When the world’s largest asset manager narrows its attention to just two crypto assets, investors take notice. BlackRock’s latest website notes that among thousands of cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH) are the digital assets it considers to be primary allocations.

Why is this important now?

In the third quarter of 2025 alone, BlackRock increased its cryptocurrency holdings by more than $22.46 billion, according to Finbold’s Q3 Cryptocurrency Market Report. This growth was largely driven by new exposure to Ethereum combined with the continued accumulation of Bitcoin.

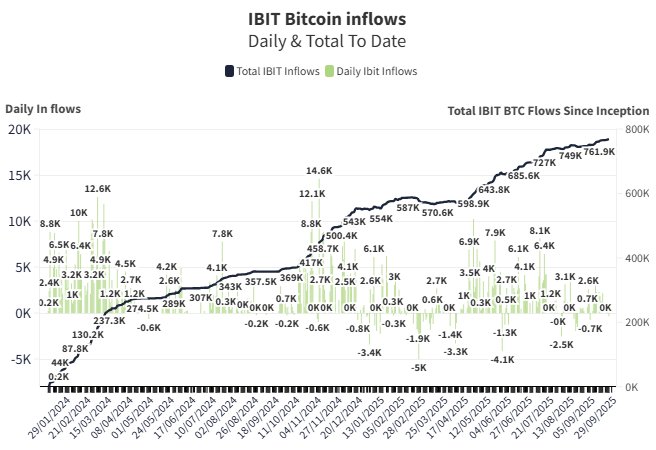

Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) dominated US ETF flows. Research shows that without IBIT, U.S. spot bitcoin ETFs would have been net negative for the year, underscoring the extent to which institutional demand is directed to a single product.

Bitcoin is still the anchor

BlackRock continues to treat Bitcoin as its primary cryptocurrency. Bitcoin remains the most liquid, most widespread and most regulated asset in the sector. Its status as “digital gold” continues to resonate with portfolio managers looking for uncorrelated hedges. Even BlackRock CEO Larry Fink recently suggested that Bitcoin could one day reach $700,000 if ETF inflows continue long enough.

You own cryptocurrencies if you believe “countries will continue to devalue their currencies,” Fink said.

BTC may not offer the explosive upside of smaller coins, but as long as institutions like BlackRock continue to buy, BTC remains the sector’s benchmark.

Ethereum is a growth play

If Bitcoin is the anchor, Ethereum is where BlackRock sees growth potential. According to a Finbold report, Ethereum holdings within BlackRock’s cryptocurrency exposure rose sharply in the third quarter, outpacing Bitcoin’s growth rate.

Why Ethereum? Unlike Bitcoin, Ethereum is not just a store of value, it supports DeFi, staking, tokenization, and smart contracts. This makes it the preferred means of exposure to cryptographic instruments rather than mere scarcity. Wall Street analysts even consider Ethereum an “infrastructure bet” for cryptocurrencies, especially with US Treasuries and real assets migrating in its path.

BlackRock’s activity in October reflects this divided approach. Between October 1 and October 29, 2025, the company’s holdings of digital assets jumped from $103.8 billion to $108.3 billion, according to portfolio tracking data.

The increase was driven by significant accumulation of both Bitcoin and Ethereum. In just under a month, BlackRock added 36,570 Bitcoin (about $3.98 billion) and nearly 218,000 Ethereum (about $520 million).