The USD BTC price was stabilized near $ 109,000 on Friday after US inflation data aligned with expectations, leaving the sellers who pressed the support to Wall Street Open.

The move came when Grok Ai Di Elon Musk has maintained a call that September will probably close near the current levels.

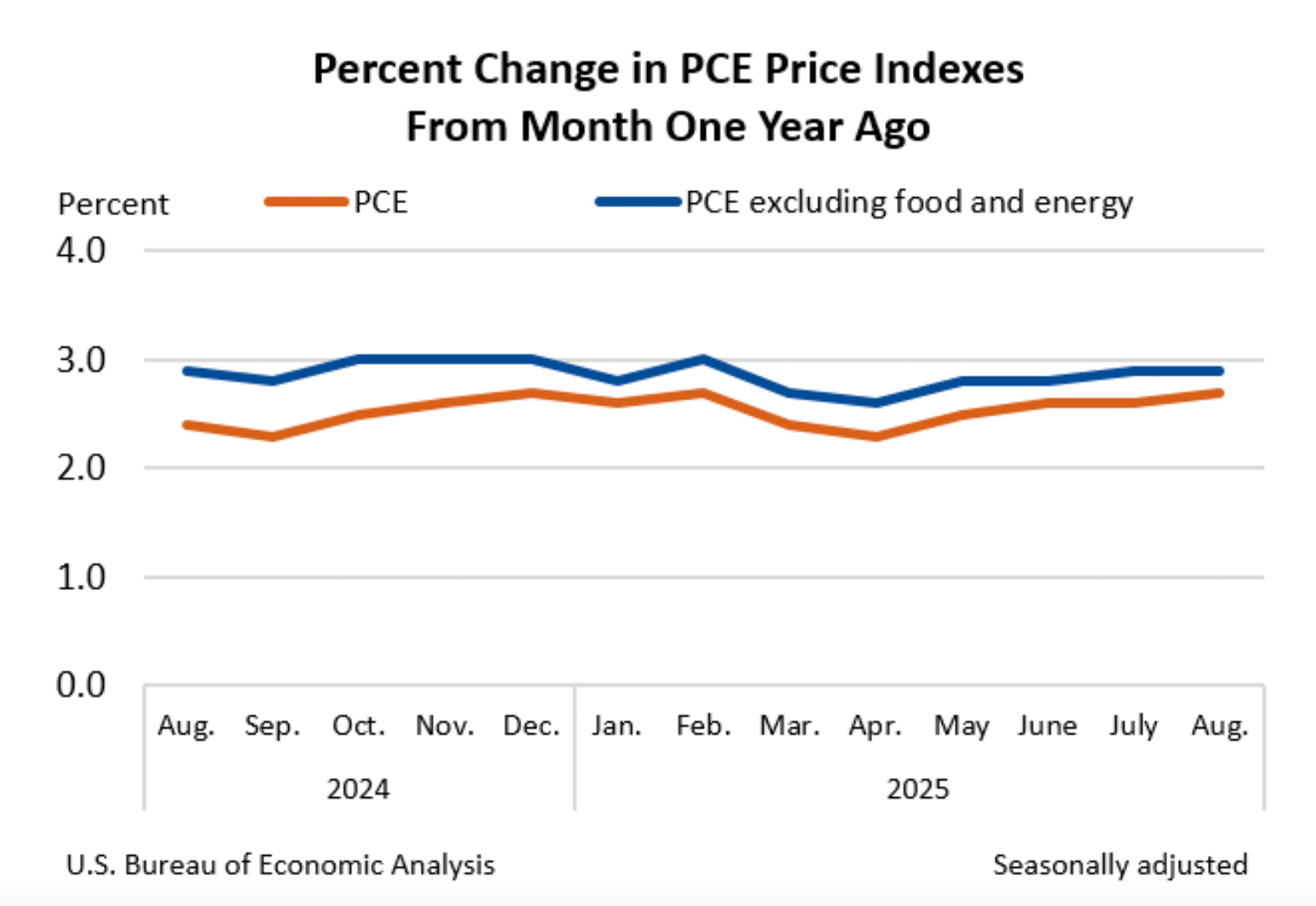

The Fed Fed inflation inflation, the expense of personal consumption (PCE), shown An annual increase of +2.9% in August, while the PCE security rises by 2.7%. Both combined the forecasts on the economist.

(Source: US PCE Index Edit: US Beaurea)

The lack of silent surprise reaction. The traders said that the reading, although above the Fed goal, still allows room for a possible cutting of the October rate.

That perspective contributed to limiting the backhand of the medal but was unable to arouse fresh purchases after a week of strong liquidations.

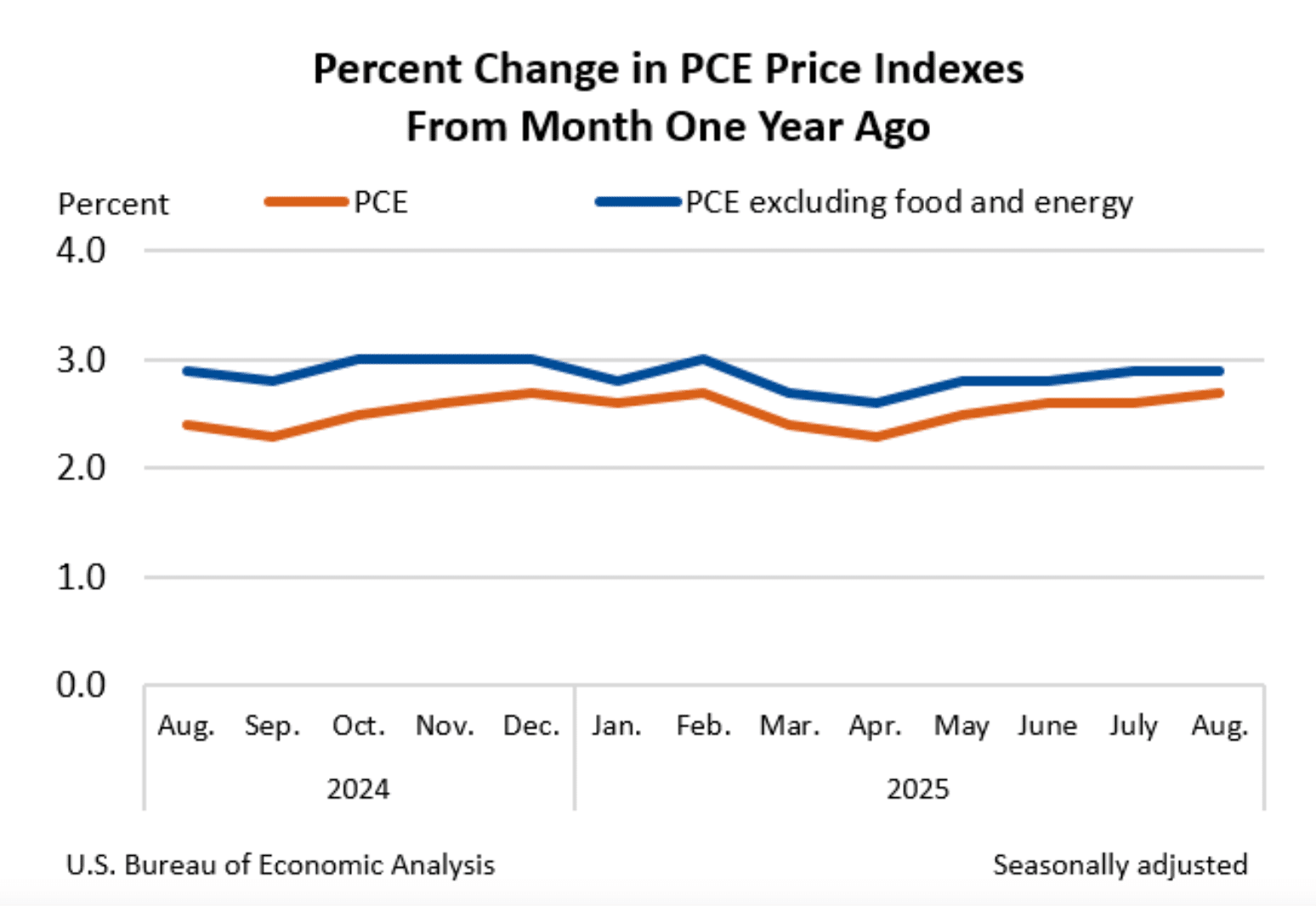

Second CoinglassOrders data showed a support cluster for offers about $ 108,200 on Binance, while the liquidation levels were just above $ 110,000.

(Source: slate)

Glassnode shown “Another wave of long liquidations” when BTC went down below $ 111,000 at the beginning of the session, calling the part of the slide of an ongoing delegation cycle.

#Bitcoin Futures saw another wave of long liquidations while the price moved below $ 111k.

This financial leverage vampiata reflects a large delegation event, often restoring the positioning of the market and facilitating the risk of further waterfalls.

https://t.co/uevhqia78z pic.twitter.com/kmdo52vxj

– Glassnode (@glassnode) September 26, 2025

Intraday, BTC was stuck near $ 109,000, with the bears that grind local support.

Analysts have reported $ 107.000– $ 108,000 as the next test below and $ 112.000- $ 117,000 as resistance above, following what has been the largest delegation event of 2025 so far.

The letter Kobeissi noted That even with PCE at a maximum of seven months, “the Fed should still continue to cut the rates”. That background increased the pressure on the downside but left the markets without impetus for a rebound.

Breaking: August PCE Inflation, the Fed Fed inflation measurement, rises to 2.7%, in line with expectations of 2.7%.

The basic PCE inflation was 2.9%, in line with expectations of 2.9%.

The PCE inflation has been at most since February 2025.

However, the Fed will continue to cut the rates.

– The Kobeissi Letter (@kobesileter) September 26, 2025

Discover: 9+ Best at high risk, high charging encryption to buy in 2025

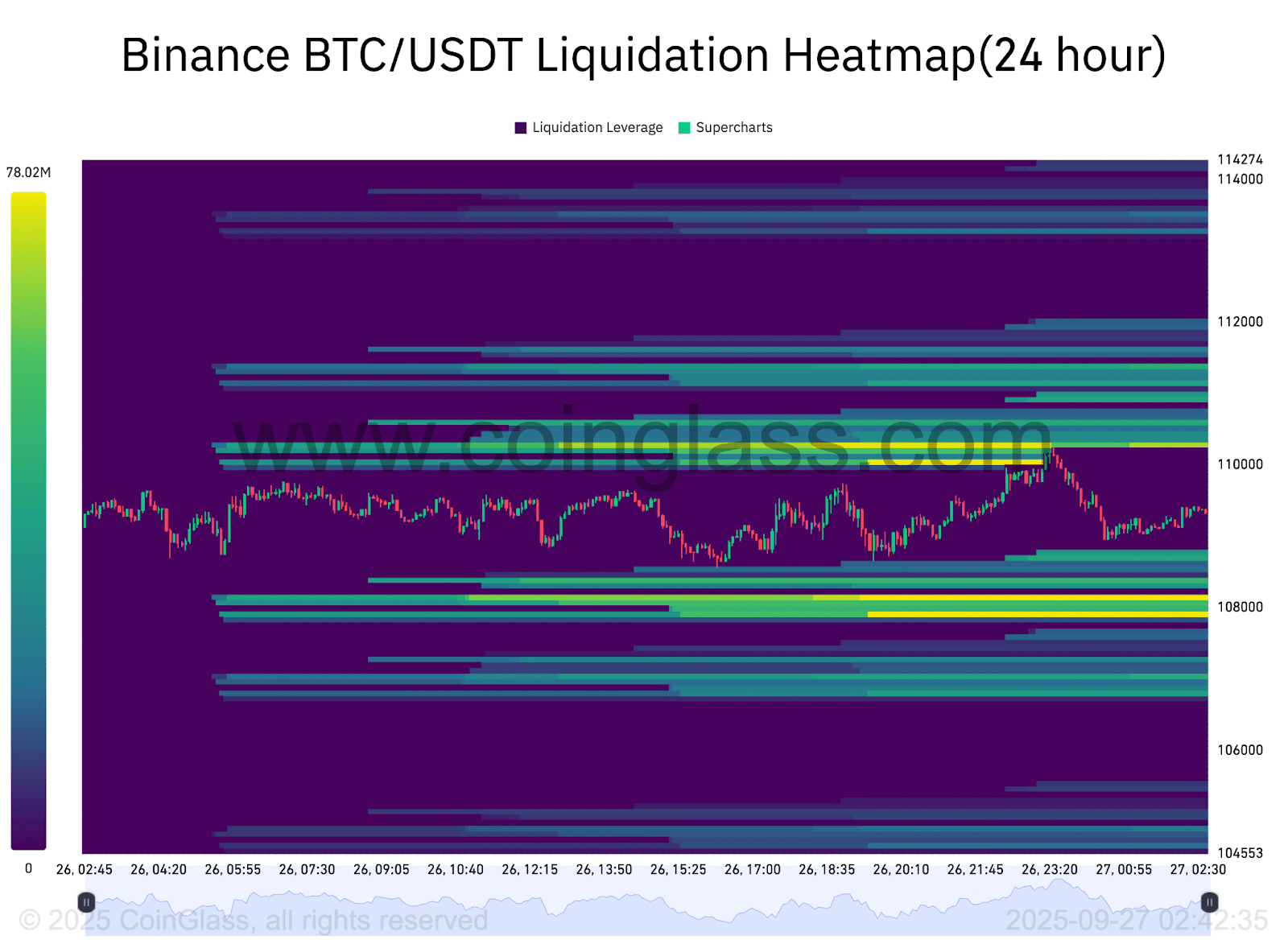

Bitcoin price forecast: BTC USD is entering its largest bears market as microstrategy deals with the risk of forced BTC sales?

A cryptographic analyst has warned To date, Bitcoin could enter its largest bears market, with microstrategy participations in the center of concern.

The largest bears market has just begun

Microstrategy will be forced to sell 639.835 BTC

I warned it this month ago, but nobody listened

That’s why and when MicrostrateGy will collapse

pic.twitter.com/tga5z35vth

– Atlas (@crptatlas) September 26, 2025

The analysis indicates Bitcoin trading in the average interval of $ 80,000, below its average estimated cost. A table shared next to the return of a notice outlines a path in which prices could weaken further in 2026.

If Bitcoin has fallen to $ 65,000 or even $ 45,000, the analyst suggests that Microstrattegy could be forced to sell part of his escort of 639,835 BTC.

The company, led by executive president Michael Saylor, has built the largest company Bitcoin treasure in the past four years. His aggressive use of the financial lever has been praised and questioned.

(Source: x)

With an average purchase price of almost $ 70,000, extended losses below that level could exert a strong pressure on its budget.

The analyst claimed to have mentioned this scenario months earlier, claiming that the financial leverage enlarges the risks downwards in a prolonged collapse.

The market observers added that any forced liquidation by MicrostrateGy would not have only achieved its finances, but also shaking trust in Bitcoin as a business reserve activities.

For years, Saylor has promoted Bitcoin as “Digital Gold”, framing it as long -term hedge for institutional budgets.

A profound correction could test this statement. While the projection remains speculative, it adds to the discomfort between the traders already wary after acute retracements in recent sessions.

The key question is now whether microstrategy can resist the further pressure pressure or if its participations can become the flash point for a wider recession.

DISCOVER: Over 16 lists of new and imminent binance in 2025

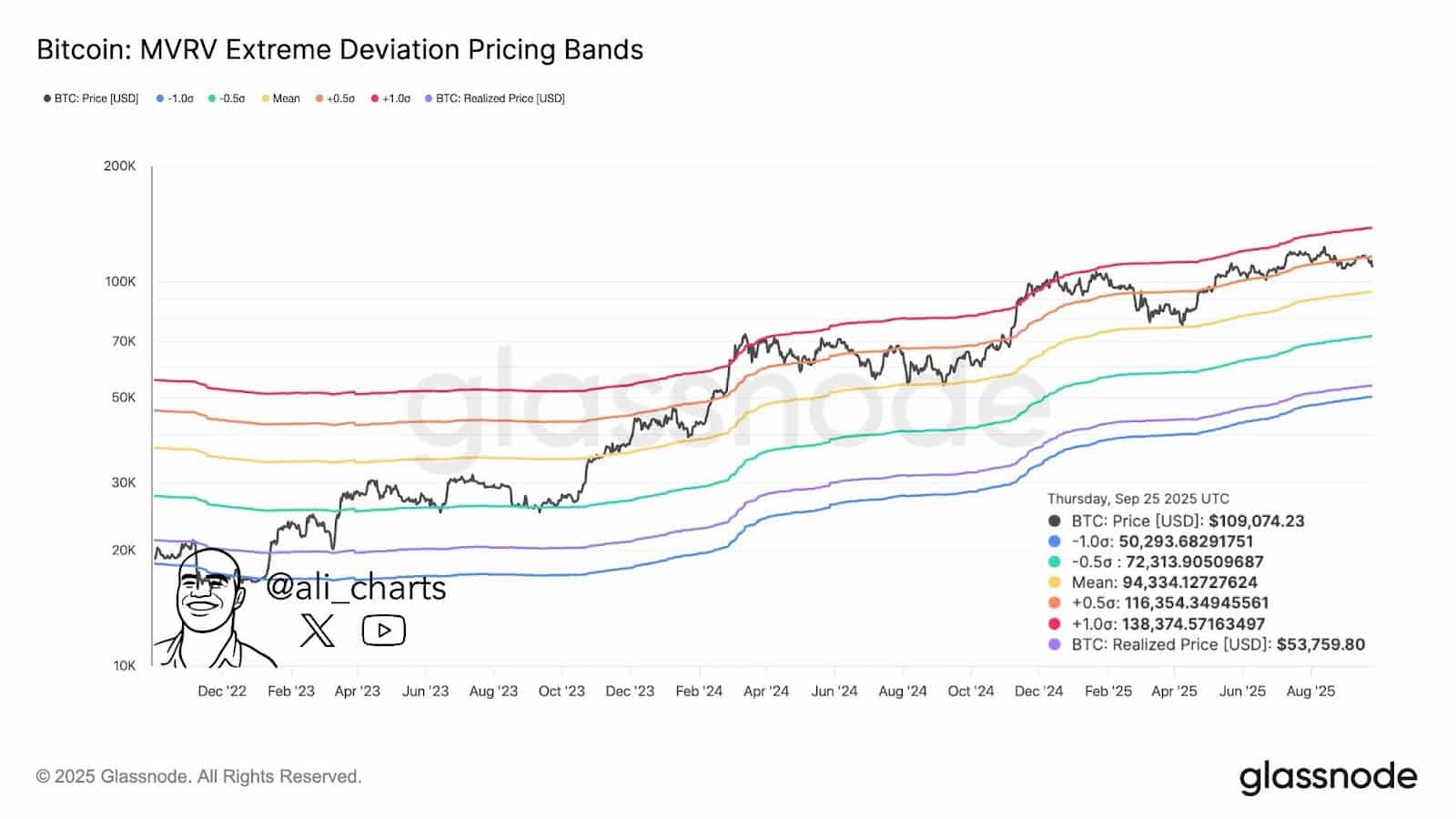

What do the Mvrv price bands of Glassnode reveal on Bitcoin risk levels?

According to analyst Ali Martinez, the Bitcoin price has to face a renewed pressure after the chain data reported $ 116,354 as a critical level to watch.

In a send On X, Martinez mentioned the deviation of Deviation Price Extreme Mvrv of Glassnode, noting that Bitcoin was exchanging at $ 109,074 on September 25, 2025, under the band +0.5work and the edges closest to the average support.

Not being able to recover $ 116,354 puts Bitcoin $ BTC At risk of a drop at $ 94,334, based on price gangs! pic.twitter.com/zruteald2J

– Ali (@ali_charts) September 26, 2025

The model sets several thresholds. The average band is at $ 94,334, while the deviation-0.5 education is located at $ 72,313. Martinez stressed that, unless Bitcoin dates back to more than $ 116,354, which acts as a higher resistance, the coin risks sliding towards the average at $ 94,334.

The analysis launches $ 116,354 as a pivot point: a recovery above could revive the upward momentum, but the refusal can deepen the bearish feeling.

(Source: x)

The warning comes in the midst of a strong volatility, with the traders that digest the macro uncertainty and the liquidation waves in the derivative markets.

Glassnode’s graph also shows the price made by Bitcoin at $ 53,759, an indicator that suggests the potential for a deeper correction if the feeling of risk will grow.

For now, Martinez’s signal leaves the traders focused on the fact that Bitcoin can contain the $ 100,000 region or risk slipping into lower evaluation bands.

DISCOVER: 10+ Next crypt at 100x in 2025

The PCE PCE Post is unable to dent the BTC USD price: Grok provides that Bitcoin Monthly Close appeared first out of 99 bitcoins.