Following the latest commercial window, the Etf Bitcoin US Spot recorded another week of overwhelming networks with investors who extract over 900 million dollars from the market. This development marks the fifth consecutive week of reimbursements that indicate a weak market trust among the institutional investors of the main cryptocurrency.

Bitcoin institutional investors retire for the fifth consecutive week

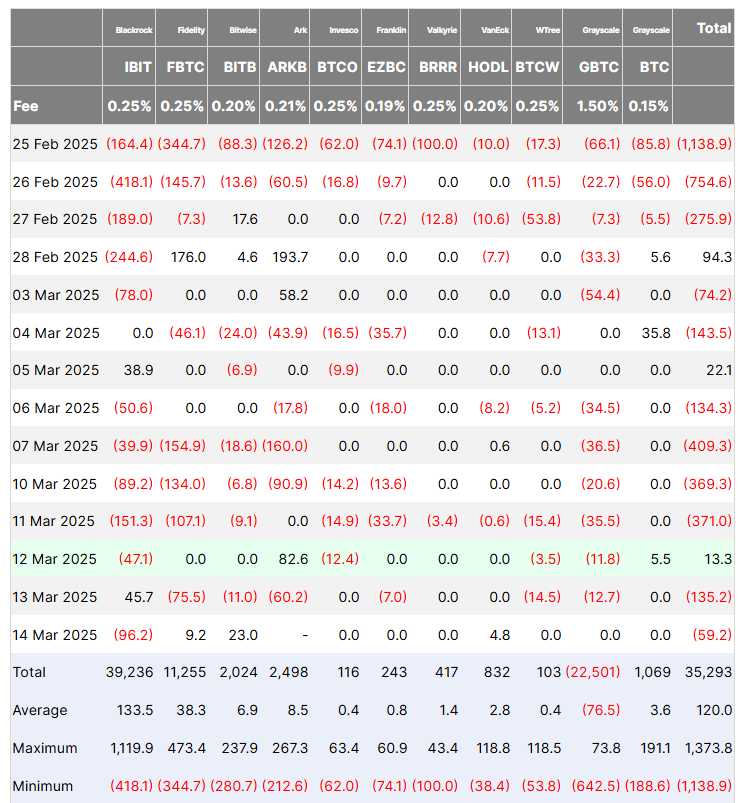

After a strong beginning of the year that saw the Bitcoin Etf attracting over 5 billion dollars of investments, institutional investors have shown a lot of caution in the last few weeks indicated by huge withdrawals. According to Farside Investors data, the Bitcoin Spot Etfs recorded $ 921.4 million in net deflowers during last week culminating in an estimated total of $ 5.4 billion in the last five weeks.

Most of the samples of last week was extracted from Blackrock Ibit which recorded $ 338.1 million in net deflowers. Fidelity’s FBTC has followed investors closely with reimbursements of funds that exceed $ 307.4 million deposits. Other Bitcoin Etfs such as ARK’s ARKB, BTCO of Invesco, the Ezbc of Franklin Templeton, WisDumer’s BTCW and Grayscal’s GBTC have seen moderate clear deflowers between $ 33 million-$ 81 million.

Meanwhile, Bitb of Betwise, Valkyrie’s Brrr and Vaneck’s Hodl have recorded minor networks not exceeding $ 4 million. Grayscale’s BTC emerged as the only fund to have a positive demonstration with net influences of $ 5.5 million.

The constantly high levels of withdrawals from Bitcoin Etfs can be associated with the recent correction of BTC market prices. In the last month, the inaugural cryptocurrency has recorded a drop in prices of 11.95% reaching levels up to $ 77,000. During this period, institutional investors showed a lot of caution, with the total net activities of the Etf Bitcoin Spots down by 21.70% to $ 89.89 billion according to Sosovalue’s data.

ETF Ethereum forgive $ 190 million in withdrawals

Among the struggles of Bitcoin Etfs, the Etfs Ethereum Spot market is experiencing such a feeling of investors following a net deceased of $ 189.9 million in the last week. This development marks the third consecutive week of withdrawals, bringing total net deceased to $ 645.08 million in this period. Similar to its Bitcoin counterpart, Etha of Blackrock recorded the largest withdrawals of last week assessed at $ 63.3 million. At the time of the writing drafting, the total cumulative affluents in the Etf Ethereum market are evaluated at $ 2.52 billion with total activities on the same time on $ 6.72 billion, that is 2.90% of the ETH market capitalization. Meanwhile, Ethereum continues to exchange $ 1,924 by reflecting a 0.73% gain in the last 24 hours. On the other hand, Bitcoin is evaluated at $ 84.009 without any significant price variation on its daily graph.