After a 100x sprint, COAI, once touted as the best cryptocurrency to buy right now, fell more than -52% in a single day as euphoria subsided and on-chain scrutiny grew.

ChainOpera AI token, COAI, is down nearly -52% in the past 24 hours after a week of rapid gains that pushed it into the billion-dollar range.

(source:Koenjiku)

As of Saturday evening ET, COAI was trading in the $10-$11 range on a daily trading volume of about $295 million on major exchanges.

This decline comes after increasing discussion about large profits among the best portfolios and potential coordinated selling.

The correction came shortly after COAI’s massive rise from around $0.14 on September 26 to an all-time high near $44.90 on October 12, a rise of more than 100-fold in just over two weeks.

Discover: 16+ new and upcoming Binance listings in 2025

What did Bubblemaps reveal about suspicious COAI wallet activity?

Koenjiku Show data The 24-hour range is between $9.79 and $25.12, making the direct market cap around $1.9-2.1 billion based on an estimated circulating supply of 188-200 million tokens.

CoinGecko lists COAI on Bitget and Gate.io, each of which handles tens of millions of trades today.

The token was one of the best performing currencies of the week, rising more than 300% before the volatility hit.

on saturday, DEX Checker Data The BNB Chain pair showed a COAI decline of around -52% over 24 hours, reflecting the decline seen in both centralized and decentralized markets.

Bubblemaps has raised questions about a group of wallets linked to Chain Opera AI (COAI) after revealing strikingly uniform trading behavior.

In achieving it subscriber On X, the analytics platform identified 60 portfolios that executed thousands of automated trades under near-identical conditions.

According to Bubblemaps, each wallet received an initial transfer of 1 BNB from Binance at approximately 11:00 AM UTC on March 25 before using the Binance Alpha platform to execute concurrent trades.

BREAKING: One entity controls half of top profits $COAI governor

Gross profit: $13 million

What’s going on with ChainOpera?

pic.twitter.com/CF4AAA9ReY

– Bubble Maps 泡泡地图 (@bubblemaps) October 16, 2025

The pattern suggests possible central control or a tightly coordinated strategy behind these titles.

At the same time, fresh Data From Nansen indicates that traders are becoming cautious. COAI tokens held on centralized exchanges rose from 47.48 million to 55 million in the past week, an influx that often indicates a potential sale or wallet turnover to other altcoins.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

COAI Price Forecast: Can COAI maintain its key cryptocurrency support between $8.65 and $7.17?

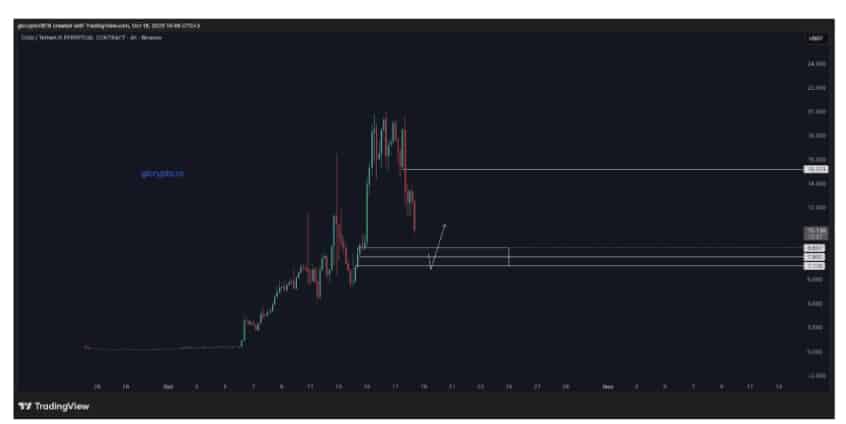

Technically, COAI/USDT 4-hour chart Reflects this mood.

After a sharp 10x jump from the $1,737 level to around $24, the token slid into a series of lower highs and lower lows, a textbook sign of profit-taking and declining momentum.

Moved 10X from $1,737 (quoted post).

Now an aggressive withdrawal. If you go straight to the range shown in the picture and don’t see a reaction, that’s not good for the coin…

https://t.co/8nJRjyLYar pic.twitter.com/LEx3YIfFSg

– GL Crypto (@glcrypto1618) October 18, 2025

It remains uncertain whether this marks a pause or end to COAI’s explosive run, but traders appear to be moving more cautiously as scrutiny around the project deepens.

COAI is now trading near $10.13, approaching the key support zone between $8.65 and $7.17.

The chart shows two main areas of demand: the first between $8.65 and $7.93, and the second around $7.17, where the previous buildup occurred.

According to the analyst, how the price reacts here will determine the next trend.

A bounce from these areas could show that buyers are moving back in, forming a short-term recovery towards the $15.21 resistance level.

(source:X)

However, an indicator of danger is the projection line on the chart.

When COAI goes to this support zone and fails to give any signal of a turnaround or high trading volume, the structure is likely to become weaker. This will likely herald its sharp rise and prove further correction.

Simply put, the long-term trend of COAI will be determined by how this pullback consolidates into a healthy pullback or will it deteriorate into a breakdown below important support levels.

discovers: 9+ Best Memecoin to Buy in 2025

Join the 99Bitcoins News Discord here to get the latest market updates

Next Post COAI Cryptocurrency Drops After 100X Sprint: Is the Chain Opera AI Run Over? appeared first on 99Bitcoins.