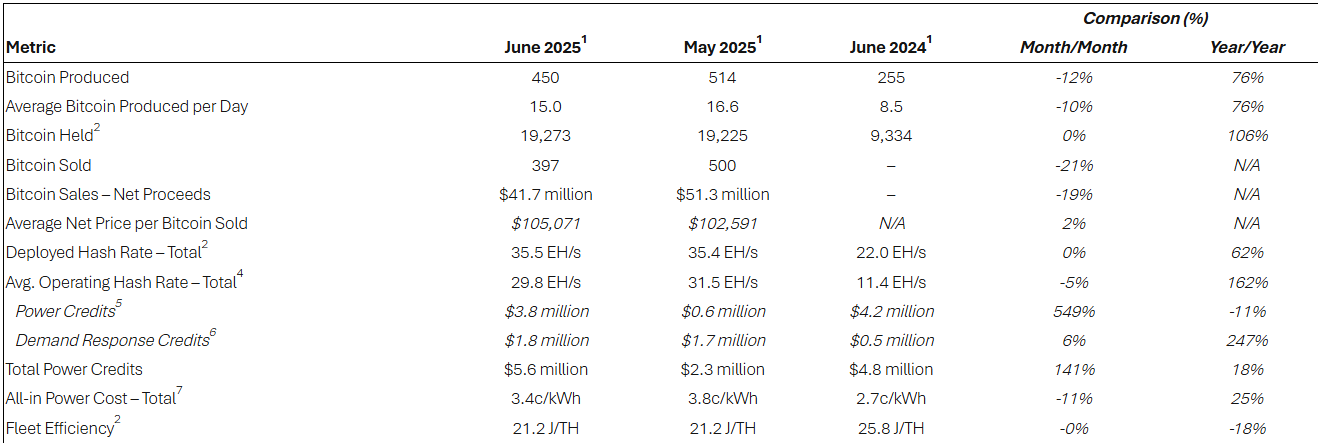

Today, Riot Platforms, Inc. (Nasdaq: Riot) recorded the production of 450 bitcoins in June 2025, a 12% reduction since May, but a 76% increase on an annual basis. The company has also seen an increase in power credits, for a total of $ 5.6 million, more than double the previous month.

Riot sold 397 bitcoins for $ 41.7 million, which represent a 21% volume reduction and a 19% drop in proceeds from May, but at a higher average price for money ($ 105.071). The company closed the month with 19,273 bitcoins, more than double the amount held in June 2024.

The average operational rate rate decreased by 5% month on month at 29.8 eh/s, but remains of 162% more than a year ago. The efficiency of the fleet was constant at 21.2 J/TH, an 18% improvement compared to the previous year.

“Riot extracted 450 bitcoins in June, which also represented the beginning of the Ercot Coincident Peak (” 4CP “) program,” said Riot’s CEO, Jason Les. “Riot’s power strategy, which includes economic reduction and voluntary participation in 4CP and other response programs to the demand, contributes significantly to the stability of the network while improving the competitive positioning of Riot.”

The June performance follows a similar April, in which Riot produced 463 bitcoins, sold 475 bitcoins for $ 38.8 million at an average price of $ 81,731 and completed a great acquisition. The company has acquired all Rhodium tangible activities in its Rockdale structure, including 125 MW of power capacity.

“April was a significant month for Riot while we closed the acquisition of all the tangible activities of the Rhodium in our Rockdale structure, including 125 MW of power capabilities and has concluded all the suspended disputes mutually,” said Les. “This transaction ends the hosting agreement with our latest hosting customer and marks Riot’s complete exit from Bitcoin Mining Hosting’s hosting activity.”