Public companies now hold over 688k BTC, reporting the institutional adoption of Bitcoin

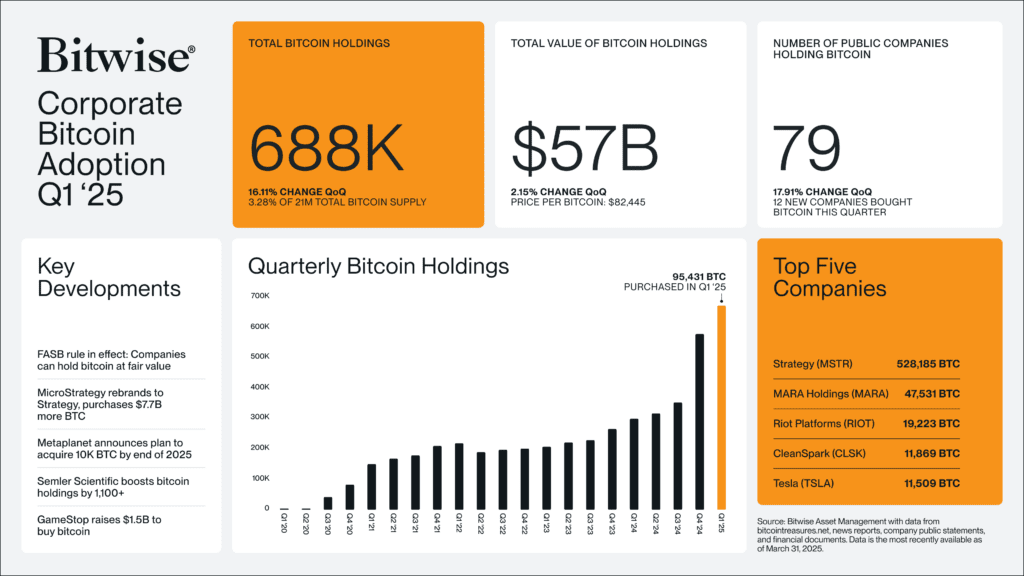

The adoption of Bitcoin by public companies has reached a historical maximum, according to a new Betwise report. In the first quarter of 2025, the companies listed on the stock exchange now hold a combined number over 688,000 BTCs, growing by 16.11% quarter in the quarter, which represents 3.28% of the fixed supply of 21 million bitcoins.

This corporate treasure is evaluated in over $ 57 billion, based on a Bitcoin price of $ 82,445, reflecting a 2.15% increase in total value compared to the previous quarter. The number of public companies with Bitcoin on their budgets grew up to 79, a quarterly increase of 17.91%, with 12 new companies that joined the list.

Betwise attributes the increase in adoption to different key developments, in particular the Fasb (Financial Accounting Standards Board (FASB) rule that allows companies to report Bitcoin to the fair market value. This accounting movement has eliminated an important friction point for CFO and Boards of Directors, opening the way to several companies to easily adopt BTC as a reserve activities.

MicrostrateGy – now renamed as a strategy – continues to drive the accusation, purchasing Bitcoin for a value of $ 7.7 billion in the first quarter and increasing his total participations to 531,644 BTC after a further purchase of 3,459 BT for a value of $ 285.8 million at the beginning of this week.

Other main Bitcoin holders include Mara Holdings (47.531 BTC), Riot platforms (19,223 BTC), Cleanspark (11,869 BTC) and Tesla (11,509 BTC).

The Japanese Metaplanet company has announced its intention to acquire 10,000 BTC by the end of 2025, while Semer Scientific added over 1,100 BTCs to its budget and deposited this week to collect $ 500 million to buy more. “In principle we have reached an agreement, enthusiastic to buy more BTC!” The president published Eric Semer on X. In a recent interview with Bitcoin Magazine, he added: “We have a lot of #bitcoin and that Bitcoin appreciates. What matters most is that we create value for shareholders … We are accumulating Bitcoin and we will continue to do it”.

Meanwhile, Gamestop holds $ 1.5 billion of freshly raised funds in the Rocket of the code project to invest in Bitcoin, adding to its 4.75 billion dollar cash reserves. Although they still have to distribute funds, their participation can further feed the company demand in the next quarters.

With 95,431 BTC purchased alone in the first quarter, the report suggests that this momentum is only building.