Balancing on the edge of a head and shoulders pattern, Bitcoin ($BTC) is seeing a brutal retest of lower support on its way above $100,000 and beyond.

Bitcoin Path .cwp-coin-chart SVG {stroke:; stroke width: ; }

Price

Trading volume in 24 hours

Last price movement 7 days

is boxed in, with support and resistance approaching after weeks of volatility. The next move isn’t just important: it’s everything. Will it rise or fall?

Key support and resistance levels for Bitcoin price

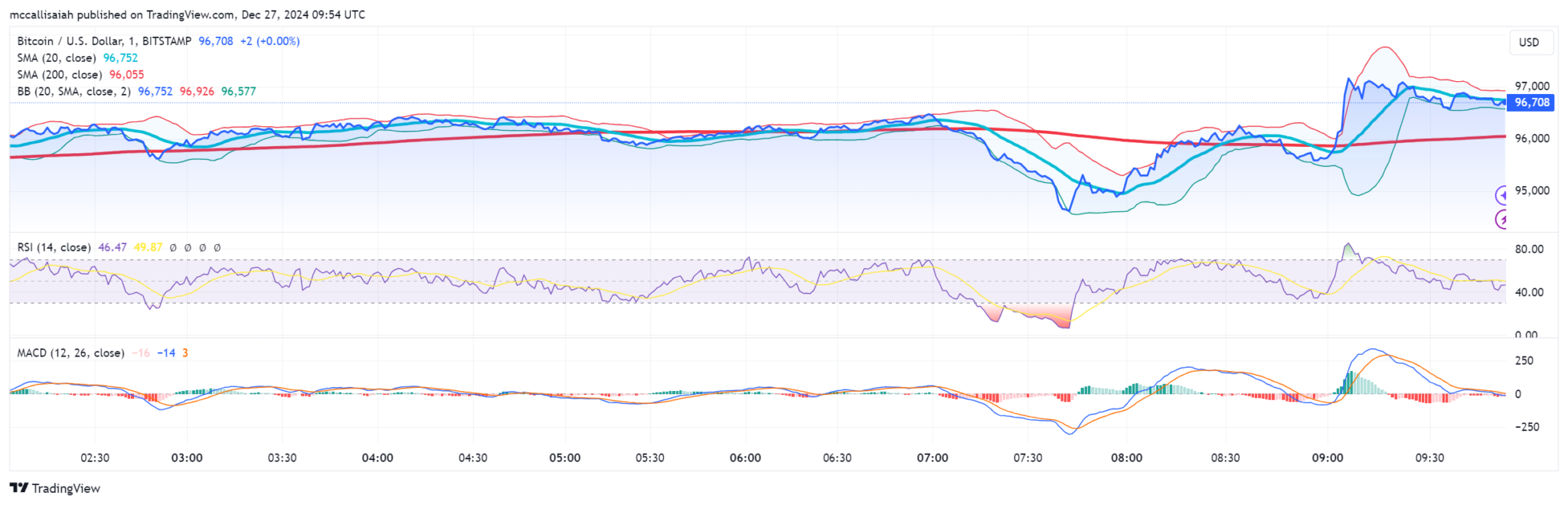

The price of Bitcoin is based on two critical points. The $96,000 support zone, closely linked to the 200-day simple moving average, serves as a solid base for bullish momentum.

Tested repeatedly during downturns, it is the line that bulls cannot afford to miss.

Martin Shkreli @MartinShkreli it’s short $MSTR.

He says:

– Saylor is crazy

– there’s no way this could end well

– Saylor is not a good advocate of #Bitcoin

– being MSTR short was painful

– is bearish on bitcoin

Welcome Martin. Have fun getting invested in Saylor and BTC. pic.twitter.com/D0duGoGAG5— Flying crow

(@OffshoreHODL) December 15, 2024

Bitcoin resistance looms at $97,000, supported by the upper Bollinger band and recent price movements. Breaking this ceiling could simply trigger a broader rally.

While there is no golden cross visible at the moment (where a shorter moving average crosses a longer average), the alignment of the SMA suggests the possibility of it forming in the coming weeks, which would typically signify bullish momentum.

Bitcoin’s Bollinger bands are widening, a sign of growing market turbulence. 99Bitcoin analysts keep an eye on volume spikes to see if they will push the price through these defining lines.

EXPLORE: 11 best AI cryptocurrencies to invest in 2024

BTC chart patterns and what to watch for Bitcoin in 2025

Other noteworthy data could tip the scales on whether BTC will exit or spiral down:

- RSI (relative strength index): At 46.47, the RSI indicates that Bitcoin is neither overbought nor oversold.

- MACD (Moving Average Convergence Divergence): The momentum is neutralizing, with the MACD line converging towards the signal line. The flattening histogram suggests limited momentum for now, but this could change quickly with new market catalysts.

Additionally, some analysts are closely monitoring a possible head-and-shoulders pattern. If confirmed, this could signal a near-term reversal with a pullback to $80,000, a widely speculated target for a mid-bull market correction.

A move above $97,000 cements the bullish continuation, paving the way for the emergence of higher resistance levels.

But if they fall below $96,000, the bears take the reins, quickly aiming for $93,000 or even the $90,000 mark.

EXPLORE: The biggest meme coin of 2024! The biggest winners of the year in review

Cryptocurrency market sentiment and whale activity

Despite the current consolidation, market sentiment appears cautiously optimistic. Research firm Santiment has noticed a recent influx of stablecoins into exchanges, often interpreted as whales preparing for buying opportunities.

Bitcoin’s chart for 2025 signals a prolonged consolidation phase, holding our breath for the next big move.

The $96,000 support and $97,000 resistance are the main battle lines, with trading volume likely to decide the winner. Will the resistance break, reigniting his six-figure ambitions, or will the market tilt towards another crash? The answer lies in what comes next.

EXPLORE: Ukraine deems Bitcoin illegal, Coinbase fights for new $50 million foundation round and more

Join the 99Bitcoins News Discord here for the latest market updates

The post Bitcoin ‘Head and Shoulders’ Pattern Triggers $80,000 Price Drop Alert appeared first on 99Bitcoins.