If the cryptocurrency market feels a little more peaceful lately, it’s not just you. According to the monthly prospects of Coinbase April 2025, the numbers confirm what many traders and manufacturers have perceived: we are in depth in a recovery time. However, there may be a cryptographic rebound by the end of the year.

Altcoin’s market capitalization – this is all except Bitcoin – has fallen by about 41% since December, descending from $ 1.6 trillion to about $ 950 billion. Ouch. It is not entirely a bass area, but it is a heavy that turns patience throughout the line.

New Coinbase report!

Crypto that enters the Bear territory with a total market capitalization down 41% from December. The money index below the signals but 200 days continued to weakness. But potential late Q2 stabilization, recovery in Q3 is possible if global conditions improve#Cryptomarkets pic.twitter.com/rdwvnjhbh

– Neomaventures (@neomavenutures) April 16, 2025

And it’s not just prices. Even the financing of the risk capital, the lifeblood for startups in the construction of the space. Compared to the peak years 2021-2022, the interest of the VC collapsed by 50-60%. Why? Mainly because the macro environment is disordered. Inflation, changes in rates, geopolitical tensions and the persistent fear that the other economic shoe could have abandoned the mischievous investors. The result? Less controls, more slow rounds and many “we wait and see”.

Market feeling indicators

The head of the research of Coinbase, David Dong, is not sugary. He says that the data show that we entered a neutral market to chaos and that the bull is probably overcome in February. That timing aligns with many traders who ask: “Wait … was it true?”

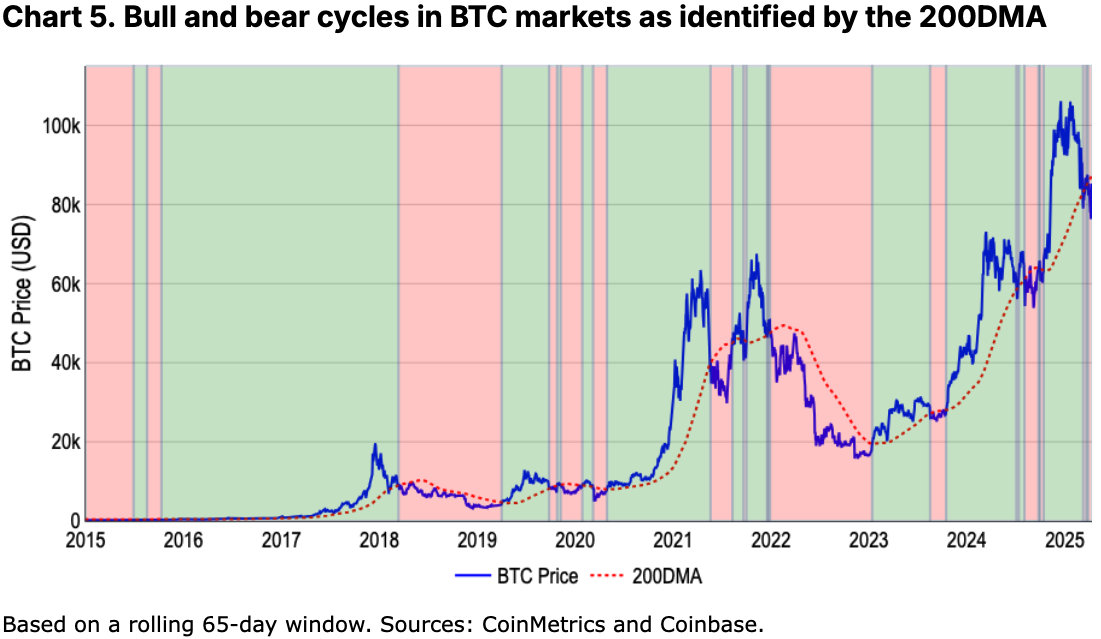

It indicates some key indicators, including the 200 -day mobile average, which has shown that between November 2021 and November 2022, Bitcoin dropped a lot, about 76%, but when the risk is adapted, that decline was similar to the drop of 22% of the’s & P 500.

In other words, both have had great moves compared to what is normal for them, even if the percentages seem very different.

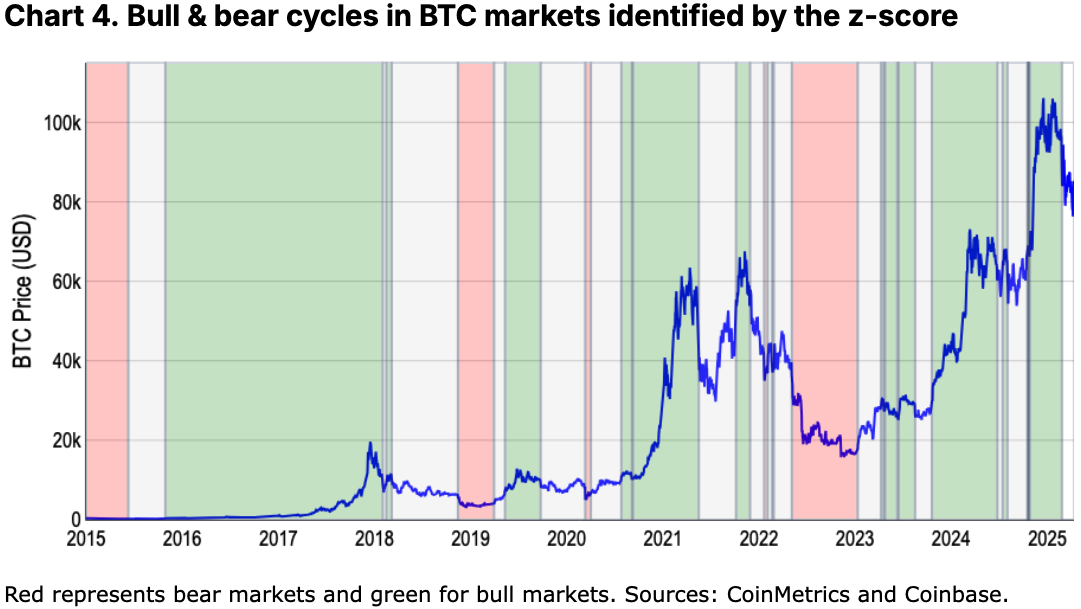

Another metric that has been examined was the Z Bitcoin score (which substantially measures such as extreme current prices are compared with historical standards). Both are flashing yellows, not red, but certainly not green.

The Z scores work well for encryption because they adapt to how wild the oscillations of prices can be, but they are imperfect. They are a little more difficult to calculate and do not always collect trends quickly, especially in the calmer markets. For example, the model showed that the last Tori race ended at the end of February, but since then everything is called “neutral”, which shows that it can be behind when the market moves quickly.

So yes, it is right to call this moment what it is: a pause, a restoration, perhaps even the first days of another “encryption mini winter”.

Find out: the best new cryptocurrencies to invest in 2025

Potential for cryptographic rebound in the second half of 2025

But, and it is a great but Dong also sees light at the end of the tunnel. While Q2 could be rough, Q3 may seem very different.

Why optimism? According to Coinbase, these types of pullbacks can be healthy. They shake the noise, restore the assessments and refresh the overheated feeling. And once the feeling detaches itself, a rebound can affect quickly and hard, especially if the macro image improves or the new narratives enter the entrance.

It is not a promise, of course. But remember that Crypto cycles are cyclic. Things go down, but they often come back.

Right now, the market is taking a break. The prices have decreased, the loan is closer and many investors are on the sidelines. But as Coinbase points out, this does not mean it is over. These breaks often lay the foundations for the next wave, especially if trust returns and macro winds calm down.

So, whether you are building, investing or simply looking at a margin, keep an eye on the second half of 2025. There may be a encryption rebound and the market may surprise you again.

DISCOVER: 20+ Next Crypto to be exploded in 2025

Join 99 bitcoins news discord here for the latest market updates

Keyway keyway

-

Altcoin’s market capitalization dropped by 41% since December 2024, descending from $ 1.6 trillion to about $ 950 billion.

-

The financing of the risk capital in Crypto is down 50-60% from the peak levels, since investors surf over macroeconomic uncertainty.

-

The research of Coinbase suggests that the market is in a phase from neutral to door, with indicators such as the average of 200 days and the flashing caution of the Z Bitcoin score.

-

Despite the recession, Coinbase sees the potential for a rebound of the Q3, noting that the cooldown often restore the assessments and the feeling before recovery.

-

While Q2 can remain unstable, the second half of 2025 could mark the beginning of a new wave: if the macro conditions stabilize and new narratives emerge.

The post Crypto market collapses 41%, but Coinbase sees the return Q3 appeared first out of 99 bitcoins.