The Cetus protocol, one of the main Dexs on the SUL, was violated, losing at least $ 200 million. Consequently, cetus meme coins have crashed, on and on the networks. Here is everything you need to know about the Hack of the Cetus protocol.

There is always a first one for everything. Ethereum has faced a fork lasts just one year after the launch. Although not a hack, the damage and the controversy have had an impact on Ethereum, causing divisions into the blockchain ideology.

Cetus hacked protocol

Launched in May 2023, the network on has enjoyed a regular race to date, when the Cetus protocol has fallen victim to hacker.

Cetus (@Cetusprotocol) On #Sui It has been violated and lost more than $ 260 million!

The hacker is converting the stolen funds $ USDC and crossed a #Ethereum to exchange $ Ethwith ~ 60m $ USDC Former cross-qued.https: //t.co/b0ugu8icxrhttps: //t.co/0bpksaygmr pic.twitter.com/txfxloimod

– Lookonchain (@lookonchain) May 22, 2025

The protocol has lost between $ 220 and $ 230 million in an accident that sent shock waves through the Crypto and Defi communities.

Hacks do not translate only into the loss of valuable objects, data and funds, but they also have serious side effects, sometimes even forcing the Sell-offs in some of the The best cryptovans to buy.

The Hack of the Cetus protocol triggered a Sell-Off, causing Cutus to collapse by over 40% and follow some of the best coins of Solana Meme.

(Cetususdt)

What is the Cetus protocol?

So what happened? The Cetus protocol is a decentralized exchange (Dex) on the network on.

Use the concentrated model on the liquidity market maker (CLMM) opened by UNISWAP and incorporates the functionality of the CLMM Design of Trader Joe.

In addition to the exchange of token, Cetus is one of the major liquidity suppliers on SUL.

Inside the ecosystem on, users mainly use cetus to exchange on/usdc, but as Dex supports hundreds of liquidity pools for various tokens coined on the net.

Over time, Cetus has become a hub for commercial meme coins on the scalable platform.

What happened?

As a basic dex on Sul, Cetus was (as expected) a main objective for hackers.

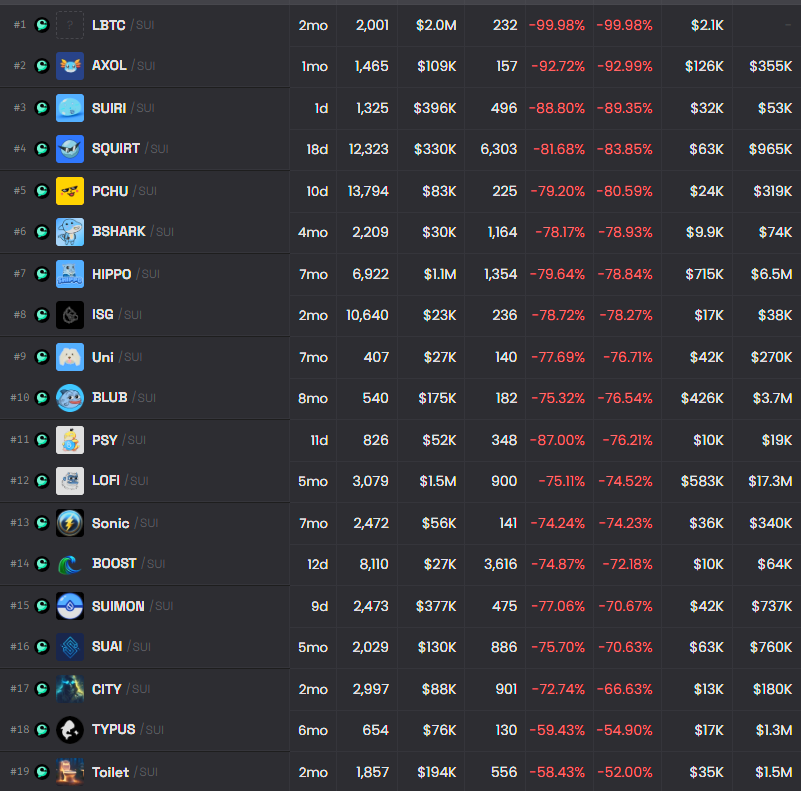

On May 22, they exploited more liquidity pools, draining $ 11 million from the pool on/USDC and canceling the funds from various pools of meme coins, causing the crash of token prices.

(Source)

The Lombard BTC (LBTC) pool (LBTC) was among the most affected, almost swept away.

How did this cetus protocol hack occur?

Analysts report that hackers have obtained control of all liquidity pools called on.

They then coined or deposited token of parody of almost zero value to manipulate curves and price reserves CLMM, extracting real activities without depositing an equivalent value.

Everything seems @Cetusprotocol LP have been drained

Looking in the TX, the probable path of exploitation was:

12. Add liquidity with an almost zero quantity, to manipulate internal LP … pic.twitter.com/ftpyrspwww

– Sashko

(@d0rsky) May 22, 2025

This was possible due to a rounding bug in the logic of the liquidity pool.

As @Cetusprotocol was hacked

A hacker abused a rounding bug in the logic of the liquidity pool.

The bug?

CUTUS MISCLATION LP Considenza:

If you added 1 token, sometimes it shared you as if I had added 2.

It looks stupid, but it worked.

The exploit:

Flashloan … pic.twitter.com/ibj3uf8kjg

– On the corners (@suicorner) May 22, 2025

Although the oracle should detect this, Cetus attributed the exploit to an Oracle Malfunction Prices.

At that point, the hackers had stolen the tokens for a value of over $ 200 million.

About 60 million dollars in USDC were quickly affected in Ethereum and exchanged with Eth within an hour.

But there is good news: according to approximately 160 million dollars, they have been frozen and will be returned to Cetus pools.

ANNOUNCEMENT

Starting today, we confirmed that an attacker has stolen about $ 223 million from the Cetus protocol. We have undertaken an immediate action to block our contract by preventing further theft of funds.

$ 162 million compromised funds were successfully paired. We are…

– Cetus

(@Cetusprotocol) May 22, 2025

Control of the damage in progress to SUL

Since Token prices have precipitated, the Cetus protocol has frozen its contracts to stop further losses.

He also promised an in -depth investigation.

Network developers promised support.

We learned that a Smart Cetus contract was violated this morning for about $ 223 million and Cetus subsequently paused their intelligent contracts to prevent further thefts.

Cetus has worked together with the other Difi protocols, the foundation on and the validators of Sul A … https://t.co/y1iw2snpw

– On (@suinetwork) May 22, 2025

Among the chaos, Changpeng Zhao, Binance’s co-founder, said they would “do everything” assist On, observing that hack “is not a pleasant situation”.

Discover: Next 1000x Crypto – 11 coins that could 1000x in 2025

Hack, Cetus crash and on the Cetus protocol

- Cetus hacked protocol, loses over $ 230 million

- The hackers have targeted liquidity pool called on sui

- Cetus prices and on the drop

- Teams and communities that investigate the accident, according to $ 160 million reported were recovered

The post cetus protocol on hacked networks and the price tank: everything you need to know appeared first out of 99 bitcoins.