Bitcoin faced a rapid correction below the $125,000 level after hitting a new all-time high of $126,200 on Monday, triggering widespread volatility across the market. The price retraced more than 4% to around $120,000, liquidating millions in leveraged positions as traders anticipated further upside. The move caught many by surprise, especially after days of strong momentum and renewed optimism that Bitcoin was preparing to enter another phase of price discovery.

Related reading

Despite the pullback, key on-chain data reveals a contrasting trend beneath the surface: massive accumulation by US investors. Analysts note that as short-term traders face liquidations, spot demand from US-based buyers continues to grow, particularly across regulated platforms and ETFs. This constant inflow of capital provides a solid foundation for long-term market strength, even in an environment of short-term volatility.

The correction may have eliminated excessive leverage, restoring market conditions for a healthier continuation. As Bitcoin consolidates around the $120,000 to $122,000 range, analysts are watching closely to see if institutional accumulation can offset the selling pressure. For now, the overall trend remains bullish, with growing evidence that US investors are using every dip to increase exposure to the world’s leading digital asset.

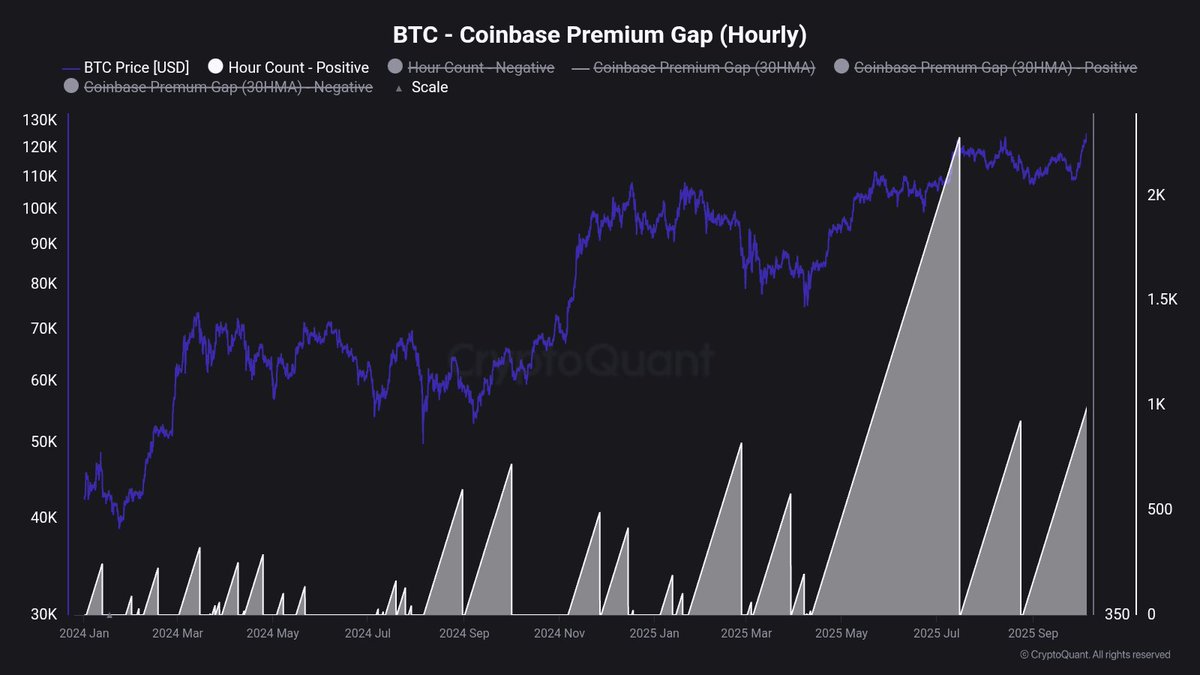

US Demand Rises as Coinbase Premium Gap Signals Accumulation

Leading onchain analyst Maartunn has shared new data revealing a sharp increase in Bitcoin accumulation in the United States, driven largely by activity on Coinbase, one of the most influential exchanges for institutional and retail investors in the United States. According to his insights, the Coinbase Premium Gap, which measures the price difference of Bitcoin between Coinbase and other global exchanges, has risen to the second highest level since the ETF’s launch earlier this year.

This spike signals an aggressive buying spree by US investors, suggesting strong spot demand that is outpacing global averages. Historically, similar jumps in the Coinbase Premium Gap have coincided with major market expansions, often preceding new highs as US capital flows into Bitcoin-led rallies. Data indicates that US traders are willing to pay a higher premium than their counterparts on platforms like Binance or OKX, a clear expression of localized demand.

Analysts interpret this as a bullish signal in the context of Bitcoin’s current consolidation near all-time highs. After a brief correction from $126,000 to $120,000, strong institutional interest could provide the liquidity needed for a new breakout. Many market observers believe that such a robust buildup is rarely coincidental; it often precedes a significant expansionary move, as buyers position themselves before another bullish phase.

If this buying pressure continues, Bitcoin may soon recover its highs and enter a new phase of price discovery. Combined with growing ETF inflows and continued accumulation trends in the U.S., Maartunn’s data strengthens the case that the market’s next big push could once again be driven by U.S. demand, the same catalyst that triggered Bitcoin’s previous all-time high earlier this year.

Related reading

Bitcoin consolidates after strong rally

Bitcoin is currently trading around $122,500, showing signs of stabilizing after its recent surge to an all-time high near $126,000 earlier this week. The chart highlights a healthy pullback from the highs, with BTC finding support just above the $120,000 level, a zone that previously served as resistance and has now turned into a short-term support range.

The 8-day and 21-day moving averages are trending higher, confirming the continuation of a bullish structure. Meanwhile, the 50-day moving average remains below the price, indicating that momentum still favors the bulls despite short-term volatility. If Bitcoin manages to hold above the $120,000 – $121,000 region, the situation could attract renewed buying pressure for another attempt to break out of the $125,000 resistance.

Related reading

However, failure to maintain these levels could open the door to a retest of the $117,500 area, where the next major support lies. This would still remain within a healthy correction range after the recent 15% rally. Overall, Bitcoin’s structure remains bullish, with higher lows forming and institutional demand, led by Coinbase inflows, continuing to support the market. A decisive move above $125,000 could signal the start of a new phase of price discovery.

Featured image from ChatGPT, chart from TradingView.com