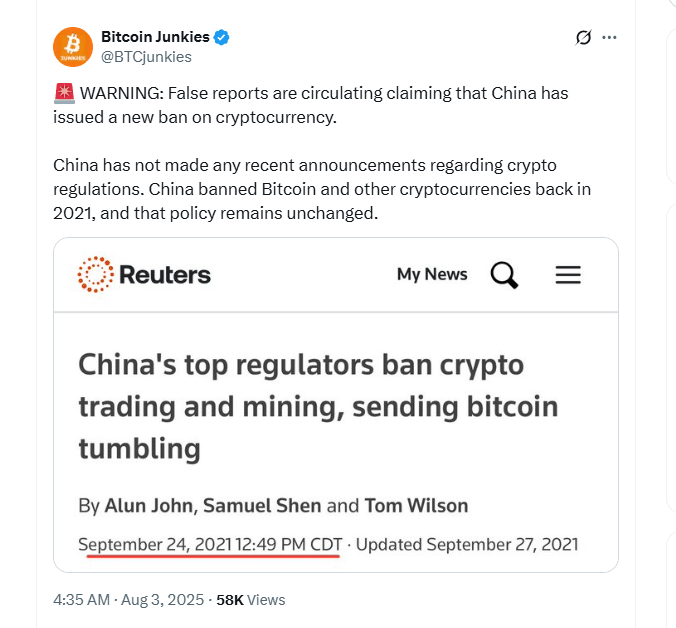

Crypto China’s ban has just added another delicious level to Asian markets. China is creating a dip so that they can buy it.

Our 99b theory is that China Bandi Btc ▼ -0.86% When the price is high and arouses it when the BTC price is low, so their citizens and companies do not buy high. Hands of forced diamonds.

In addition, Beijing has announced this week that he will begin to download his stock of cryptocurrencies seized through exchanges authorized to Hong Kong.

By pushing the resources confiscated into authorized platforms, China injects liquidity, volume and model Hong Kong in a price engine for the global cryptocurrency markets. Here’s what you need to know:

China Crypto Ban is a lie that will see Hong Kong become the largest hub btc

The framework of the digital resources of Hong Kong is based on several legal pillars:

- The ordinance on financing of anti -terrorism anti -terrorism of 2022 (Amlo) It imposes the license of all virtual activities trading platforms.

- Stablecoin ordinanceStarting from 1 August 2025, it imposes rigorous reserve requirements, reimbursement and incorporation mechanisms based in Hong Kong for broadcasters.

- Leap 2.0Introduced in June 2025, it offers unified licenses through cryptographic products and promotes the collaboration of the sector.

However, the lightenings do not create influence. The liquidity does it. By downloading the state crypt-seed through Hong Kong, we will see the addition of liquidity transform the city into a pressure valve and China can open or close to influencing the markets of global cryptocurrencies.

(Source)

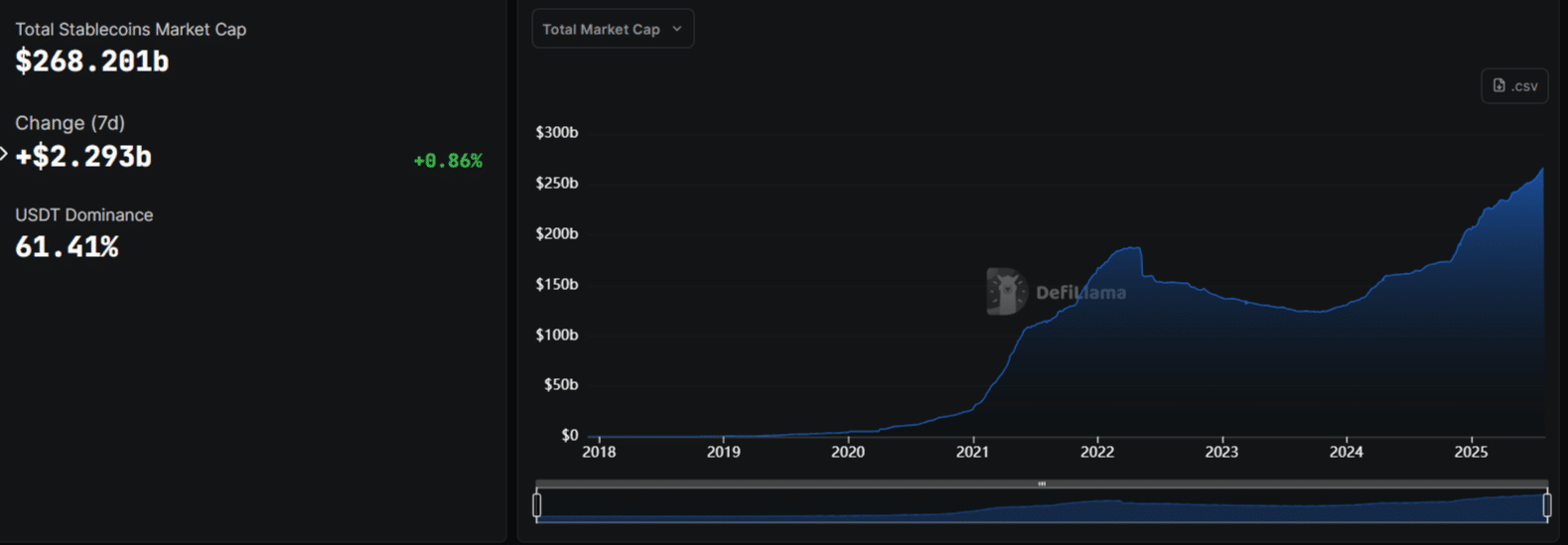

The real -time data of Coneslass and Defillama illustrate the impact of the open interest on cryptocurrency couples listed on Hong Kong, which have increased by 35% in recent weeks.

In addition, Stablecoin TVL On-Chain through the issuers aimed at Hong Kong Stablecoin licenses already shows a 28% increase in month on month, which allows institutional capital to be positioning for the new regime.

(Source)

DISCOVER: The best new cryptocurrencies to invest in 2025

Strategic implications: Hong Kong, Us Passive ascendant

Strategically aligning regulation and liquidity, China aims to build Hong Kong in a digital super-hub, a geopolitical and financial lever. Unlike the United States, which maintains a “Solo” Bitcoin reserve, Hong Kong can convert and distribute cryptocurrency to influence market prices and narratives.

This shift raises critical questions:

- Do US regulators respond by building mechanisms to claim influence on cryptographic liquidity?

- Can global conformity paintings adapt to jurisdictions using liquidity as a strategic activity rather than a regulatory requirement?

For cryptocurrency investors, conformity professionals and politicians in the same way, the takeaway is clear: Hong Kong now holds the passage.

For years, Crypto has been retained by Boomer who refuse to accept that writing is on the wall. The same people who pursue wars who cannot win are holding the cryptocurrency because they think they can still govern the world if they censor the Internet.

China is waking up to that game and nobody can stop them.

Explore: Tether’s CEO Paolo Aroino hopes for the positive net elections from the US elections, states that Bitcoin Strategic Reserve is an excellent idea: 99bitcoins Exclusive

Join 99 bitcoins news discord here for the latest market updates

Keyway keyway

-

Crypto China’s ban has just added another delicious level to Asian markets. China is creating a dip so that they can buy it.

-

Strategically aligning regulation and liquidity, China aims to build Hong Kong in a digital super-hub.

The post china plan to destroy the dollar: Smart Money is on Hong Kong appeared first out of 99 bitcoins.