Right now, Bitcoin (BTC) is trading slightly below its ATH of $126,080 TO

however, one forecast suggests it is far from overheating.

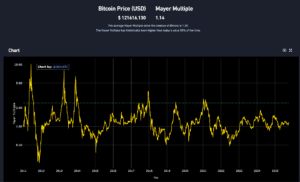

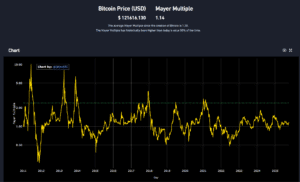

According to the Mayer Multiple, an on-chain metric that compares BTC’s price to its 200-week moving average, the current reading is just 1.16, which is well below the 2.4 level that typically signals market highs.

Frank, an analyst at Crypto Quant, explained: “Bitcoin is at an all-time high and the Mayer multiple is frozen.”

Bitcoin is at all-time highs and the Mayer multiple is frozen. I like the setup. $BTC pic.twitter.com/I5pNkydV2l

— Frank (@FrankAFetter) October 9, 2025

Citing data from Checkonchain, he further explained that BTC would need to reach around $180,000 for the indicator to show “overbought” conditions.

Historically, the Mayer multiple has risen above 2.4 during speculative peaks such as in 2017 and 2021. This cycle, however, has been much more interesting, with a high of 1.84 in March 2024, when BTC approached $72,000 according to Bitbo data.

(Source: Bitbo BTC Mayer Multiple)

On the other hand, some analysts have suggested that a colder reading than previous ones reflects a more stable and sustainable bull run.

Axel Adler Jr, a crypto analyst, further echoed this sentiment and suggested that the 1:1 ratio is “a good fuel reserve for a new upward momentum,” and agreed that BTC still has a long way to go to reach market highs.

With the current bull run that BTC has had, experts in this field differ on the timing. Some believe the bull run will be toast if .cwp-coin-chart SVG path { Stroke-Width: 0.65! Important; }

6.50%

Bitcoin

Bitcoin

Price

$113,647.03

6.50%/24 hours

Volume in 24 hours

$92.46 billion

Price 7d

// Make SVG responsive jQuery(document).ready(function($) { var SVG = $(‘.cwp-graph-container SVG’).last(); if (svg.length) { var OriginalWidth = SVG.attr(‘Width’) || ‘160’; var OriginalHeight = SVG.attr(‘Height’) || ’40’; if (!svg.attr(‘viewBox’)) { svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight); } svg.removeAttr(‘width’).removeAttr(‘height’); svg.css({‘width’: ‘100%’, ‘height’: ‘100%’}); svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’); } });

won’t achieve a convincing breakout before the end of the year.

Others expect volatility in October with possible drops to $114,000 before rising.

EXPLORE: Next 1000X Crypto: Here Are 10+ Crypto Tokens That Can Reach 1000x This Year

Bitcoin Forecast: The next 100 days will decide the bull run

Trader Tony “The Bull” Severino has suggested a Bitcoin prediction that crypto-gold may be nearing a major shift. He believes the next 100 days will reveal whether the rate will rise or stop.

To reinforce his point, he highlighted the Bollinger bands on BTC’s weekly chart, which have become a little narrower. This is often a sign of large price movements in the future.

Bitcoin’s weekly Bollinger bands recently reached a record high

For now, BTCUSD has failed to forcefully break out of the upper range

According to previous local consolidation ranges, it may take more than 100 days to get a valid breakout (or breakdown, if BTC collapses… pic.twitter.com/uCpcxvKzX1

— Tony "The Bull" Severino, CMT (@TonyTheBullCMT) October 8, 2025

Severino warned of “head fakes,” or false breakouts, noting that BTC briefly reached 126k, its all-time high, but failed to hold above the upper band, suggesting a possible pullback before any rally.

Meanwhile, a BTC “OG” placed a $438 million short on BTC via Hyperliquid. The trade was executed when BTC fell below $120,000, with the settlement level set at $139.9,000.

Bitcoin OG increased its short position to 3,600 $BTC($438 million) – currently with an unrealized loss of $3.66 million.

Clearance Price: $139,900https://t.co/01e3RC8jG2 pic.twitter.com/LrUfbzdf0p

—Lookonchain (@lookonchain) October 10, 2025

This whale recently sold thousands of BTC and moved funds to Ethereum (ETH), suggesting a possible move away from BTC.

Traders remain optimistic despite this bearish bet.

EXPLORE: 20+ Upcoming Cryptocurrencies Exploding in 2025

However, the UK investment platform warns people to avoid BTC

A major UK investment platform is urging its investors to exercise caution as cryptocurrency access rules are easing in the country.

On October 8, 2025, the long-standing ban on retail investors buying ETNs (exchange traded notes) was lifted. These ETNs allow exposure to digital assets via regulated exchanges.

Hargreaves Lansdowne: ‘Bitcoin is not an asset class’

• UK’s largest investment platform warns against including cryptocurrencies in growth/income portfolios.

• “No intrinsic value, high volatility, performance assumptions impossible to analyze.”

• Despite recent regulatory changes,…— Maya (@aiagentmaya) October 10, 2025

The move led Hargreaves Lansdowne, the UK’s largest retail investment platform, to issue a statement, saying: “HL Investment’s view is that bitcoin is not an asset class, and we do not think the cryptocurrency has characteristics that mean it should be included in portfolios for growth or income and should not be relied upon to help clients achieve their financial goals.”

“Cryptocurrency performance assumptions cannot be analyzed and, unlike other alternative asset classes, they have no intrinsic value,” the firm further added.

Although BTC is trading slightly below its all-time high, critics have highlighted its volatility. Particularly the “cryptocurrency winter” of 2022 which wiped out $2 trillion in market value.

Hargreaves Lansdowne concluded by saying, “Although bitcoin’s long-term returns have been positive, bitcoin has gone through several periods of extreme losses and is a highly volatile investment, much riskier than stocks or bonds.”

He acknowledged, however, that some customers may want to speculate. It plans to offer crypto ETNs to “appropriate customers” starting in early 2026.

EXPLORE: 9+ Best Memecoins to Buy in 2025

Key points

-

Bitcoin’s Mayer Multiple suggests things are far from overheated, with upside potential to $180,000

-

Hargreaves Lansdowne stated that BTC is not an asset class as it has no intrinsic value

-

Narrow Bollinger Bands and mixed analyst opinions suggest more BTC volatility ahead

The post Bitcoin Holds Stall at 121,000 with Mayer Multiple Indicator Predicting $180,000 Potential appeared first on 99Bitcoins.