After months of poor performance compared to BTC USD, Ethereum Crypto is now focusing. Not only was it flexible, as it absorbs the pressure pressure, but after disappointment in H1 2025, the currency is on the threshold of the 2021 collapse. At instant prices, ETH USD is trading above $ 4,500 after height to more than $ 4900 during the weekend. Although prices were rejected and decreased to the current levels, the upward trend remains.

From the daily chart, BTC USD found major support around the level of $ 110,000. It is worth noting that the decline that was seen in the past few hours today is a continuation of sale published on August 24, when Beers reflected gains on August 22. Technically, as long as the BTC USD has been directed to less than $ 118,000, the bears controlled, and it may penetrate through 110,000 dollars in the continuation of the bear from August 14.

(source: Tradingvief))

Meanwhile, ETH USD optimistic. based on Coingecko dataEthereum Crypto increased by 22 % last month and 67 % impressive in the last year of trading. Despite the shaking in Bitcoin during the weekend, Ethusdt increased by almost 8 % in the last week of trading.

Technically, the gains of August 22 determines the short -term price procedure. Buyers have the upper hand as long as prices exceed $ 4200, which is the lowest level on August 22. Once the break -up periods of $ 4900, ETH USD will enter a new area, and perhaps a solid basis for a stem of up to $ 10,000.

He discovers: The most important 12+ hearing codes for purchase now

The bulls dominate Bitcoin with the dry liquidity

While confidence is high between Ethereum holders, merchants should be careful, given The high market dominance in Bitcoin. As of August 25, Bitcoin controls 56 % of the total encryption market, while ETH Crypto rose to 14 %. This high market hegemony means that if Bitcoin decreases to less Top Solana Meme CoinsHigh.

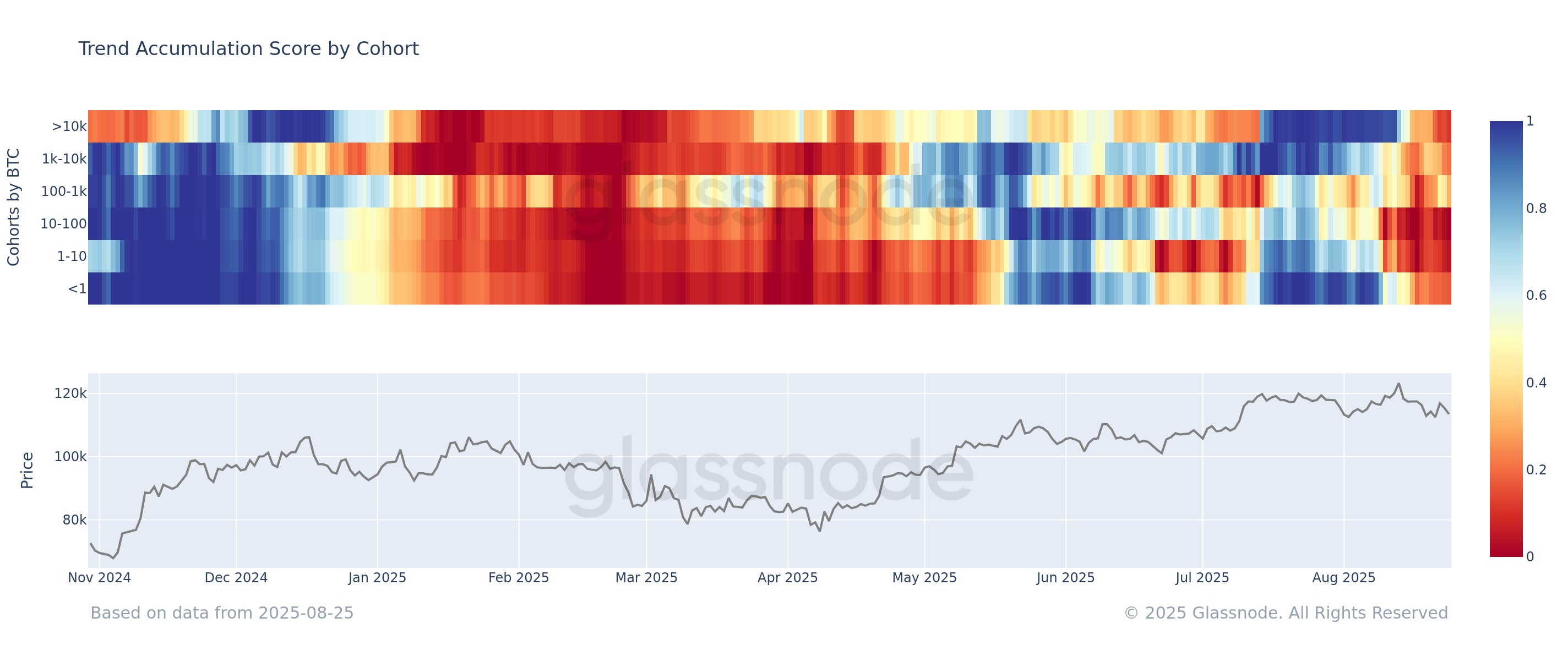

The possibilities accumulate against bitcoin. According to Glassnode, as of August 25, all Bitcoin groups, who are young, retailers to whales, are in distribution, sale or preparation for sale. Analysts note that those who carry between 10 and 100 BTC are driving shipping.

(source: Glassnode via X))

Multiple factors, including achieving profits after the last boom to their highest levels ever, can lead this wide sale. The total economic uncertainty, such as softening the labor markets and high inflation, are considerations. Although the Federal Reserve may consider reducing rates in September, BTC USD may face tremendous pressure for sale from pregnant pregnant in the short term.

With the sale of holders, onchain data shows that bitcoin liquidity is also decreased. The consumer scale, which measures the total value of BTC processing daily, shrinks with an average of 529000 BTC last week. This decrease indicates that negative momentum may fade, although analysts advise traders to follow up with caution.

General Motors!

Consumer size (BTC)- the total size of the coins you spend daily. This scale reflects the flow of liquidity, although it is still sensitive to internal transfers by exchanges and services. This week, its average value decreased to at least 529 km per day.

This indicates that … pic.twitter..h390vbjfcj

Excel

ACLADLERJR August 23, 2025

He discovers: 20+ next to the explosion in 2025

Institutional shift to ethereum: a blessing for ETH USD?

Besides liquidity decrease, adult sellers are active in all major exchanges. An analyst notes that many of these sellers do not realize the average times the weighted price (Twap), which adds to the volatility.

It is a little about that adult sellers appear in exchanges who do not know about Twap.

In general, CEX Netflow is still green, but it is close to the point where sellers exceeded the number of buyers.

Currently, it will be the perfect time for Saylor & Co. pic.twitter.com/noxmf8evdwExcel

ACLADLERJR August 25, 2025

The net flow to the exchanges is still positive, which is declining BTC ▼ -2.69 % Since more metal coins parked on stock exchanges are likely to be sold for cash or blue altcoins, in the first place ETH and others Best encryption for purchase.

This happens, as analysts note that more institutions are heading towards ETH. Last week, BitMine, Ethereum Treasury Company led by Tom Lee, well -known bitcoin bull, Purchase $ 2.2 billion from ETH. The company now owns more than 1.71 million ETH and 192 BTC.

New: Tom Lee explains how $ 6.6 billion from ETAREUM is born more than $ 200 million in net income.

"If you are holding $ ETH And you agree to their participation and verify the validity of the transactions, you are winning the fees of integrity, which is 3 %."

He plans to use income to pay the point holders in cash profits … … pic.twitter.com/drlmaj3fgl

– Cryptosrus (Cryptosr_us) August 22, 2025

According to LEE, thanks to this great hideout, BitMine generates more than $ 200 million of net revenue from Stokeing.

He discovers: 9+ best highly risk, highly bonus for purchase in 2025

BTC USD is located with ETHEREUM rise: Is ETH USD broken $ 5,000?

- BTC USD The support is about $ 110,000

- ETH USD increased by 22 % a month, trading over $ 4,500

- Bitcoin owners are looking to empty BTC

- I bought a $ 2.2 billion in ETH last week

Post BTC USD feels pressure as big players turn to Ethereum: What is the following? First appeared on 99bitcoins.