Yesterday Bitcoin saw a modest retracement, immersing himself slightly but continuing to trade in a limited interval between the key and resistance key levels. While the largest Altcoin market faces greater volatility and remarkable losses, BTC remains relatively resistant, but the momentum appears uncertain. Analysts warn that if feeling weakens, a wider correction could take place.

Reading Reading

The Top Darkfost analyst has highlighted a critical dynamic now that it is developing: the vulnerability of short -term owners (STH). These investors, who entered the market during recent price waves, hold Bitcoin with significantly higher cost. While the price action blocks or portrayed, they are generally the first to capitulate, creating greater sales pressure.

With the Altcoin already under stress, all eyes remain on the fact that Bitcoin can hold back the current support levels or if even if it starts to decipher in the short term. This phase could act as stress tests for recent buyers, while long -term owners and institutional participants continue to monitor the areas of key prices.

The key -made levels suggest that the Bitcoin structure remains bullish

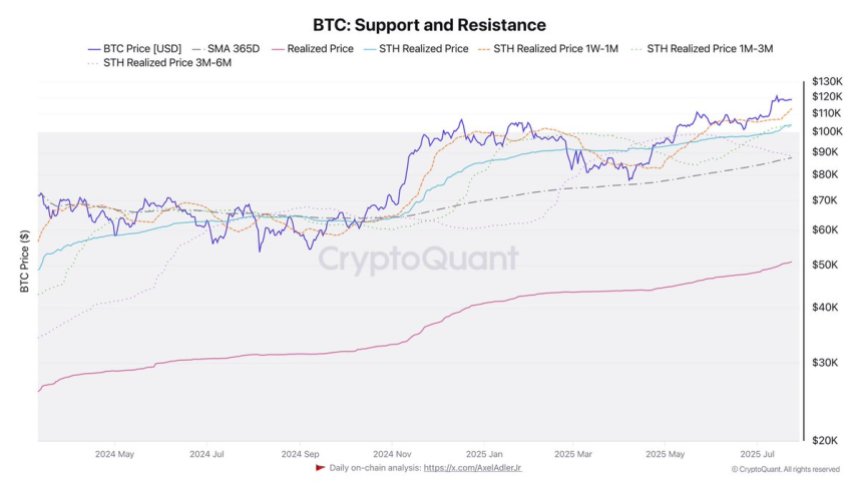

Darkfost shared a graph that offers a deep dive in the prices made of Bitcoin through various seal cohorts, focusing in particular on short -term owners (STHS). These metrics are being proved crucial to identify the support areas that could be defended if the price continues to correct in the short term.

The largest price made for Bitcoin is currently at $ 50.8k, while the annual average is significantly higher at $ 87.5k. More critically, the price made for STHS – those who have bought coins recently – is positioned at $ 103.9k. Keep it further, let’s see the prices made based on the time detained:

- STH 3M -6m: $ 88.2k

- STH 1M – 3M: $ 104.1k

- STH 1W – 1m: $ 113k

These figures represent the average price to which several groups of recent investors have acquired their coins. As such, they act as psychological and technical support levels during corrections.

With Bitcoin that currently consolidate after a small retracement, the bulls are observing these price areas built to evaluate whether the structure remains bullish. The level of $ 104k, in particular, is essential: it aligns up close with the 1 m -3m price of ShH and could act as a decisive line for the feeling and defense of prices.

If buyers can contain BTC above this level, the market bullish structure will probably remain intact, suggesting a healthy consolidation rather than the reversal of the trends. On the contrary, losing it could trigger the sale of short -term panic among the recent participants.

Reading Reading

Bitcoin prices analysis: key levels are worth new maximums

Bitcoin continues to consolidate in a narrow range after setting new tops of all time at the beginning of this month. As seen in the 3-day graph, BTC holds over $ 115,724-Ua Key-E horizontal support under immediate resistance near $ 122,077. This consolidation range has remained intact for over a week, reflecting both the strong question and the hesitation near the psychological resistance.

Despite the recent little Pullback, the general market structure remains bullish. The price is exchanged well above the 50 -day mobile averages ($ 98,536), 100 days ($ 93,833) and 200 days ($ 76,201), which continue to hang up. This confirms a strong medium and long term moment.

Reading Reading

The volume slightly decreased during the current limited movement for the interval, indicating a break after the aggressive rally from less than $ 100,000. However, the bulls are clearly defending the region of $ 115,000 – $ 116,000, an area that coincides with the top of the previous breakout.

First floor image from Dall-E, TradingView chart