The price of Bitcoin cut laterally for months, but the liquidity data that monitored this cycle are almost perfectly playing that they could soon change. Global M2, Stablecoin Supply and Gold Correlations everyone suggests that BTC is building pressure for its next breakout.

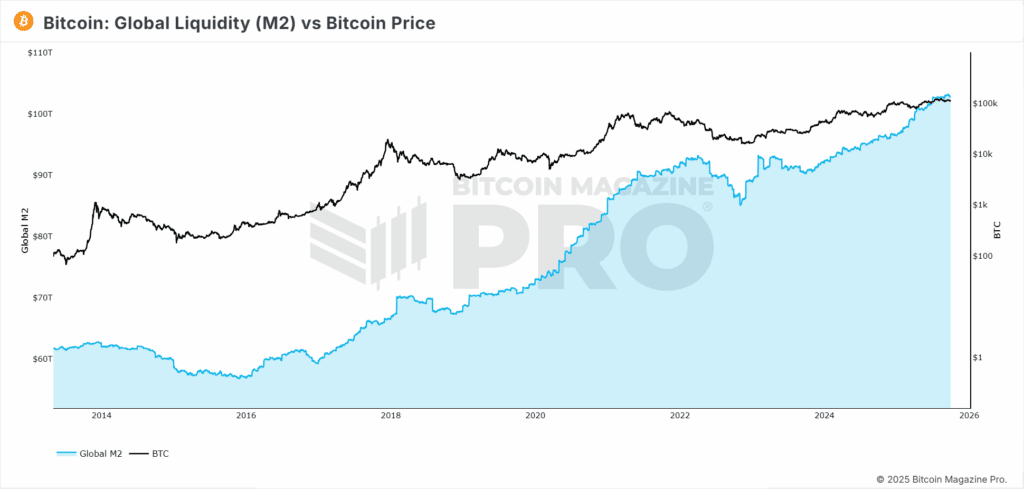

Global M2 and the Bitcoin price

The M2 global money offer has historically shown a strong link with Bitcoin cycles. The expansion tends to coincide with the bull markets, while the contraction or stagnation have aligned themselves with periods of chop and disadvantage. In recent months, the global growth of M2 has slowed down and BTC has reflected with a stagnant price action after reaching a maximum of all time close to $ 124,000. When Global M2 accelerates again, it is constantly flowed into speculative activities, with Bitcoin one of the major beneficiaries.

Stablecoin Supply and Bitcoin Price Trends

The Stablecoin offer within the cryptographic ecosystem has shown that it is an even stronger indicator of global M2. The correlations with BTC reached over 95%and, on an annual basis, the alignment remains almost perfect. When the variation rate of the supply of Stablecoin cross above the 90 -day mobile average, it has historically reported an ideal period to accumulate Bitcoin before strong gatherings. The opposite was also true, with contractions in line with periods of weakness.

Gold correlations and the price of Bitcoin

During 2025, Bitcoin has traced the gold more closely with a delay of about 40 days, showing a correlation of over 92%. Gold’s incessant push to the new maximums of all time this year has provided a tail wind for BTC, which often follows while investors revolve in more difficult and more speculative activities. If this report is worth, BTC could see a breakout around $ 150,000 in early November.

Force in US dollars vs. Bitcoin price

While the liquidity and correlations of gold bent up, the strength of the US dollar strength showed the opposite. Bitcoin generally exchanges in the dollar inverse and the Dxy has bounced in recent weeks. On a year on year, the reverse correlation is about 40%. This suggests that a short -term cut or reduction could remain, even if the greatest trend promotes the highest prices.

The confluence of global M2, stablecoin supply and gold correlations indicate that BTC are on the verge of a large breakout, with the Q4 seasonality which adds further weight to the bullish case. However, the contrasting signals of the dollar remind us that lateral trading and false parts are part of each cycle. The Bitcoin price has a story of long consolidations before explosive moves and current data suggest that we could be right at the limit of one hour.

For a more in -depth look in this topic, watch our most recent YouTube video here:

Bitcoin is perfectly following this data point

For deeper data, graphic designers and professional insights on Bitcoin price trends, visit Bitcoinmagazinepro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for more experienced insights and market analysis!

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.