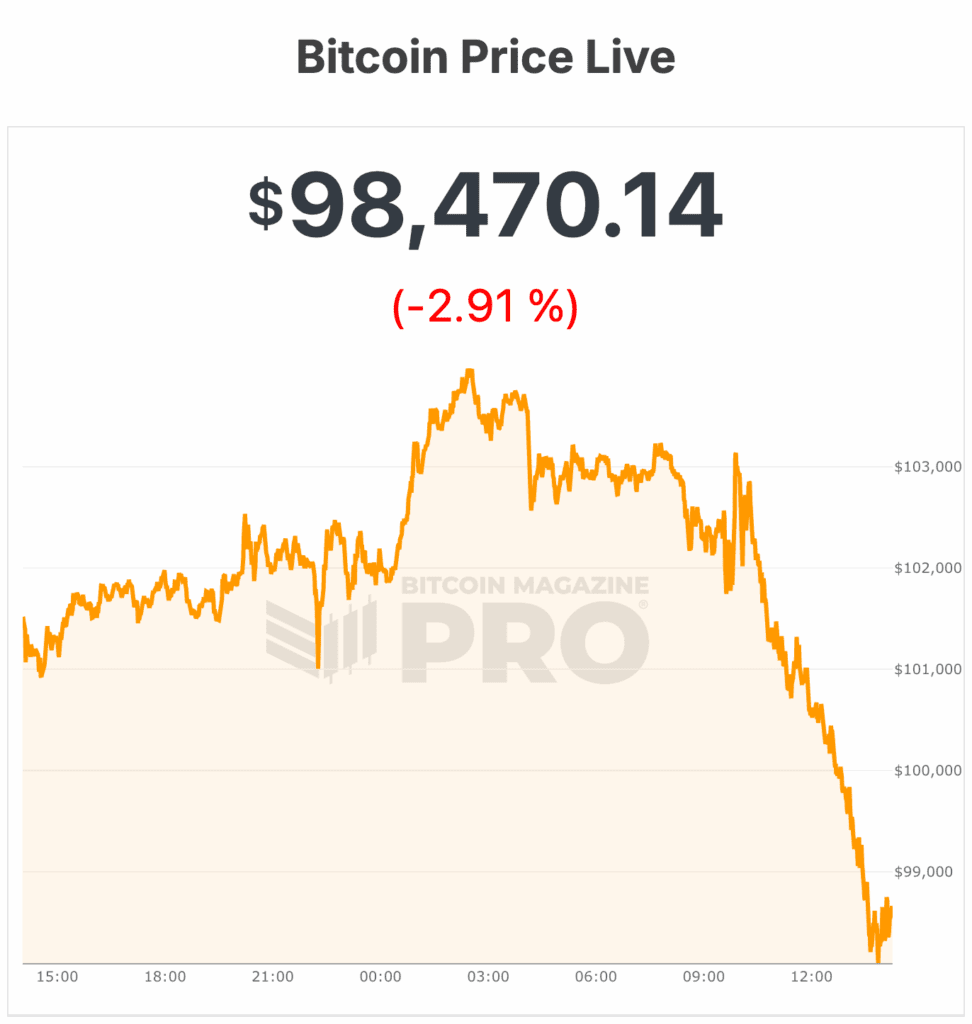

The price of Bitcoin fell sharply today, falling from an intraday high of $104,000 to $98,113, erasing earlier gains and marking a decisive break in price action.

As of morning trading, the price of Bitcoin steadily fell from $102,000 to lows of $97,870.

According to data from Bitcoin Magazine Pro, the last time Bitcoin’s price was close to these levels (below $98,000) was in early May, around May 8, depending on your time zone. The price of Bitcoin rose above $100,000 for over 40 days before falling back to $98,000 at the end of June.

One possible reason for the price of bitcoin is that long-term holders are offloading at record levels. Data from CryptoQuant shows that around 815,000 BTC were sold in 30 days, the most since early 2024, as spot and ETF demand weakened. Profit-taking dominates, with $3 billion in gains realized on November 7 alone.

Institutional buying also fell below the daily mine supply, intensifying selling pressure. Prices are hovering near the crucial 365-day moving average of around $102,000, and failure to hold there could trigger deeper losses, according to Bitcoin Magazine Pro analyses.

Bitfinex analysts say bitcoin’s current pullback mirrors mid-cycle retracements of the past, with the decline from the October high matching the typical 22% decline seen during the 2023-2025 bull market.

“It is also important to note that even at the $100,000 level, approximately 72% of total BTC supply remains in profit,” Bitfinex analysts wrote Bitcoin Magazine. They believe a brief relief rally is likely, but that a sustained recovery will require new demand.

According to The Block, JPMorgan analysts say that bitcoin’s current estimated cost of production of $94,000 serves as an all-time low price, suggesting limited downside.

Analysts believe the network’s growing difficulties have pushed production costs higher, keeping bitcoin’s price-to-cost ratio near historic lows. Analysts maintain a bold 6-12 month upside projection of around $170,000.

This comes as the US government reopened after a record 43-day shutdown, the longest in history, following President Trump’s signing of a relief bill last Wednesday.

Although federal operations are resuming, the recovery will be slow. Federal workers are still waiting for back pay, and air travel delays could persist.

Timot Lamarre, director of market research at Unchained, described Bitcoin to Bitcoin Magazine as a “canary in the coal mine for drying up liquidity in the market”. He notes that the recent government shutdown has caused the Treasury’s general account to swell, absorbing liquidity, and adds that as the government reopens, “more liquidity injected into the system will benefit the dollar price of bitcoin in the near term.”

Agencies like the IRS face significant backlogs, and national parks struggle to recover lost revenue. The short-term financing measure only extends until January 30, leaving the threat of another lockdown looming.

The return to normality will take time as the effects of the prolonged closure continue to be felt on the economy and public services.

The price of Bitcoin soared until October, when the government shutdown began, reaching new all-time highs above $126,000. But the excitement quickly gave way to turbulence: Bitcoin’s price fluctuated wildly for the rest of October and into November.

At the time of writing, the price of Bitcoin is $98,470.

Despite an overall bullish mood in the market, bitcoin price continued to drop deeper over the course of the month.

Bitcoin price and Nasdaq is the correlation that only hurts: Wintermute

Bitcoin is still closely tied to the Nasdaq, but it shows an unusual pattern: It reacts more strongly to stock market declines than gains, according to a recent report from Wintermute.

This “negative skew” – a stronger fall on bad stock days than rise on good ones – is typically seen in bear markets, not when BTC is near all-time highs. This suggests that investors are a little tired, not elated.

Two main factors are driving this. First, in 2025 attention and capital have shifted towards stocks. Big Tech and Nasdaq growth stocks are absorbing much of the risk appetite that could have flowed into cryptocurrencies. Bitcoin moves with the market when things go bad, but doesn’t get the same boost when optimism returns, acting as a high beta tail of macro risk.

Secondly, liquidity in cryptocurrencies is tighter than before. Stablecoin issuance has stalled, ETF inflows have slowed, and trading depth has not fully recovered. This makes downward movements more pronounced and widens the performance gap.

That said, BTC is holding up very well according to Wintermute. Even with this persistent downtrend, it is less than 20% below its all-time high. The pattern is unusual near the highs – it usually occurs near the lows – but it also reflects Bitcoin’s growing maturity as a macroasset.