Bitcoin slipped at $ 114,736 before bouncing to $ 116,314 on Monday, the mobility of greater market weaknesses with a global crypto capitalization dropping 1.42%, according to CoinMarketCap data. The decline came as entrepreneurs were glued with increased geopolitical risk, technical breakdowns, and signs of institutional appetite.

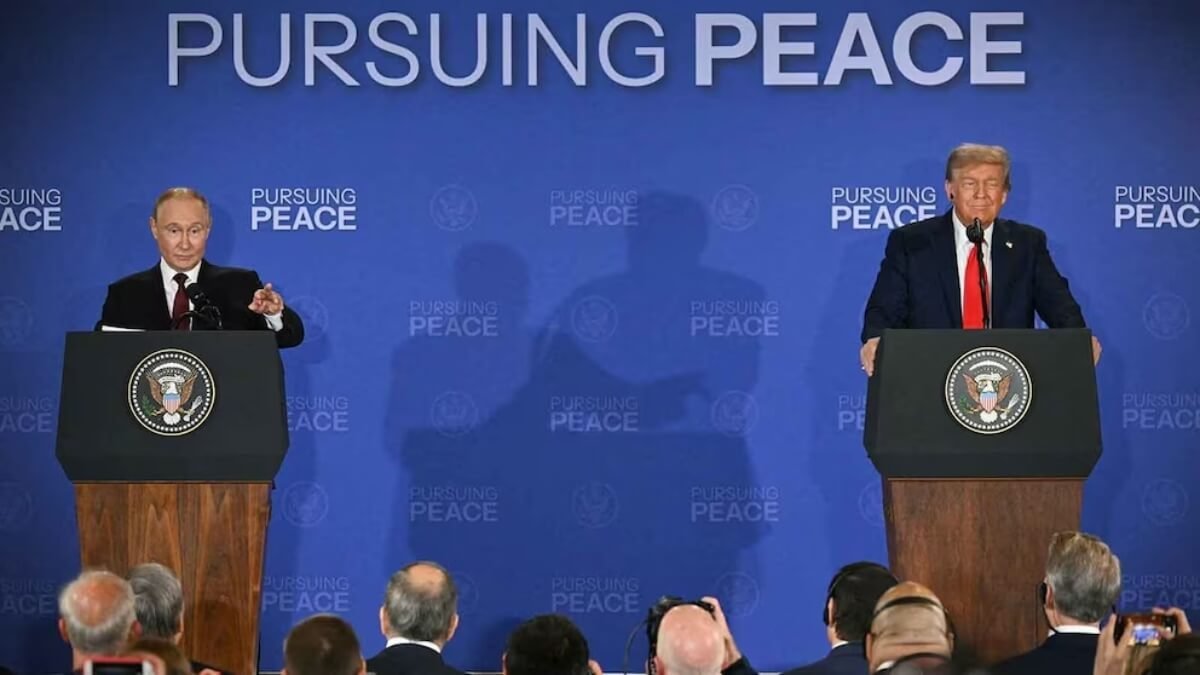

Geopolitical uncertainty sparks liquidations

The markets negatively affect the unhappy Trump-Putin summit in Ukraine, which failed to deliver clarity in the direction of future policy. The uncertainty has been able to trigger $ 584 million in extermination, with a long position worth 86% of the total. Historical patterns suggest that periods of geopolitical stress often drive crypto sellers, which disturb the appetite of risk to digital properties. Investors are closely watching US-led Ukraine conversations scheduled for later (August 19) to measure the next impulse in the market.

Technical breakdown increases pressure

Bitcoin violates key support levels, slipping under 7-day simple transfer of average ($ 118,992) and the 23.6% fibonacci retracement ($ 121,504). Momentum indicators were also careful, with a relative power index at 47.24 signing neutral-to-bearish conditions. The slide activated stop-loss trigger and algorithmic seller, boosting the downside pressure. Analysts filed $ 114,500, 38.2% fib retracement, as a critical support zone. A breakdown can expand losses to $ 111,000, though the 200-day EMA at $ 100,286 remains intact, maintaining a wider uprising.

ETF Outflows Signal Cooling Institutional Demand

Spot Bitcoin ETF recorded their first net outflows for a week, with a $ 14 million release of funding, while Ethereum ETF poured $ 59 million. It follows a record of $ 3.75 billion flowing earlier this month, suggesting institutional investors rotating income after aggressive accumulation. Noteworthy, Blackrock’s Ibit draws $ 336 million in fresh flow on August 15, emphasizing mixed demand signals to large investors. Analysts warn that ETF flows will remain a major price floor, and that long -term flows can weaken structural support for BTC.

Context: From ATH to correction

Bitcoin’s latest sinking will come just days after it sets a fresh all-time high, strengthened by the unprecedented ETF flows and Macro sentiment. Historically, pullbacks often follow record records because books and market traders are testing new support levels. The current correction reflects a natural cooling season after a super -hot rally, with returns of ETF flow, technical reset, and geopolitical concerns acting as catalysts. Despite the short-term pressure, the 200-day EMA shows long-term trend remains a steady intact, which frames the fall as a combination rather than reversed.

Specializing in the market

Ryan Lee, chief analyst in bitget, Bitcoin said it appears to be set to combine -combining between $ 112,000 and $ 118,000 while Ethereum traded at $ 4,100 to $ 4,600 range.

He noted that the action remains high in the markets in futures, boosting volatility in both directions. “Macro factors remain important, especially at the discretion of the Federal Reserve of September.

Shivam Thakral, CEO of Buyucoin, That -Hillight that the total Captto Market Cap dropped below $ 4 trillion, with BTC forced by fluids and global uncertainty.

“ETH lost its vapor after its rally, combined with close to $ 4,300, while XRP and Sol saw 4-5% denial,” he said. Thakral added that reducing the rate of dependence rate suggests markets can remain choppy in the near term.

Bitcoin’s close view

The near term of Bitcoin depends on whether the $ 114,500 holds in support in the middle of a rear of elevated action, geopolitical headlines, and transferring ETF flow. While the long-term uprising remains intact above the 200-day EMA, entrepreneurs face a volatile atmosphere with risks that tilted further collapse if uncertainty continues.

Also Read: Solana Expands Stablecoin Payment Reach by Incorporating BitPay

Denial: The information provided to Alexablockchain is for information purposes only and does not generate financial advice. Read the complete decline here.