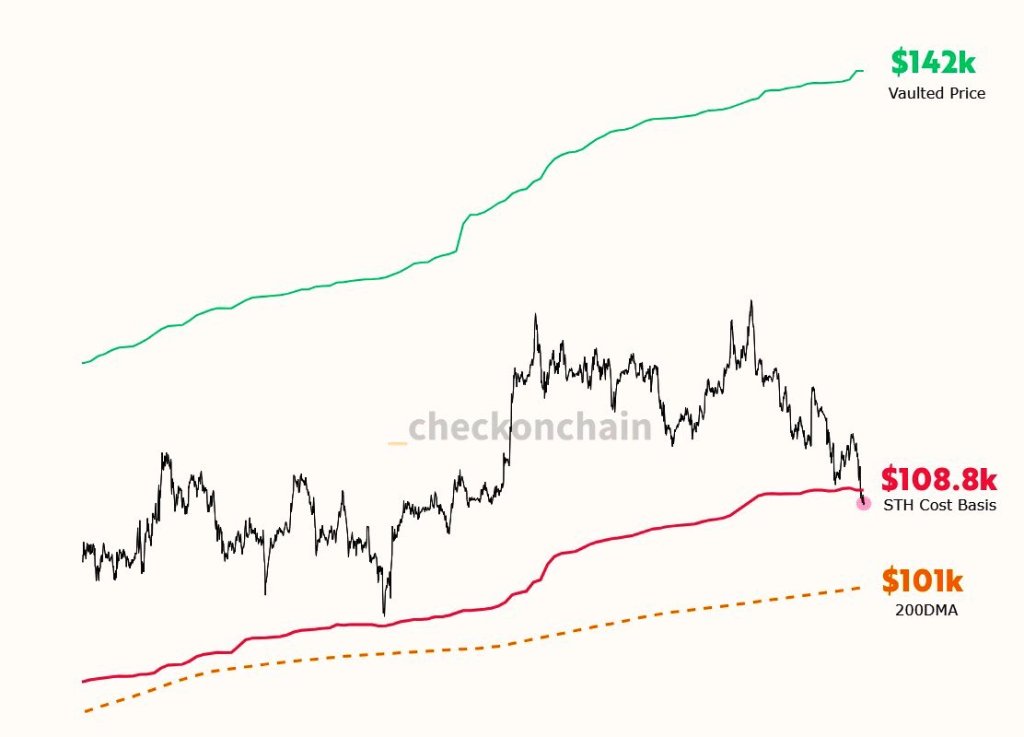

Risk markers remain clearly defined. Frank Pegs The short-term owner has created the aggregate base price for recent coins-a $ 108,800. “If BTC breaks under the basis of the short -term support of $ 108.8k, it may want to investigate the demand for the 200 -day mobile media, which is located at $ 101k.”

That stratified support map frames the hyper -fired print as a tactical signal within an even long -term long -term tendency, but also recognizes that the violations of the base of the SHP cost can extend the tests to the primary trend indicator of the cycle.

As a whole, the confluence of these signals has a strong confluence, according to Frank. The fact that the rhyme history is based on the demand spot by emerging above the short -term cost and on the fact that any movement towards aggressive lowering provides fuel for a narrow. As Frank summarized, “if we are in a bull market – and I think we are – this is the type of behavior that generally lays the foundations for the subsequent highest leg”.

At the time of the press, BTC exchanged $ 111,382.

First floor image created with Dall.e, graphic designer by tradingview.com