Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

According to the entrepreneur Crypt Arthur Hayes, it is likely that Bitcoin (BTC) basically about $ 70,000, marking a 36% correction compared to his latest maximums of all time (ATH) of $ 108,786. Hayes said that such corrections are “very normal” in a bull market.

Bitcoin to immerse yourself further?

Yesterday Bitcoin touched a minimum of four months of $ 76,606 while both the global cryptocurrency and the share markets collapsed among the growing fears of an economic recession. For the context, the S&P 500 (SPX) has dropped by almost 8% in the last month.

Reading Reading

The latest predictions on the polimarket of the market platform assign a 39% probability of an American recession in 2025. On February 28, the platform gave a 23% probability of an US recession this year.

Despite these economic concerns, Hayes recommends cryptographic investors to remain patient. In an X send Published yesterday, the former Bitmex CEO said BTC will probably find a put the bottom a About $ 70,000, completing a routine correction of 36% from its ATH in January.

Hayes also observed that once BTC has reached $ 70,000, traditional financial markets – including S&P 500 (SPX) and Nasdaq (NDX) – should experience a strong decline, accompanied by failures in the main financial institutions.

This, in turn, would push the central banks such as the Federal Reserve (Fed), the European Central Bank (ECB) and the Banca del Japan (Boj) to start quantitative Easing (QE), creating an optimal purchase opportunity. He added:

Then load the truck. The traders will try to buy the dive, if you are more than the risk, wait to relieve the central banks, then distribute more capital. You may not take the bottom, but you will not even have to mentally suffer for a long period of lateral and potential unrealized losses.

Historical data suggest that the QE was very advantageous for the price of BTC. During the last period of QE, from March 2020 to November 2021 – between the Pandemic Cofana – BTC rose from $ 6,000 to $ 69,000, marking a surprising 1,050%gain.

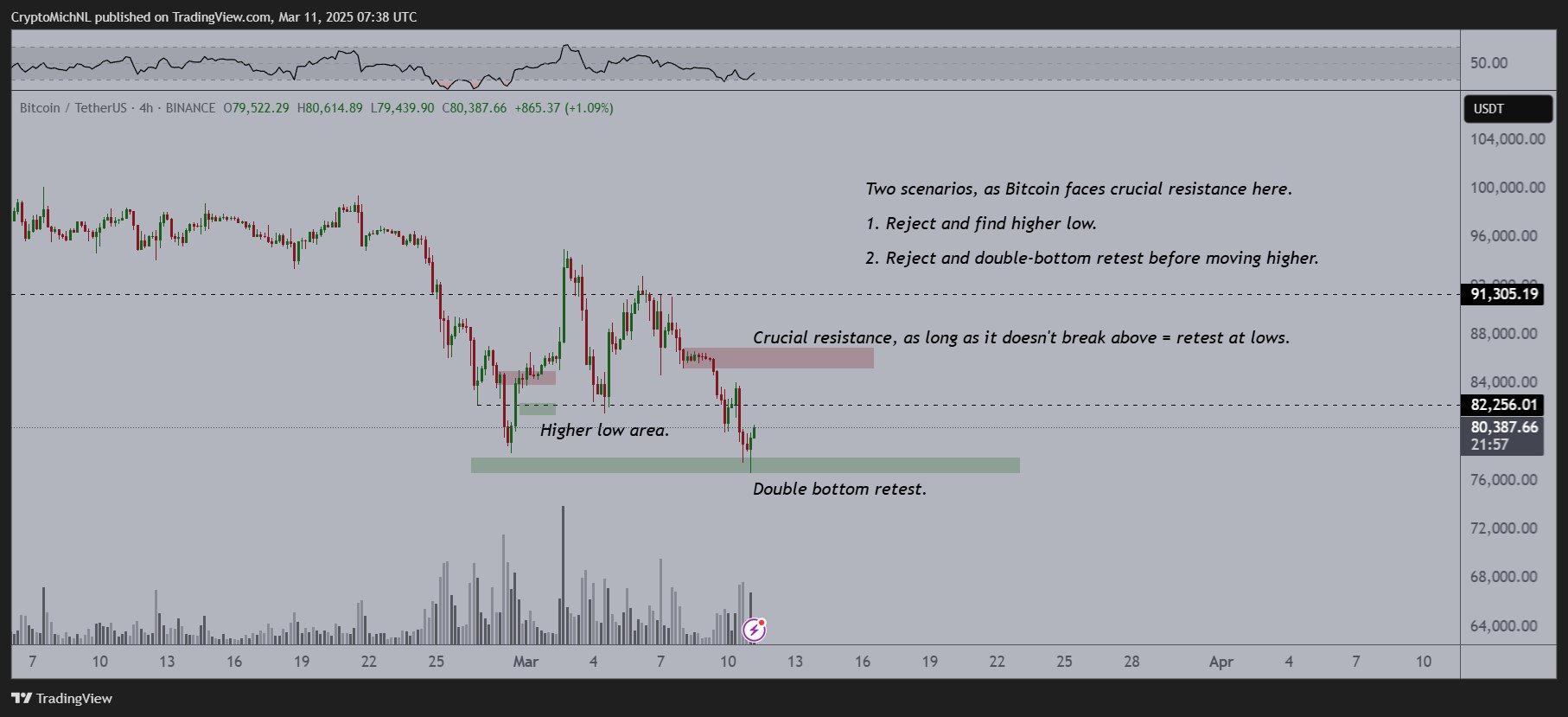

Similarly, cryptographic analyst Michael Van de Poppe shared The following graphic designer, observing that BTC probably completed a double bottom re-test and experienced a strong rebound after yesterday’s minimum potential. He also suggested that if BTC passed over $ 83,500, he could see an even stronger move to the rise.

Data points towards the reversal of the BTC trend

While Hayes provides that BTC has yet to doctors, several indicators suggest that the top cryptocurrency could soon attend a turnaround. For example, the relative resistance index of BTC (RSI) is currently to his lowest Level from August 2024, indicating that a potential recovery can be imminent.

Reading Reading

In addition, the US dollar index (Dxy) recently experienced one of its largest weekly loss Since 2013, collecting hopes for an event in risk activities such as Bitcoin. At the time of printing, BTC is exchanged at $ 80.008, growing by 0.1% in the last 24 hours.

In the foreground image from Usplash, X and TradingView.com graphics