Bitcoin has gone down to the lowest levels from 8 July after the opening of Wall Street on Friday, with the prices that slide and trader climbing to re -evaluate the short -term plans.

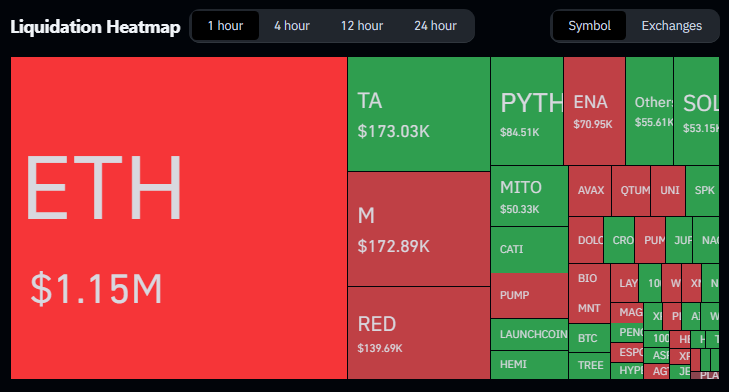

According to Coinglass, the 24 -hour cryptocurrencies approached $ 540 million when the sales pressure intensified in the main exchanges.

Reading Reading

Whales and distribution pressure exchange

On the basis of market observers reports, the heavy sale of large holders has contributed to pushing the drop. The distribution on the binance was highlighted by traders as a key factor that has worsened losses.

Bitcoin lost almost 5% the day and some large accounts were connected to the wave of sales that triggered the arrest orders and quick exits.

The popular trader Daan Crypto Trades has indicated a “key reversal area” around recent intervals and consolidation levels.

Some experts had similar price levels on his radar, observing that Bitcoin was unable to transform $ 112,000 into support. Other rumors in the market have reported $ 114,000 as an important weekly closing threshold for bulls.

The divergence of RSE Relizist maintains a fragment of hope

Technical observers found a bright point. According to the Crypto Javon Marks commentator, the four-hour ranking still shows a divergence of up-and-and-a model in which the RSI produces higher minimums while the price produces lower minimums. That configuration can suggest an advance.

$ BTC Good area to continue looking. Right at the top of the previous range and in the consolidation area. https://t.co/weag2if6nv pic.twitter.com/y7rftsqdio

– Daan Crypto Trades (@daancrypto) August 29, 2025

Marks claimed that Bitcoin could stage a rebound. He suggested that a transition to $ 123,000 is possible, which would be about a jump of +14% from the current levels. That projection is optimistic and is based on momentum that rapidly launches in favor of buyers.

Macro data, seasonal weakness Add the contrary winds

Seasonality and macroeconomic data added pressure. September was historically one of Bitcoin’s weakest months and investors were looking closely at the inflation readings.

The favorite inflation measure of the Federal Reserve, the index of personal consumption expenses, has combined expectations and showed signs of rebising rebound.

However, the Fedwatch tool of the CME group showed market prices in rates cuts, a factor that could help risk goods such as encryption if it holds.

Reading Reading

Range Bound for now, traders watch $ 112.000 – $ 114.000

Reports revealed that the traders focus on a restricted series of price markers. If Bitcoin can recover $ 112,000 and keep a weekly closing greater than $ 114,000, the bulls would earn breathing.

If these levels fail, more disadvantages is possible and short -term operators could face further liquidations.

For now, the market seems tight. Some technical signals indicate a rebound, but the macro data and large sellers keep cautious mood.

Trader and investors are looking closely both the action of prices and the economic prints while the United States head towards the key data and the FED decisions window on September 17th.

In the foreground image from Usplash, a tradingview graphics