Bitcoin has gone back this week after a fresh peak, but a strong bullish field is taking a ride. According to market updates, the coin touched around $ 124,390 before sliding to $ 114,158 and then exploit up to $ 115,285 at the time of the press.

Reading Reading

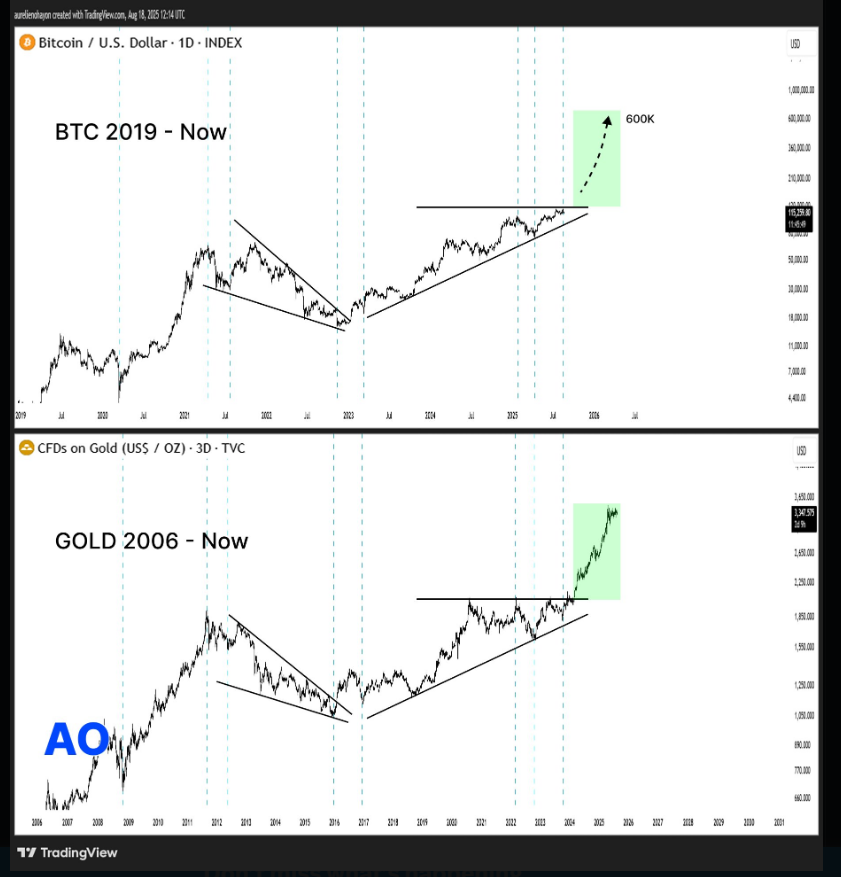

Based on the relationships of an analyst focused on the graph that goes from AO, Bitcoin can trace a model such as that of gold and that model could indicate an increase at $ 600,000-a jump by about 420% from current levels.

The analyst sees the golden model

AO’s view is based on graphic shapes. Compare the recent Cuneo of Bitcoin and the Ascending Triangle in the way the gold has moved in the last decade. According to AO, Bitcoin consolidation around $ 115,000 could be the base for a large breakout.

#Bitcoin He is ready for a huge race of Tori. pic.twitter.com/eorprzkneq

– ao (@Ao_btc_analyst) August 18, 2025

The AO scenario includes what they call “missing legs”, and puts a possible race over half a million dollars by 2026 if the model completes the way in which it expects.

Reports mentioned similar geometric comparisons by other observers, although few attach a specific price goal like $ 600,000.

Market scale if the target shots

Based on these numbers, a price of $ 600,000 would imply the market value in the baseball field of about $ 12 trillion.

That figure would push Bitcoin beyond many big technological names and would position it closer to Gold’s evaluation than where it is now.

According to the same relationships, this is the idea used to support the case of Bitcoin as an important value shop. The mathematics behind the main number is simple and the size of the move – about 420% from about $ 115,000 – is what makes the request dramatic.

Bull houses supported by some big names

The institutional voices add fuel to the speech. Michael Saylor of Strategy, who was one of Bitcoin’s most coherent supporters, continues to argue that the activity exceeds traditional valuable shops while more companies adopt it for their budgets.

Cathie Wood by Ark Invest has shown that Bitcoin could possibly climb the sign of $ 1 million, underlining the growing trust among high -profile investors.

In the meantime, the Mexican billionaire Ricardo Salinas Pliego has also expressed his opinion on the fact that Bitcoin could exceed the evaluation of about $ 22 trillion dollars in time.

https://www.youtube.com/watch?v=9BGVQ4LDS4K

Reading Reading

Signs that could change history

Not everyone treats the model’s call as a forecast. Some analysts warn that corresponding to a form of the gold graph does not show that the same result will follow.

The two activities have different buyers, liquidity and use cases and a huge lifting at $ 600,000 would probably have needed long-term flows and large bitcoin-ad flows for example large institutional allocations or permanent-non-non-non-short reserve moves.

Regulation, interest rates and market shocks are other real factors that could alter any plan.

First floor image with an ETF flow, tradingview graphic designer