It is about to be Bitcoin Bull Run to be superior, and this time, not Michael Sailor. Bitcoin Frdy comes where CME Bitcoin BFF is launched at a major incentive at Bitco Bull Run.

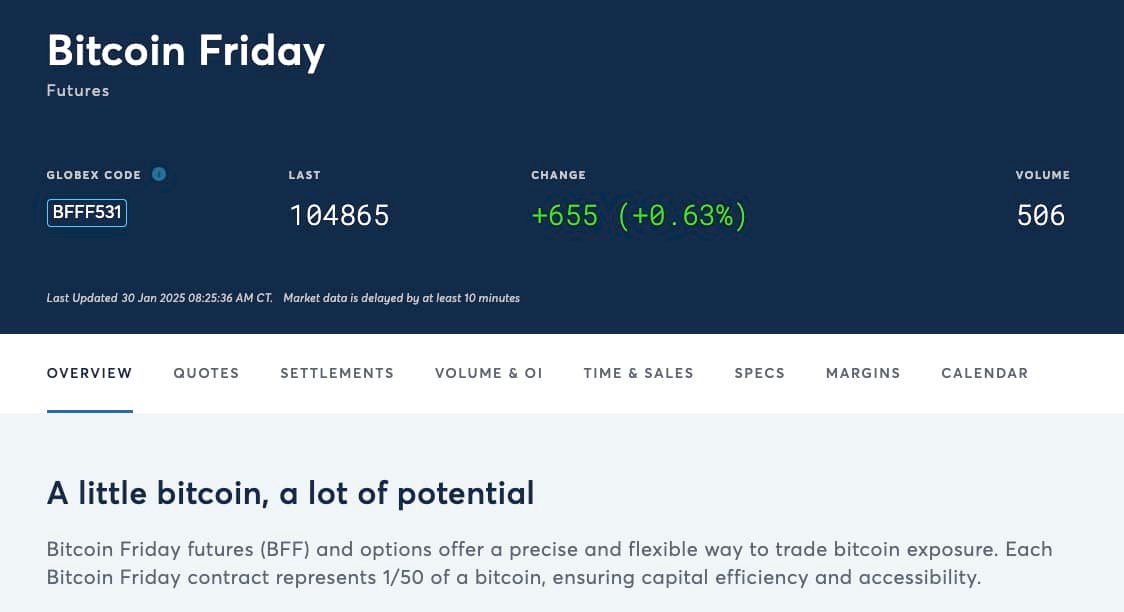

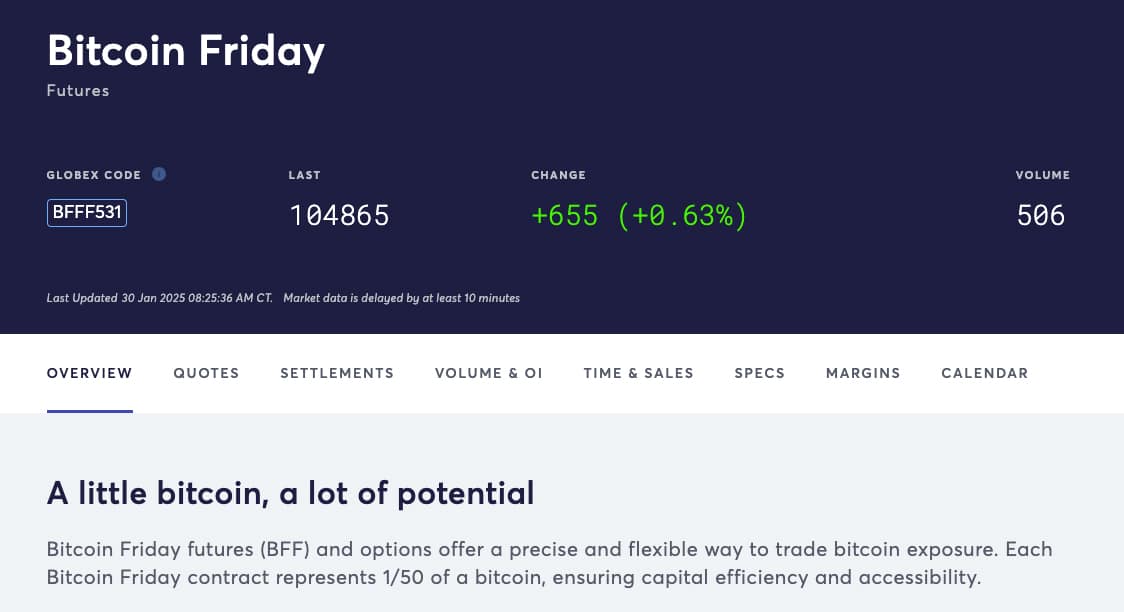

As I recently mentioned, the Chicago Mercantile Exchange (CME) will offer options on Bitcoin Futures (BFF) starting from February 24, 2025, according to approval.

This will provide merchants for increased accuracy in managing short-term Bitcoin price. CWP-COIN-Chart Svg Path {Stroke-Width: 0.65! Important; }}

price

Size in 24h

?

->

7D price

Risks. New BFF options will be accessories for successful BFF from CME, which are bullish news for bitcoin and encryption in general.

The price of Bitcoin is madly optimistic: How will Cme’s BFF double the Bullrun potential

Soon CME’s BFF, which first appeared in September last year, became one of the most successful CME Group products in CME Group.

More than 775,000 contracts have been traded since then, which are very popular among investors. These contracts are smaller in size, in one to 50 bitcoin coin, and are characterized by daily joins from Monday to Friday.

Giovanni, Picoosu, head of encrypted currency products at the CME Group Group, highlighted the accuracy offered by these new options for traders.

The presentation of these options complements the current offers of the CME group, which includes bitcoin options and the physically settled ether, along with the small Bitcoin and the CWP-COIN-Chart Svg Path {stroke: 0.65! a task ; }}

price

Size in 24h

?

->

7D price

Futures.

(source)

In addition to developments in its markets, Crypto also received a bullish batch of organizational news. Federal Reserve Chairman Jerome Powell recently indicated that banks can be allowed to provide encryption nursery services.

This statement, which was held during a press conference, immediately pumped the price of bitcoin.

Powell’s comments indicate a possible shift in how banks interact with Crypto, giving them the opportunity to hold digital assets on behalf of their customers. He stressed that the federal reserve will continue to monitor the risks associated with encryption and/or bitcoin closely.

“The banks are completely able to serve the encryption customers,” says President Jerome Powell.

After mentioning Bitcoin, it started to rise again now at $ 104,000 pic.twitter.com/iicnx51fyg

Pig

(IvVagriat) January 29, 2025

Before this statement, Powell explicitly stated that Bitcoin is not a competitor to the US dollar but is competing with gold. Bitcoin describes as closer to digital gold. “It is like gold, only it is default. It’s digital.”

Bitcoin has a solid cover of 21 million coins. Every 4 years, the “half” event occurs, which reduces the mining bonus by half, which effectively reduces the new bitcoin offer that enters the market. This scarcity pays bitcoin with an increased demand. The last half in the year 2024 reduced the rate of release, which helped in the nature of the Bitcoin shrinkage.

Despite limited, new gold is extracted annually, which increases the supply by about 1-2 % annually. There is no compact mechanism like the half of Bitcoin to reduce this growth growth. Gold comes from nature, forecasting the number of difficult supplies, making it more abstract as investment.

Related: Bitcoin guide – for how long will the bull will run?

The market value of Bitcoin is $ 11 % of the maximum GOLD market at approximately $ 18.

Bitcoin is the best form of money. Bitcoin is on computers anywhere and everywhere. In the next 5-10 years, it is likely to exceed the maximum bitcoin gold market.

6 reasons

December: Bitcoin has … pic.twitter.com/edigqfwvyp

– ₿Rian Maass (MaassCfo) January 25, 2025

During the past decade, Bitcoin has proven to be an exceptional superior investment compared to gold. Starting at about $ 300 in 2014, the price of Bitcoin turned over $ 100,000 by 2024, with an amazing return of about 33,000 %.

This means that if you have invested $ 1,000 in Bitcoin at the beginning of the contract, your investment now will now reach about $ 330,000. Gold, on the other hand, which started the contract by about $ 1,200 an ounce, witnessed only an increase to about $ 2200, providing a return of about 83 %.

In comparison, this translates into an investment of $ 1,000 in gold that grows into about $ 1830 during the same period.

Bitcoin’s contract has been more profit over the past ten years. Not, Bitcoin does not stop soon. They are assets of one million dollars, where smart institutions and funds join the Bitcoin vehicle.

Bitcoin bet

In 1989, Michael Celor co -founded Microstrategy with Sanju Bansal. The company initially focused on data extraction, the company became a pioneer in business intelligence, mobile phone programs, and cloud -based services.

Silor was the CEO from 1989 to August 2022, when he moved to the CEO. This decision allows him to focus more on Bitcoin strategies.

Michael Celor got Microstrategy PubLic in June 1998, at the start of the stock at the beginning of $ 12, and doubles on the first day of trading. By early 2000, his clear wealth increased to $ 7 billion, which made him one of the richest wealthy in the world.

In 2020, Microstrategy announced that it would use Bitcoin as the assets of the primary treasury reserve, a decision that led to the purchase of more than 471,107 Bitcoins by early 2025, at a value of approximately $ 30.4 billion.

Silor is ready to calm the criticism of Maxi in order to make bitcoin “less superficial”

Providing coverage for institutions to spread capital in BTC and pump our bags

legend

– Mitchell

(mitchellhodl) October 21, 2024

Sailor became a bitcoin advocate, as he appeared on many podcasts and media to discuss its capabilities as a hedge against inflation. Under his supervision, Microstrategy has made significant investments in Bitcoin.

These Microstrategy procedures were placed at the forefront of the future of financial transformation. This asks the question: What are you waiting for if you do not do the same?

Explore: 15 new Coinbase menus to watch in 2025

Join Discord 99bitcoins News here to get the latest market updates

Post CME has a secret plan to charge Bitcoin Bull Run: What is Bitcoin BFF? First appeared on 99bitcoins.