A entertainment company based in China has made a large move in cryptocurrency, purchasing 300 bitcoins just as the market exchanges near $ 114,000.

Pop Culture Group (Nasdaq: CPOP), based in Xiann, revealed the purchase of $ 33 million in a press release.

The company underlined the beginning of its treasure of digital resources and part of the largest plans to connect its entertainment activity with web3.

He shared his plan to invest in additional Bitcoin, Ethereum and Bot activities to establish a diversified cryptographic fund to finance entertainment initiatives oriented to Blockchain.

Bitcoin price analysis: how is the purchase of Bitcoin Trading Post?

Bitcoin holds close to $ 114,400, with intraday passages between $ 113,200 and $ 114,700. The largest market remains optimistic while the traders bet on the cuts of US rates after inflation data have satisfied expectations.

The timing of the entrance of the Pop Culture Group coincides with what analysts see as a key technical configuration for Bitcoin.

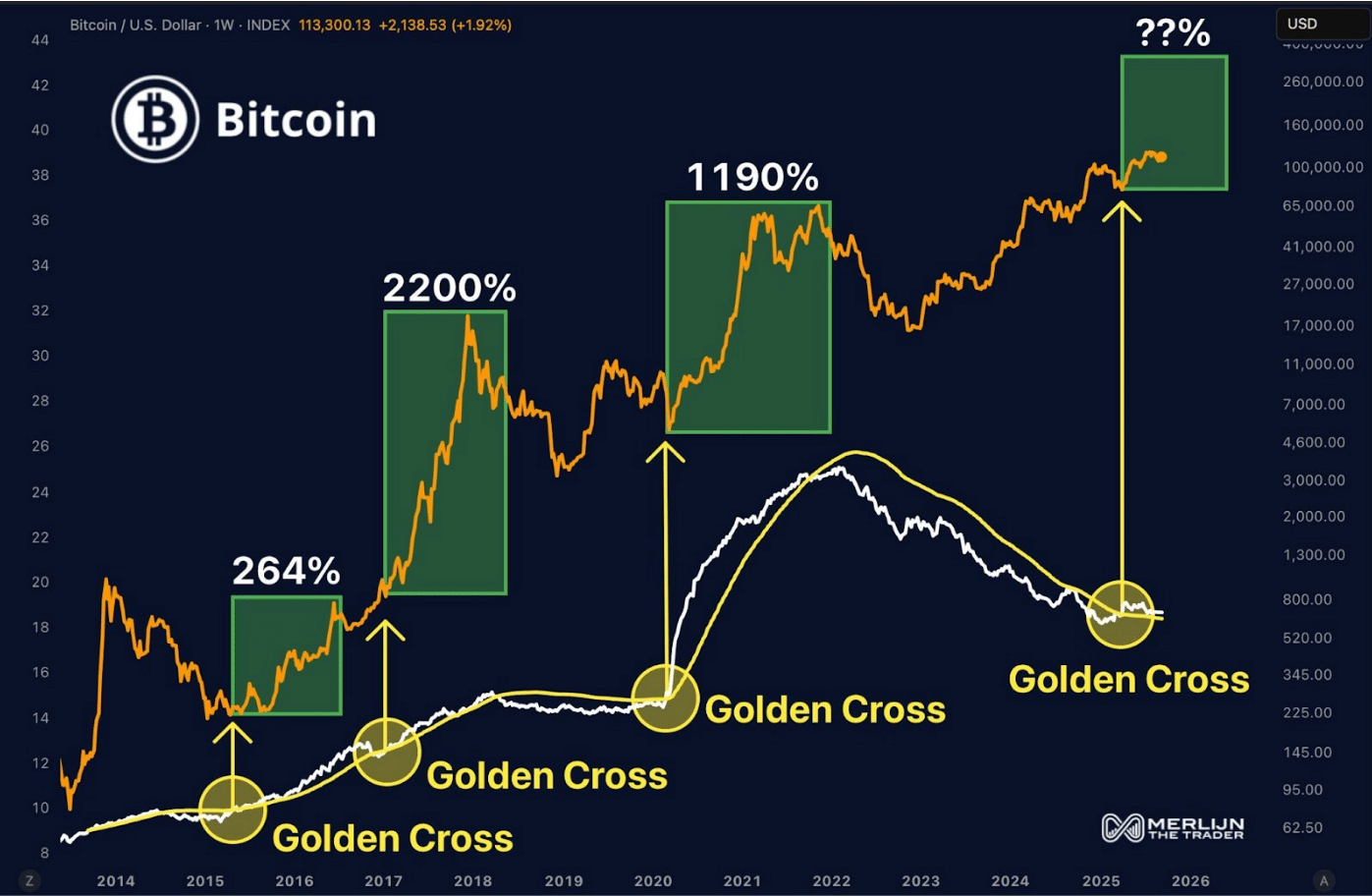

Merlijn, a cryptocurrency analyst, shared the graph of X, which shows that Bitcoin formed another “gold cross” when the 50 -week mobile average rises above the 200 -week mobile.

Recovery of Bitcoin phases | Eth blasts $ 4.4k | Altcoin in flames!

Look here:

https://t.co/bcksaughg0 pic.twitter.com/s16rpatzg0

– Merlijn the trader (@merlijntrader) 11 September 2025

This crossover is widely seen as a bullish signal.

In past cycles, the golden crosses preceded strong gatherings. Bitcoin increased by 264% in 2015, 2,200% in 2016 and 1.190% in 2020 with the highest cross, signal and record, respectively.

Bitcoin is exchanging between $ 113,000 and $ 114,000 in a consolidation band. The trend is similar to the previous phases, in which the asset has established a fund and therefore significant movements upwards.

Analysts observe that the long -term tendency is characterized by higher and minimal higher highs.

The golden crosses do not foresee future results, but the story indicates that they tend to coincide with the beginning of the multi -year growth cycles.

The question that the traders are thinking is now if this last signal will lead to another giant rally or if you block in the middle of the resistance.

Bitcoin is still driving the market, even if Eth erases $ 4,400 and Altcoin warms up.

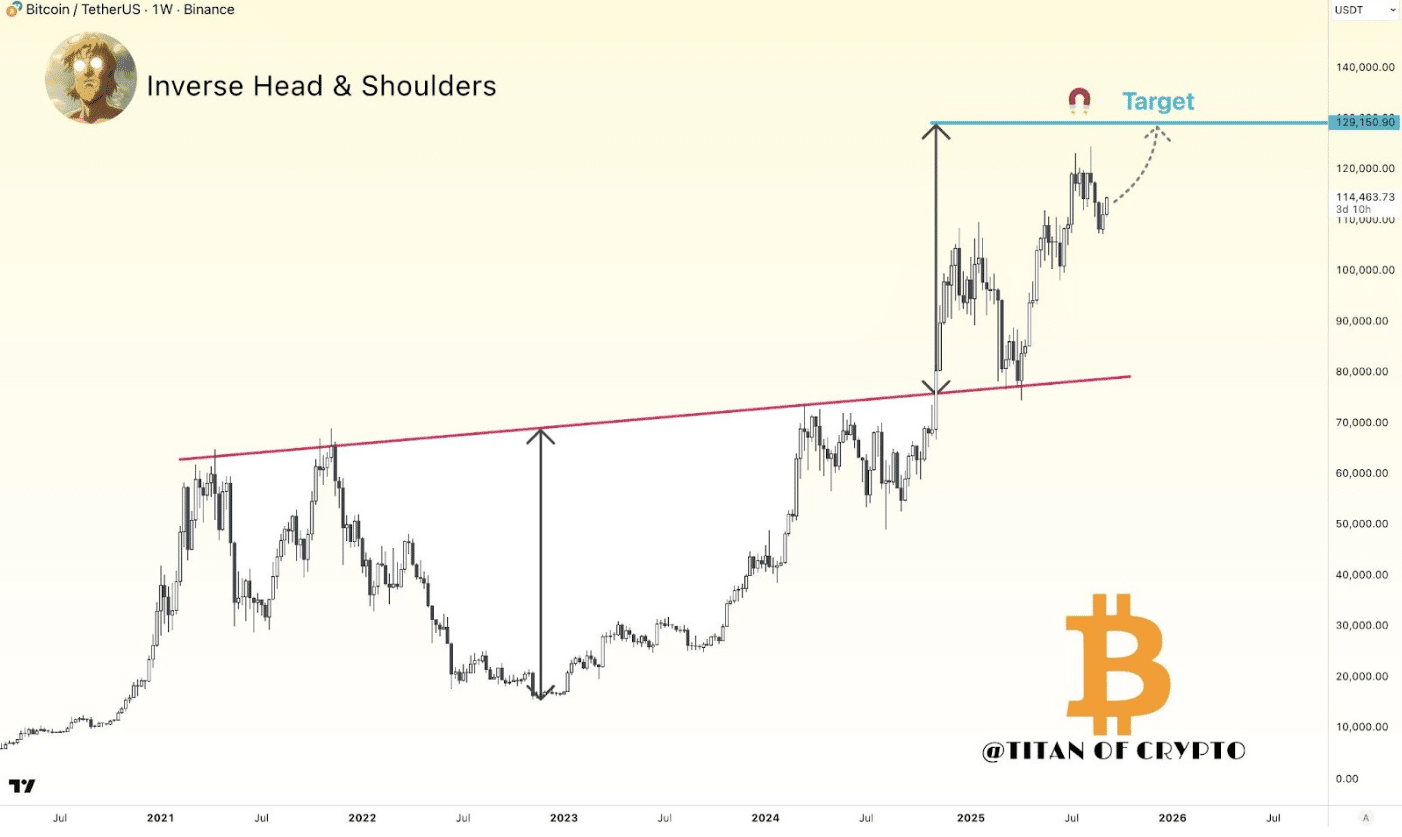

Crypto’s Titan graphic analyst keep A long -term bitcoin lens of $ 129,000. The view is based on an inverse model each and shoulders that resisted through the recent swings.

(Source – x)

On the weekly graph, the price broke definitely above the neckline, designed against the 2021-2022 peaks.

That breakout completes the model and indicates a move measured towards $ 129k. Bitcoin is exchanging about $ 114,463 after a strong race at the beginning of this year.

The test near $ 80k acted as a clean support control before the highest move. Until the price is higher than the $ 110k area, the bullish case remains intact. Lose that area and the momentum could vanish.

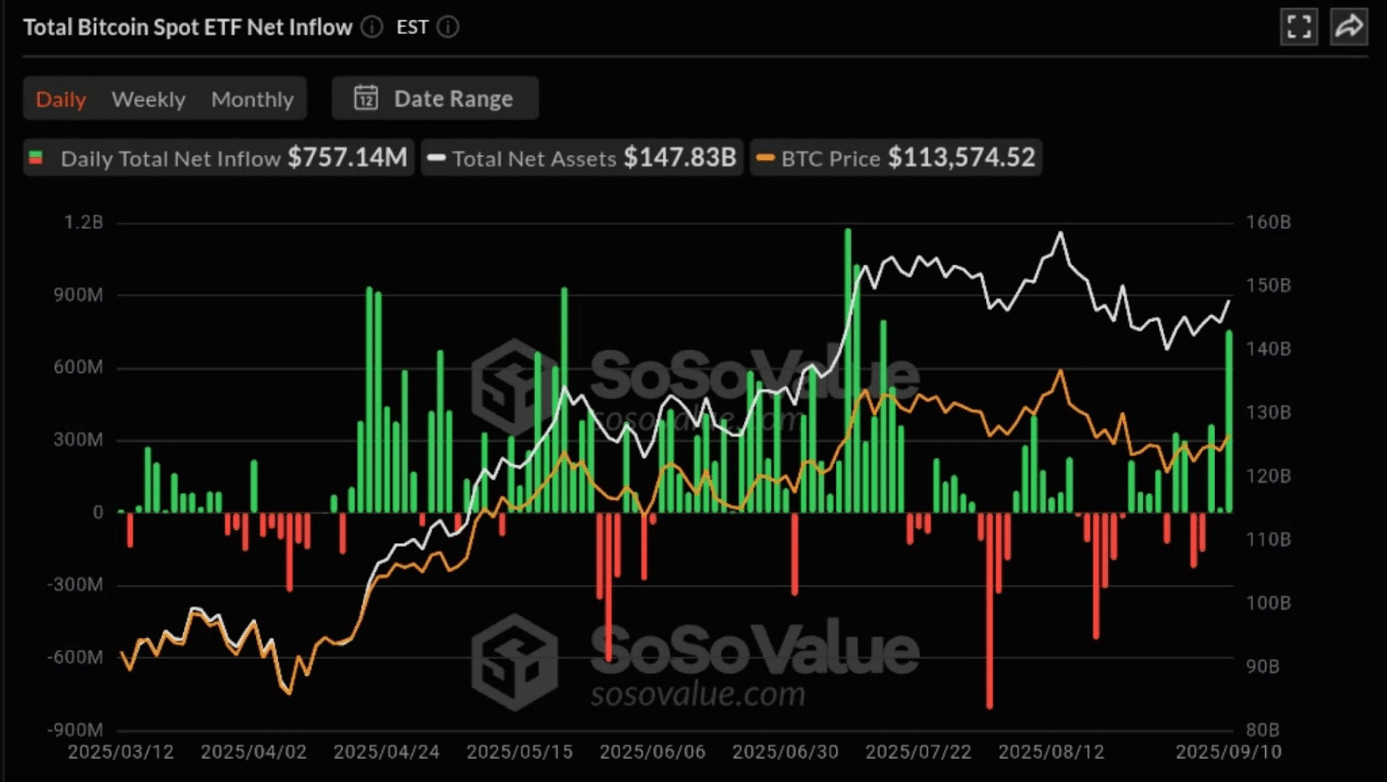

According to Sosovalue data, Net affluses reached $ 757.14 million from today, the strongest in two months.

The green bars return to the positive area after a difficult period, but a white line indicates a price that increases by over $ 113,500.

(Source: Net Etf Total Bitcoin influx, Soso Value)

(Source: Net Etf Total Bitcoin influx, Soso Value)

Previously assisted to deceased in July and August it had been a resistance to feeling. However, the new institutional purchases are restoring trust. This is important since coherent ETF offers tend to cushion the pulbacks and can push the price upwards.

If $ 110k hold and the affluses persist, $ 129k remain a realistic goal. Otherwise, expect a slower grounding and deeper support tests

How do Chinese companies find a way of encryption despite restrictions?

The markets tilt towards a September rate cut after the inflation data of the combined United States, giving a push to risk activities.

Bitcoin briefly exceeded $ 114,000 while the traders have a price of 25 basis points from the Federal Reserve. The CPI numbers remain central in the short -term interval.

There are still restrictions on trading in the mainland, but companies relating to China continue to trade through the listing abroad and the assignment of the treasury shares.

The recent acquisition of Bitcoin by the Pop culture group reflects a larger trend of Asian companies that experience web3 strategies despite the restrictions declared.

Etf Spot flows are guiding most of the prices and this week the affluent hit the maximum most weeks, aligning with the push of Bitcoin towards the resistance to $ 115k.

The volumes of negotiation in the last 24 hours remain strong, showing a greater influence from macro flows compared to retail trade.

Analysts see $ 115k as a key obstacle. A clear break and a socket could attract the operators of the moment that chase higher levels. The failure to move May Trap BTC between $ 104k and $ 114k.

The Chinese post money enters the painting while Bitcoin Price slams $ 114k appeared first out of 99 bitcoins.