Bitcoin recovered the crucial level of $ 115,000 after being briefly immersed at $ 112,000 at the beginning of this week, reporting a renewed force from the bulls. The strong recovery highlights the resilience of buyers after recent volatility, with the action of prices that now shows signs of bullish domination. This rebound comes when traders and investors are preparing for the potential subsequent backpack, observing higher levels of resistance.

Reading Reading

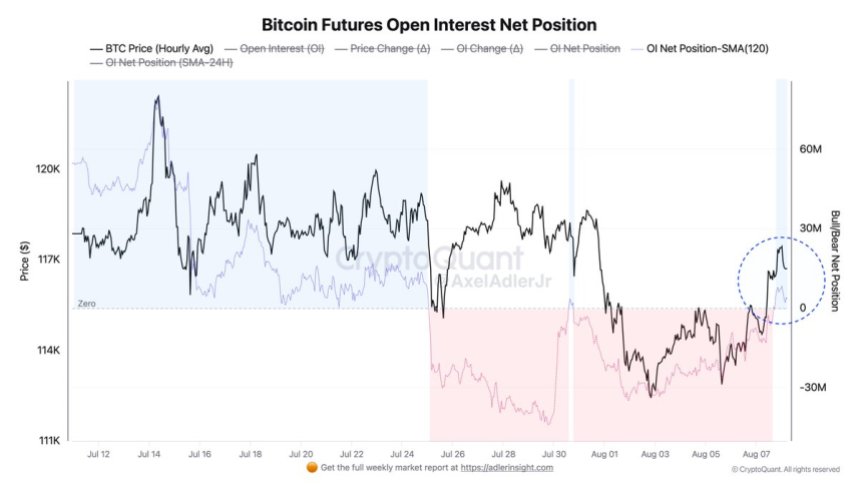

The key market data add weight to the bullish case. The clear position of interest open to the Futures Bitcoin – an indicator up close that keeps track of the balance between long and short positions – has moved to the bulls, showing a clear edge on the shorts. This change in positioning suggests that feeling is becoming more optimistic, with the participants in the market that bet more and more on the positive side.

However, while the momentum is building, the next few days will be decisive. Bitcoin must maintain its suspension above the $ 115k level to confirm this turn and open the door to a push towards the subsequent main resistance. Otherwise, it could invite a new sales pressure, putting recent earnings at risk. For now, data on the market structure and derivatives suggest that the bulls have control and the stadium is set for the next significant move of Bitcoin.

Bitcoin Market sentiment shift as technical and fundamental alignment of tail

According to the best analyst Axel Adler, Bitcoin’s market structure is undergoing a considerable change. After a prolonged bearish regime since the end of July-Contrascted by a short pressure and represented in the red-la SMA-120 line for Bitcoin Futures Open Interest Net the position, the position reversed upwards, reaching the zero neutral sign. This indicator, which reflects the balance between long and short positioning, indicates that the market has gone from a short aggressive domain to a neutral-bullish position.

Adler notes that such a reversal attempt occurred only a week ago but was unable to hold, leading to a renewed sales pressure. This time, if Sma-120 remains above zero for another two consecutive days, he would confirm a change of regime, potentially opening the way to a more sustained bullish phase.

From a fundamental point of view, the momentum is supported by an important political development: the President of the United States Donald Trump has signed an executive order that allows alternative goods, including cryptocurrencies, to be included in the Perenial Plans 401 (K). This reference decision could open the doors to millions of Americans to earn Bitcoin exposure and other digital activities through their savings for retirement, significantly expanding potential demand.

Reading Reading

BTC Test the key levels of liquidity

The daily graphic of Bitcoin shows a strong recovery after recently immersed in the $ 112k region, with bulls claiming the critical support level of $ 115,724. The rebound pushed BTC to the $ 116,700 area, reporting a renewed purchase interest after a panic sale period.

The 50 -day SMA (blue) is currently providing dynamic support near $ 113k, helping to strengthen the short -term bullish case. Above, the next great resistance is at $ 122,077, which marks the upper border of the recent consolidation interval. A decisive breakout above this level could open the door for a repetition test of all time.

Reading Reading

The prejudice of the market relies up upward until BTC remains above the 50 -day SMA, but the traders should look at the slander signals. If prices increase slowly while approaching $ 122k, the risk of a pulback grows. Overall, the current BTC structure reflects a market that attempts to bring back to a bullish posture, with $ 115,724 that act as a key line in the sand for continuation.

First floor image from Dall-E, TradingView chart