Bitcoin is currently Keeping it just above The level of $ 108,000 and bulls are keeping the momentum After a volatile beginning in July. However, a look more attentive to the data on chain shows how fragile that position can be.

Interestingly, two support levels, $ 106,738 and $ 98,566 are now the most important areas For bulls to defend. These levels represent clusters of addresses that contain large quantities of bitcoin and lose them could trigger a deeper correction.

Reading Reading

Bitcoin support is pampered about $ 106,000 and $ 98,000

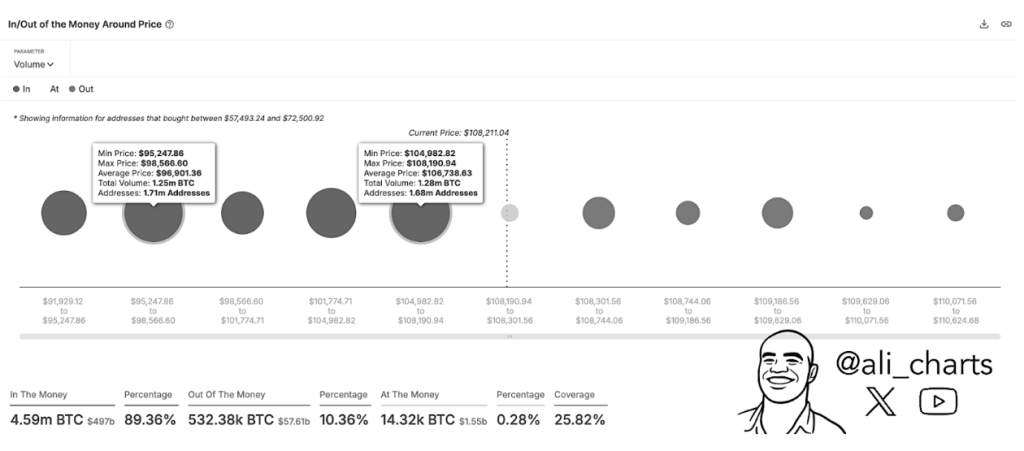

Bringing on the social media platform X, cryptographic analyst Ali Martinez aimed at Two main support levels based on data showing Bitcoin’s purchase clusters. These data are based on that of Dental (previously Intatheblock) in/out of the money around the metric of prices among the addresses that Purchased bitcoin close at the current price.

As shown by the metric, the most important purchase areas of purchase are $ 106,738 and $ 98,566. These two areas are where a huge purchase activity has occurred in recent weeks and could act as a support in case of collapse of the Bitcoin price.

The first area, between $ 104,982 and $ 108,190, contains 1.68 million addresses with a total volume of 1.28 million BTC at an average price of $ 106,738. Below the first area, a group larger than 1.71 million addresses holds a volume greater than 1.25 million BTCs in the price range of $ 95,248 at $ 98,566, with an average price of $ 98,566.

As long as Bitcoin continues to exchange above these levels, the ongoing rally could continue to push upwards. However, if these pockets of the application are broken with sufficient sales pressure, the main cryptocurrency could enter an uncertain price area with little purchase interest to provide support.

Speaking of sales pressure, the chain data show a slow down the pressure to sell among the great owners. Second data from The analysis platform on a fierce chain, Bitcoin has recorded its fifth consecutive week of networks from centralized exchanges. Last week alone, over 920 million dollars of BTCs transferred to self -aware or institutional products, mostly Etf Bitcoin are recorded.

Bitcoin must break the weekly resistance for the new maximums

Even with areas of solid demand below, Bitcoin’s path to new maxima is not yet confirmed. Analyst Rekt Capital has weighted her analysis, noting that Bitcoin is currently facing a strong weekly resistance band just under $ 109,000. In particular, Bitcoin is at risk of a lower structure on the weekly graph of the candlestick frames.

Capital rekt noted that a The weekly closing above the red horizontal resistance line must be reached to allow Bitcoin to recover a more bullish position. That resistance, which is currently about $ 108,890, acts as a ceiling for the rally rally of Bitcoin.

Reading Reading

As such, Bitcoin should do it close weekly Above $ 108,890 to position yourself for new maximums of all time. Unless there is a convincing breakage of that level, the action of the Bitcoin price could be irregular and susceptible to a retracement A $ 106.000.

At the time of writing, Bitcoin is exchanged at $ 108,160.

In the foreground image from Usplash, a tradingview graphics