Crypto has absorbed his largest liquidation shock of 2025, with the heaviest drying of one day since the summer of 2023 for Eth and Sol and the largest from June for BTC, triggering a decisive acute and guided by sentiment through Major and Altcoin with great capitalization. In a video analysis published today, the Cryptoinsighttuk analyst urged the moderation and claimed that the move seems to be a vampiata of financial leverage rather than a structural break, indicating liquidity maps, footbugs of momentum and composites in Capone who, in his opinion, are still inclined constructive once the dust is established.

Not in a hurry and panic this morning, “he said at the beginning.” The only race and panic thing you should do right now is if you just want to buy commercials … nothing has really changed. “He framed the sale against closings almost all times last week through the aggregates of Market-Cap: Total2 (ex BTC)” closed at about $ 1.66- $ 1.67 trillion “, total (ex BTC, ex-ETH) at” $ 1.13 trillion “and total crypto market at only $ 4 trilion trilion. 3,96 “. The message, he said, is that of” zoom “, evaluating the structure and watching a family background sequence that often follows long liquidations.

Reading Reading

The short -term short -term roadmap on a classic liquidity sweep plus the setting divergence. After a vertical wick cancels the offers and stumbling blocks, seek the price to “cut”, revisit – and marginally underestimate – the bottom intraday, while the RSI establishes a higher minimum. “What we are structurally looking for … is a higher minimum on the RSI, perfect if it is located in the hyper -fired area … When we have a higher minimum on the RSI and a lower minimum of price action … the impetus of the sale is falling”, he said, defining this configuration a reliable revision “tells” the higher the frame time, better “.

Crypto Watch: Eth, XRP, Doge, Ada

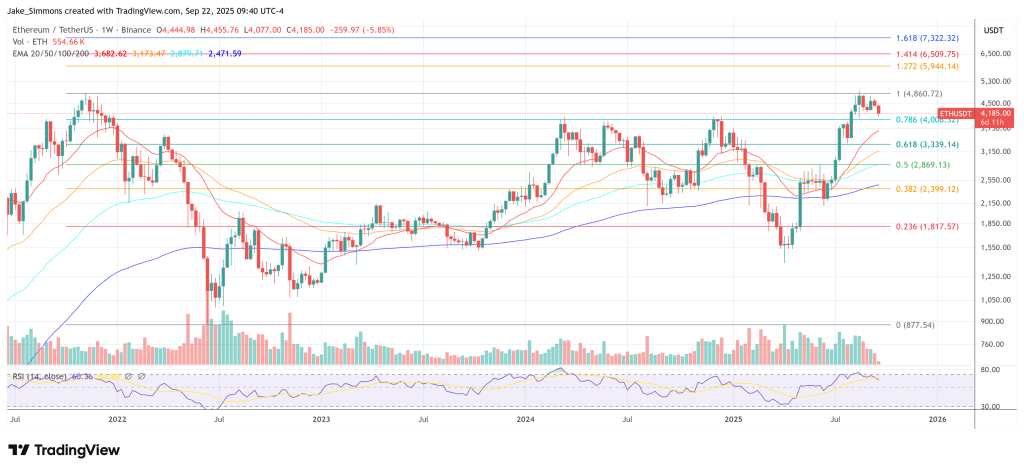

He mentioned new examples between Major. For Eth, a “about $ 4,400 to $ 4,000” sampling hit through a “dense” cluster of liquidity lower than the price that had accumulated for weeks. “This is the first time that we see more liquidity above us than we have since followed” the previous advance of five waves, has supported, consistent with an ABC correction that could be matured.

XRP, he said, “identified” his only remarkable pocket of sub-price liquidity, which accumulates at $ 2.66, a level that has mapped $ 2.8– $ 2.69. Now he sees the “main liquidity … above us for XRP at $ 3.40, while allowing a short filling today could complete the divergence model he is looking at.

Bitcoin dominance spike also adapts to its playbook. He described the RSI domain as “enormously hyper -mp … probably like every hour as the overload as I have seen it”, noting that the previous raids in this area coincided with local peaks in the relative force BTC before returning to large hats and selective alts. That context-together with his “enlarged” vision-at the basis of his statement that “the upright feeling is rewarded over time”, even if the path includes unnerving resets.

Dogecoin, he warned, can still probe the $ 0.19- $ 0.20 area after recovering the support region of $ 0.22, but has reported that the 4-hour RSI is depressed as regards the previous minimum cyclic. He revealed a doge “2x” for a long time about $ 0.225, recognizing that they do not stop difficult, given his sentence in the trend of the highest bodies and accepting the risk of further cuts.

Reading Reading

Cardano “evil in” a liquidity shelf mapped near $ 0.77, with “main liquidity … up to $ 1.00 and $ 1.20” on the day, a configuration that considers asymmetrically favorable once the market is stabilized.

What to look now

During everything, he stressed that today’s damage was amplified by the lever, not by the base. “We had a liquidity redness,” he said, referring to a social post, he saw that “a billion dollars of leverage was downloaded in 30 minutes”. For him, this is “positive; we want to see this restoration of the lever”. He warned that the short -term direction is hostage for the cash flows in cash: “The United States could wake up and … they sell, or … buy the [dip]”-But insisted on the fact that the largest structures are intact:” weekly … we are still sitting at the top of all time … whether it is the upper part or not, I don’t think. Really, really, really, really, really, really. “

Its short -term control list is simple: let volatility follow its course, look for the RSI higher than a lower marginal price and compared to the default support/target areas. “Take your emotion away and look for structures you know are background structures,” he said.

The trader’s psychology, in his story, is critical as levels. “These things happen and it seems a culmination of feeling … anger, frustration and now probably desperation … if it is too much … go running”, he recommended, adding that “the market doesn’t matter” nobody’s mood and “it will still do what it will do”.

If the “real storm” is yet to come, it implies that it is the post-Flush move that matters, whether a final liquidity sweep completes the divergence or rapid rotation raises the majors in the air liquidity it has mapped. In any case, he claims, the decisive phase is ahead, not behind: “Let’s see how things go … it’s not time to panic … If you want to buy things … When we are hypercurring in this way, it’s a decent moment to buy,” he said.

At the time of the press, Eth was exchanged at $ 4,185.

First floor image created with Dall.e, graphic designer by tradingview.com