Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

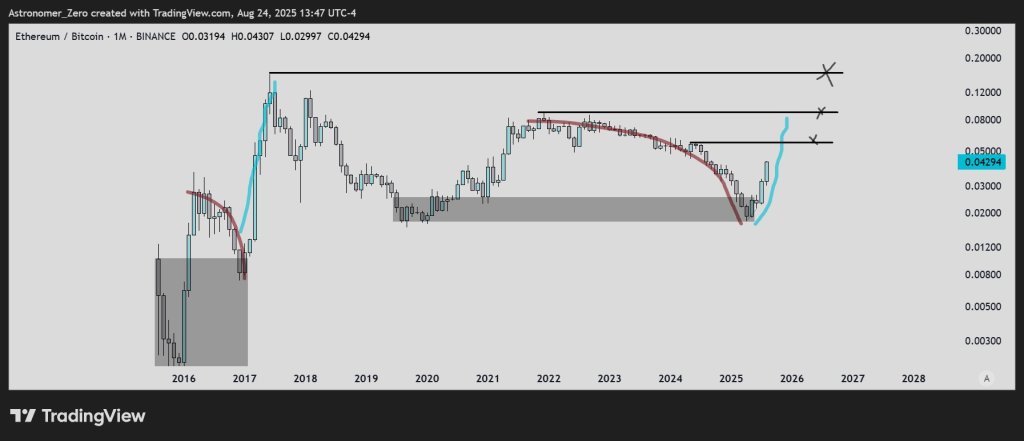

Crypto Astronomer’s analyst (@astronomer_zero) says that his long -standing basic thesis on the Eth/BTC couple played and has published explicit cycle objectives anchored to the cross. In a shared graphic designer, he reiterated that the “back call ETH” is inside and framed the roadmap entirely through the levels of Eth/BTC rather than ETH/USD, claiming that Ether’s supperperformance generally follows the Bitcoin impulse and that “all the main liquidity come from BTC”.

How much can Ethereum go in this cycle?

The astronomer is centered on a multi-mese “area” on Eth/BTC that had marked in advance as a potential cyclical inflection. He writes that the call seemed “delusional” when he was designed for the first time – a “” ridiculously “forecast (directly from the bottom) forecasting) by what” could be impossibly the EthBTC fund ” – but says that the turn aligns with his own owner’s work.

“The feeling on ETh was the worst that my metric of sentiment has ever monitored”, with narratives ranging from “Eth is a bad investment”, “Eth Foundation is selling”, to “Sol is the new Eth”, to “the utility coins have died”. In his words, “that type of feeling has allowed us to confirm the Ethbtc fund in line with our ancient plan, at the moment it has hit our area”.

Reading Reading

With this background, the graphic designer and the comment expose three Eth/BTC objectives for the rest of the cycle. The first is 0.058 BTC for ETH, which observes “still 35% above here” at the time of publication and, translated directly using Bitcoin Spot, “puts Eth at about $ 6,500 if BTC remains at this price”.

The second is 0.091, “practically a double from here”, corresponding to “$ eth a $ 10,000+, 5 digits”, a level in which it says that “it will have sold over half of my bags.”

The final and higher goal is 0.16, “just under a 4x from here, putting Eth at $ 20,000 or more”. It is explicit that the 0.16 sign is aspiration rather than the basic case: “This is certainly my highest goal, and I don’t expect it to be guaranteed. But I love it open in case it happens.”

The technical logic it presents is deliberately guided to couples. By mapping the cycle with Eth/BTC, try to capture the relative force rather than an absolute price and to evade the mobile base of the value of the BTC dollar. The ETH/USD levels implicit in its post are simple translations of the price ratio × btc; He adds that those USD conversions “will, in fact, be subjected to underestimation when I will also see BTC further increase”. In other words, the horizontal levels of the graph are Eth/BTC at 0.058, 0.091 and 0.16; The USD numbers are contingent and float with Bitcoin.

Reading Reading

The analyst also refuses heuristic of the calendar. “The reason why I never talk about seasonality or” Red September “or” sell in May, move away “… it’s because I don’t want to promote your capital earned hard on weak data … seasonality has none of the two.” He adds that “the seasons do not work in the markets, they only do it cycles” and signs with a jab to the meme: “For red September, kindly, visit your local forest …”

It is important to underline that the path it describes is subject to the same relative rotation dynamic that has ruled the past cycles: the bitcoin cables, the delays of ether until the liquidity revolves, therefore ETH/BTC advances through predefined shelves. In that framework, the analysis does not depend on any single ETH/USD number; It depends on the recovery and keep the bands mentioned.

The astronomer is also sincere on the positioning of psychology. He claims that while “it seems that many are all bulls who publish Eth now and that hold large bags”, the order flow suggests “most of those people have not purchased from a bass, they are rather frozen or are forced to buy higher with a higher lever”. In his opinion, that structure still favors the advantage towards the ETH/BTC objectives published: “So as long as it remains so, I continue to expect these goals”.

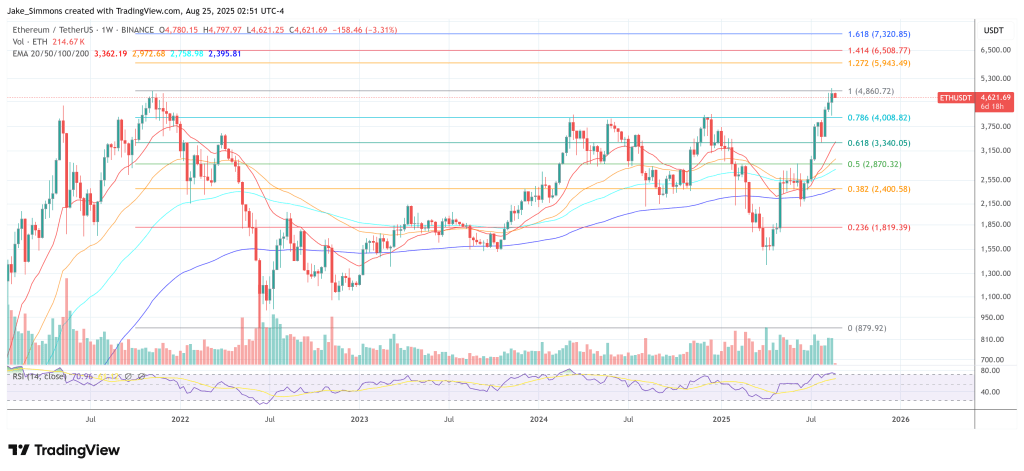

At the time of the press, Eth was exchanged at $ 4,621.

First floor image created with Dall.e, graphic designer by tradingview.com