The listless ribbon of Bitcoin in the face of the roaring Macro risk is less a contradiction of a timeline problem, supports this week of The Weekly Insight (week 160, 20 September 2025). Writing under the “Why’s BTC delayed?” Banner? “, The collaborator @cryptoinsighttuk establishes a decidedly constructive medium-term tone-” I want to start this week by saying that I am bullish and I will continue to be bullish until I believe that we are close to the top “-while the market feels late searched and emotionally put around. “Having said that, I think we are closer to the top than a minimum here,” he adds, but the author still believes “we are approaching the most euphoric phase of this bull cycle”.

Why is bitcoin late?

The piece supports much of today’s malaise on the reflexivity of feeling. The negativity of the grinding-twitter grinding is described as a feedback circuit that generated the view that makes the market heavier than it is. “That delay may seem frustrating,” writes the author, observing that the Fear & Greed index did not show the readings grouped of “extreme greed” that characterized the double top of 2021.

Reading Reading

Apart from an explosion of exuberance around the end of 2024/at the beginning of 2025— “which coincided with the XRP rally from about 50 cents to $ 2.70, possibly inserting itself from about $ 3.30 to $ 3.40”-the index remained in the balance in the middle band, far from the explosion conditions that typically Mark Cycle Clecle. The implication is simple: despite the noise, the market has yet to show the classic euphoria clusters that precede the peaks.

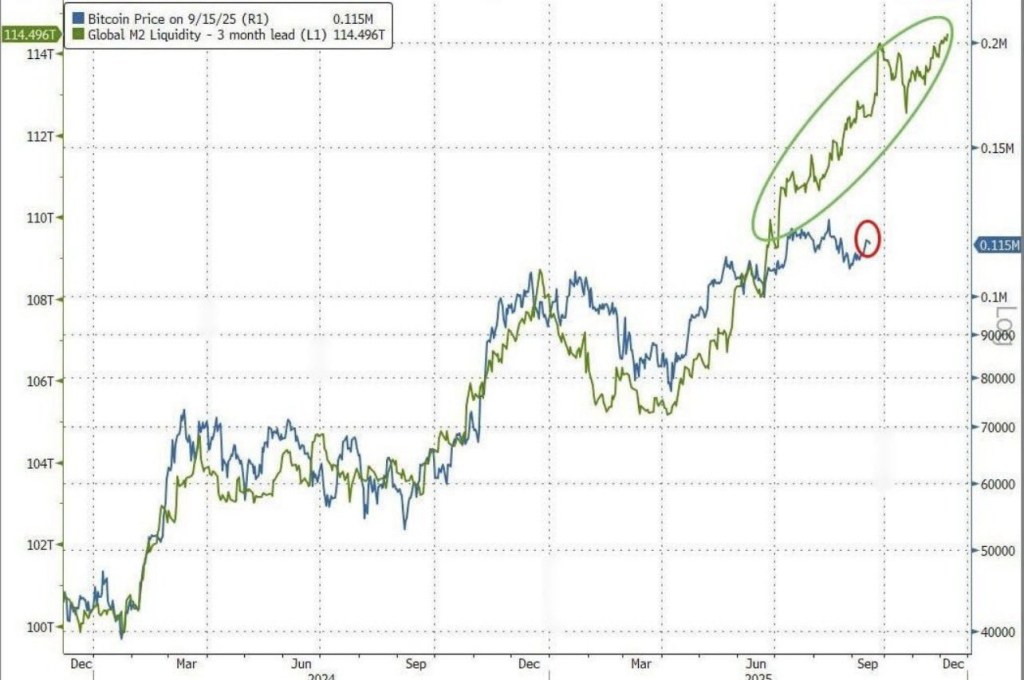

The macro correlations, often invoked to explain the leadership or submerform of Bitcoin, are used here to discuss the delay rather than the failure. On the offer of M2 coin, the author reiterates a three -month -old connection well blocked: “Bitcoin and the offer of M2 money are related up close so far, but in the last two or three months M2 has absolutely torn”. From here, readers can “argue that the correlation is broken or that Bitcoin is simply late and has yet to recover”.

A similar reading extends to gold. The directional leadership has alternated between the two activities, but with a bullion that presses higher, a recovery in BTC “would imply a passage towards at least $ 135,000, compared to the current level of about $ 115,000”. The actions tell the same story in another register: the Nasdaq, Dow Jones, S&P and Russell 2000 are high or almost fresh of all time while Bitcoin has “mostly chopped laterally”, “they seem as if it could be late.”

The market microst structure adds a decisive layer. The letter underlines the interaction between visible and consolidation dynamic pockets. “Whenever there has been a significant accumulation of liquidity, in the end Bitcoin has overcome.” As the price has increased, liquidity at rest has thickened: “Red indicates the deepest liquidity, orange the next and green the lightest” – and the breakouts have been stronger once those deep pockets have been taken.

The example provided is the “$ 70k to $ 100k” race, in which “heavy consolidation was followed by an explosive breakout”. With that logic, the current map “indicates a move to $ 140k or higher”, which also adapts to the topic of golden equality. The author’s metaphor is saying: “I often explain a price action such as the stored energy. Firm and consolidate longer and consolidate, the greater the possible release”.

What role do Altcoin play?

The strongest statement in the question does not concern Bitcoin but Altcoin. It is said that it is Total2 (Crypto Ex-Btc) and Total3 (Crypto Ex-Btc and Eth) have “closed a daily candle in the discovery of prices”. Total2 “has closed a maximum weekly of all time and is now extremely close to the closure of a second consecutive weekly maximum”, while Total3 is located “right on the limit to break into new maxims of all time”.

Structurally, the Total2 framing report such as completing an accumulation of Wyckoff and a cup and a handle and total like carving an ascending triangle ready for continuation. The combination – feeds the discovery of prices while Bitcoin “is preparing to push the new maximums” – is the installation that the author is associated with “mania or euphoria”. It is also the basis for a clear dissemination of positioning: “It is exactly the reason why I am completely positioned in Altcoin here”.

Reading Reading

That rotation view is supported by a call on Bitcoin domain. The author reiterates a longtime goal: “I think we are going down at least at the level of 35.5 percent and potentially even up to 20 years”. Historical analogues are unequivocal: from 2017, the domain “decreased by 62 percent” and by the maximum of 2021 “has decreased by 46 percent”, each time accompanied by an acceleration in the monthly decline.

If a similar acceleration coincides with BTC “snatching with new maximums of all time”, the result would be “an altcoin face that melts the face that most people cannot even imagine right now”. The letter connects this purely market configuration with external catalysts, citing “important legislative changes in the largest financial economy in the world” and “the potential influx of trillion dollars through Stablecoins and the Clarity Act, which could be approved as soon as November”.

Where will Bitcoin Price price come?

The problem closes with a complementary technical brief of @Thecryptmann1 which focuses on the short -term risk map. For BTC SPOT, “decision time … quickly approaches”, with the area between $ 111,000 and $ 115,000 marked as “huge”. Losing it and “liquidity around the $ 105k range seems inevitable”. The heat maps of the orders book on the exchange side show “a piece of liquidity sitting here through all exchanges”, suggesting a high volatility if tested. The analyst does not force a directional call – “I’m not sure what the market oscillates” – and label the “dangerous” aggressive speculation in the current chop.

A second lens comes via USDT Dominance (USDT.D), which the analyst reverses to keep track of appetite at risk. The metric was “blocked [a] Range in the last 15 months “, but structurally” seems to be a graph that is about to revisit its maximums (which, in reality, are the bass) “. The declared goal remains of 3.76%. It is not a financial advice, precisely the way I am approaching.”

The short -term path “Max Pain” is designed with irony of the characteristic market. A plausible sequence is “$ btc that pushes up to $ 120,000, everyone goes to panic and go for a long time, feeding the liquidity under us and then sweep the minimums”. The analyst warns that a direct drop in the “$ 100,000 range of” low “seems” too obvious “, but admits that both liquidity on the side and downward are attractors in a compressed volatility environment. The mood music for the traders is extremely added in a single line: “It is getting cigolating time”.

At the time of printing, BTC exchanged $ 112,712.

First floor image created with Dall.e, graphic designer by tradingview.com