China is close to exploring Stablecoins, a change that can reshape global payments and help pushing the yuan to the global theater. Reports indicate that the State Council reviews a road map that sets goals for the use of Yuan -backed Stablecooin, set roles for local organizers, and set risk management rules. Senior leaders are expected to meet this month to discuss the policy of internationalization and slicen-a noticeable transformation from the 2021 ban on the trading of encryption and mining, and a development that closely monitors projects such as Conflux Crypto, which puts itself as a compatible organizational basin in China.

Only in:

China Axis to Stablecoins after the United States passes the law of genius.

Beijing is now formulating the Wind -backed StableCoin road map, with two pilots abroad

Hong Kong.

This represents a major shift: Just focus on CBDC E-CNY (home use), you see China now Stablecoins … pic.twitter.com/jlqsmbz5xdJessica Gonzales (Lil_disreptor) August 28, 2025

Beijing has always extended to the yuan to compete with the US dollar and the euro in global payments. However, despite the extensive trade surplus in China, strict capital controls have culminated in its international influence.

Stablecoins are digital -related numerical symbols and provide immediate low -cost immediate transfers. For a country that has long been applied for strict capital controls, Stablecoins provides an opportunity and challenge: it can make yuan flows across the border, but the organizers will need guarantees to prevent capital aviation and financial instability.

Yuan’s share of global payments recently decreased to about 2.88 %, confirming why Beijing is interested in tools to enhance international currency.

Explore: The 12 most important prior people are encrypted to buy now

The Stablecoin Road Map from Beijing can redefine the internationalization of the yuan, challenge the dominance of the US dollar, and the excitement of a new era for the compatible files with China such as Conflux Crypto

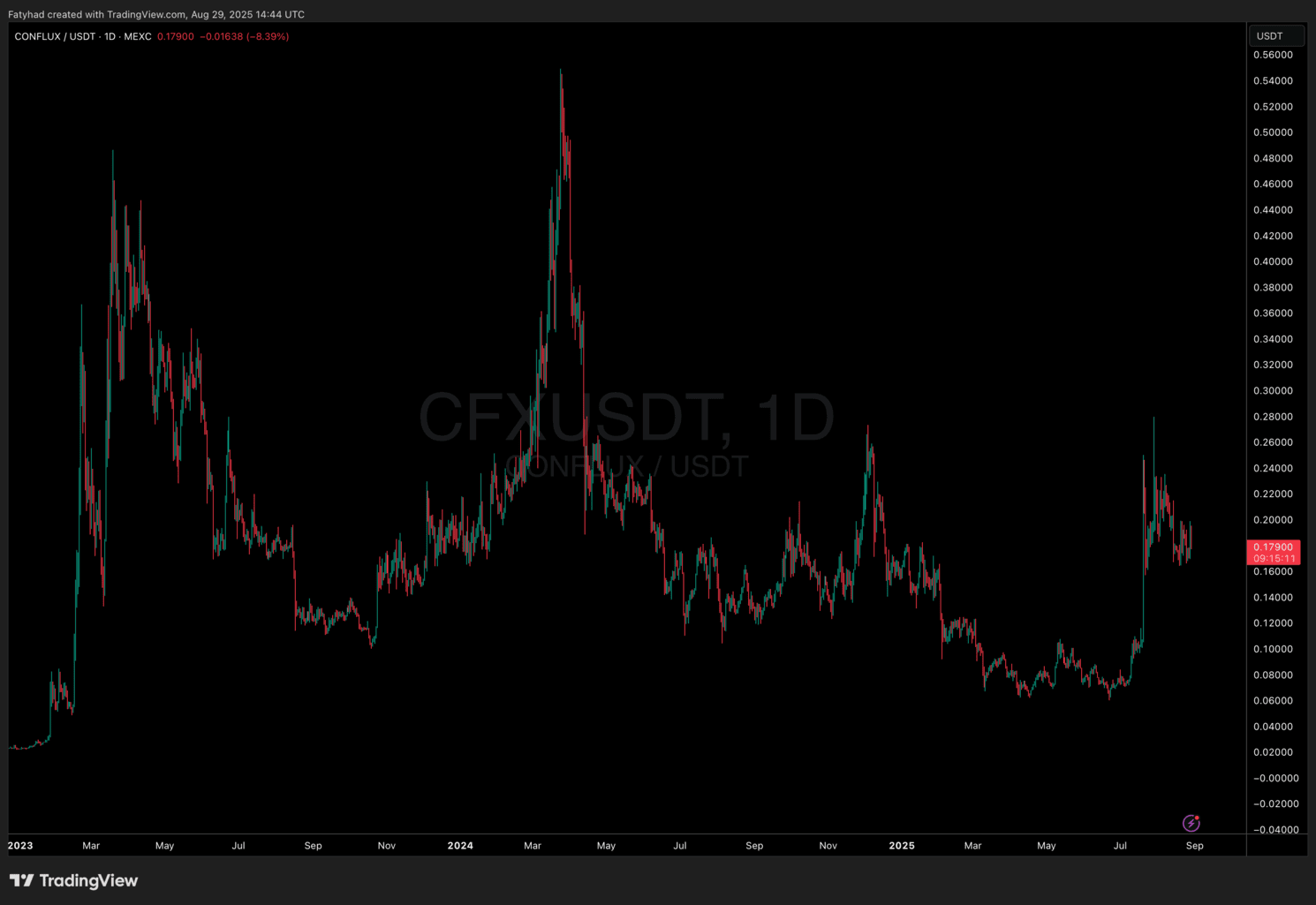

After this change in the heart, the Confress (CFX) exploded higher. Since July, CFX has risen sharply after two main addresses: a plan for a Stablecoin in Yuan Begin’s abroad designed with Fintech partners, the Conflux 3.0 launch, which is a faster productivity (up to 15000 TPS) and better border settlement support.

The trading volume jumped from less than 60 million dollars to more than $ 1.7 billion in two days, which led to the maximum CFX market for a period of one billion dollars.

(Source: cfxusdt)

Conflux also prepares a critical network upgrade (version 3.0.1). Solid thorn is scheduled for August 31 (08:00 UTC+8); Binance said that she will suspend the CFX deposits and withdraw from September 1 as a preventive measure during the upgrade – a standard practice to help ensure a smooth transition.

Discover: Jpmorgan says Bitcoin is less than its value-the fastest layer 2 Bitcoin Hyper can accelerate the payment to fair value

The Stablecoin experience of Petrochina highlights the adoption of companies and the organizational role of Hong Kong

Meanwhile, Petrochina is studying whether Stablecoins can be used for border settlement and payments, citing the new Stablecoin bases in Hong Kong (as of August 1) and the exact monitoring of HKMA.

China National Petroleum Corporation, one of the largest energy companies in the world, revealed at its half -year results that the company is closely following the recent developments of the Hong Kong monetary authority regarding the licenses of Stablecoin version, and will do …

– Wu Blockchain (Wublockchain) August 29, 2025

If energy specializations such as Petrochina begin to settle transactions in the distinctive symbols of the yuan, the potential impact on world trade corridors may be huge. For China, this means a direct application of Stablecoin technology to expand the scope of the settlement provided by the yuan, which reduces dependence on the US dollar in the oil and commodity markets.

Can Conflux Crypto become a major player in this sector? The answer to the regulatory results in Beijing and Hong Kong depends on the smoothness of Confrenux, and whether the major companies are actually moving to stability in Stablecoins in Yuan. Currently, Conflux sits at the center of a story that mixes policy, infrastructure promotions, and pilots in companies – this combination is the reason that traders can only help watch closely.

Main meals

-

The Chinese State Council reviews a road map for the supported Stablecoins from Yuan. This indicates a major political shift.

-

Conflux Crypto acquires momentum with the edge of upgrade and compliance 3.0, and is in line with Blockchain’s aspirations in China.

-

Petrochina explores Stablecoin settlements under the new Hong Kong framework, highlighting wider dependence in traditional industries.

Beyond China moves on Chinese Stablecoin: Is Conflux Crypto Pump evidence of smart money accumulation? First appeared on 99bitcoins.