This article is based on research and analysis originally presented by Matt Crosby di Bitcoin Magazine Pro.

Bitcoin has waveted in recent weeks, with the Bitcoin price that has exceeded $ 95,000 after months of not very brilliant performance. For many traders and investors, this turn marks the return of the Tori market that has been long awaited. The question about everyone’s mind: can Bitcoin finally break his previous $ 108,000 maximum or is it just another fleeting event?

In this article, we will examine the factors that guide Bitcoin’s recent impetus, dive into the technical data and on chain and we will discuss the wider macroeconomic context to evaluate whether the cryptocurrency leader can support this upward race.

A quick rebound: the recent increase in bitcoin

The price of Bitcoin had previously experienced a significant dive of over 30%, descending from its maximum of $ 100,000+ in the $ 70,000 interval. However, after a period of uncertainty, the king of cryptocurrencies regained his foot and returned to $ 90,000. This price recovery comes after a multi-mese consolidation phase, which many have seen as a bearish market structure. But recent developments suggest that Bitcoin could be on the cusp of a severe breakout, supporting a renewed wave of Bitcoin Prices’ forecasting models that enter the discussion.

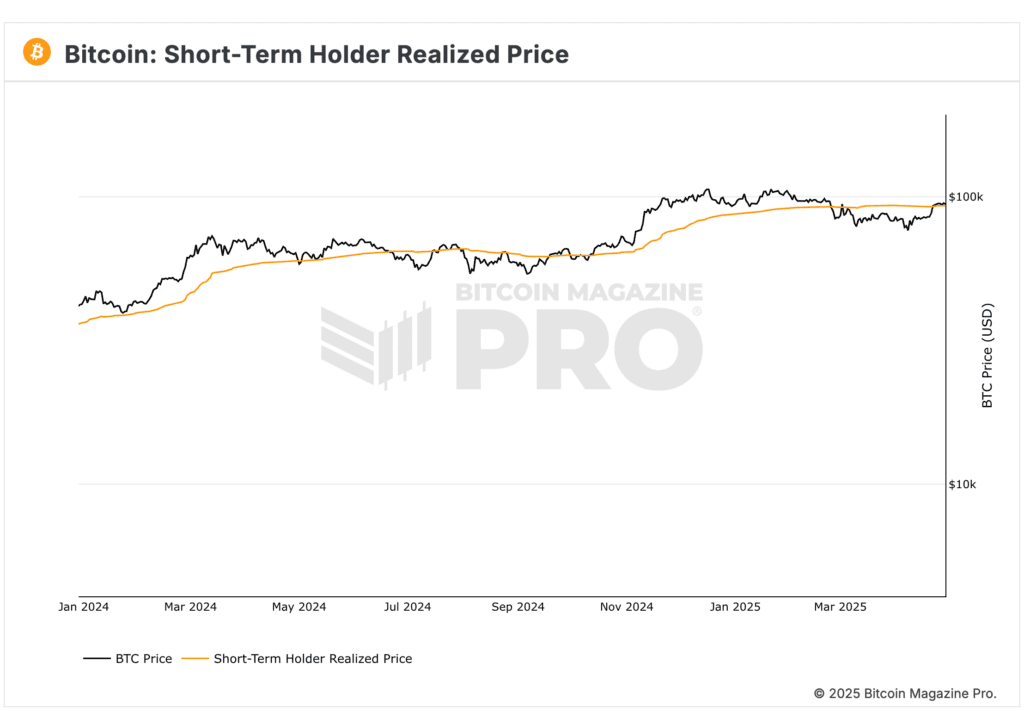

The action of Bitcoin prices recently recovered several key levels, including short -term critical support has made the price (ShH has made the price), which is often seen as an important sign of market resistance. Historically, during the Toro Markets, the short -term owner realized that the price acts from a support level. When this metric moves from resistance to support, it generally indicates a solid base for further movements upwards.

In recent weeks, Bitcoin Price (BTC) has recovered the level of about $ 93,000 to $ 95,000, indicating that the market may have prepared for a more substantial event. Since previous bull cycles have seen similar behaviors after recovering the key levels of prices, many are starting to feel more and more confident about the potential for a new historical maximum in 2025.

Chain data: the bullish signs of the market strength

When you analyze Bitcoin, it is not only the action of the price that matters, but it is also the chain data. These data help us understand the behavior of the market participants and provide information on the health of the network. The recent movement of the supply of long -term support is one of these indicator that indicates the prospects for strengthening Bitcoin.

In recent months, Bitcoin had experienced an unusual model in which long -term owners (those who have held Bitcoin for over a year) actively sell their participations, potentially blocking profits. This had led many to worry that Bitcoin’s price was close to his peak. However, recent data show a reversal in this trend. Long -term holders have started to accumulate again, which is often a strong bullish signal in a Bitcoin market cycle. Historically, when long -term owners move on to the accumulation mode, it generally marks the beginning of a new phase of bull.

In addition, the presence of ETF afflusted further strengthens this optimistic perspective. In recent weeks, Bitcoin Etfs have seen hundreds of millions of dollars flow, which indicates a growing institutional trust in Bitcoin. These affluses arrive in a period when traditional markets, such as the S&P 500, had to face volatility, but Bitcoin managed to maintain its position and even the rally despite the largest market corrections.

The role of the fundamentals of the market: because this move seems different

There is a fundamental change that takes place in the Bitcoin market right now, which suggests that this is not just another short event. The current bitcoin high motorcycle seems to be guided mainly by guided commercials to commercials, rather than a trading too leverage. When the Bitcoin price increases due to the increase in the spot demand rather than the excessive leverage, the move is generally more sustainable and less subject to acute inversions.

One of the key drivers of this more organic pressure upon rise in the Bitcoin price is the drop in the resistance index of the US dollar (Dxy). In recent weeks, the Dxy has fallen, reporting a decrease in demand for the dollar. This trend has made resources at risk as more attractive bitcoins. Since global liquidity has increased due to various monetary political actions, Bitcoin benefits from this wider trend on the market. The reduction of the dollar strength also reports a potential change in the feeling of investors, with more capital flowing in activities that could overperform in an environment in weaker dollars.

In addition, the Bitcoin correlation with traditional equity markets, in particular the S&P 500, was a key factor to be monitored. For most of 2023, Bitcoin has shown a strong positive correlation with the stock market. This means that when the S&P 500 rallies, Bitcoin tends to follow the example. The recent action of prices has shown that Bitcoin has been able to hold its position despite a temporary dip in the equity markets, further suggesting that the bullies in Bitcoin could be supported, especially if traditional markets continue to bounce.

Macro factors: the state of global liquidity

The broader economic context cannot be ignored. Large quantities of liquidity have been injected into global markets from 2020 to 2022 by central banks. While this liquidity initially pushed the inflation of activities in all markets, now it also shows signs of positive influence also in Bitcoin.

Bitcoin has historically correlated to global liquidity and recent data trends suggest that the greater liquidity in the financial system is finally starting to influence the cryptocurrency market. The recent increase in Bitcoin coincides with this growing liquidity, further strengthening the case of a more prolonged bullish phase.

However, there is still a crucial factor to consider: the state of global actions and their potential to influence the price of Bitcoin. The S&P 500, while showing a strong rebound, is still facing a resistance to key levels. The price of Bitcoin has been closely linked to the wider performance of the actions and if the stock market has to face further turbulence, it could also dampen the prospects of Bitcoin.

What is Bitcoin’s future: $ 100,000 and beyond?

The $ 100,000 level is the immediate goal for the Bitcoin price, but the real question is: can it break through this resistance and push in a new territory of all time? The recent recovery of key levels, as the short -term owner has created the price and mobile media (100 days, 200 days, 365 days), shows that Bitcoin is in a strong position to test $ 100,000 again.

From a technical point of view, Bitcoin is currently in a distinctive situation. If it can contain over $ 90,000- $ 95,000 and continue to create support, the path to new maximums of all time becomes increasingly likely. The next great resistance will probably be about $ 108,000, which is the current maximum of all time. If Bitcoin can break through that level, we could see a quick move to higher levels, reaching a little $ 130,000 in the next cycle.

However, there is always the possibility of a retracement. If Bitcoin is unable to hold its support levels or if the global market conditions become reiterated, we could see the price falling into the interval of $ 80,000. A bearish test would be a critical moment for the market, since the failure to recover the support could prepare the foundations for a more significant negative aspect.

Conclusion: a bullish perspective with cautious optimism

All signs indicate a potential Bitcoin gathering, with strong data on chain, a favorable macro environment and a positive feeling in the derivative markets. However, the key to supporting this bullish momentum lies in Bitcoin’s ability to hold its current levels of support and navigate potential market corrections. The strong correlation with the S&P 500 remains a crucial factor to look at, since any recession in actions could have an impact on the action of Bitcoin prices.

In the coming weeks, all eyes will be on Bitcoin’s ability to recover $ 100,000 and prepare the foundations for the new maximums of all time. While there is a lot of space for optimism, traders should remain vigilant and prepared for any potential volatility. As always, the key to success in the cryptocurrency market is to remain guided by data and adapt to market conditions while evolving.

To explore the live data and stay informed on the latest analysis, visit Bitcoinmagazinepro.com.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.