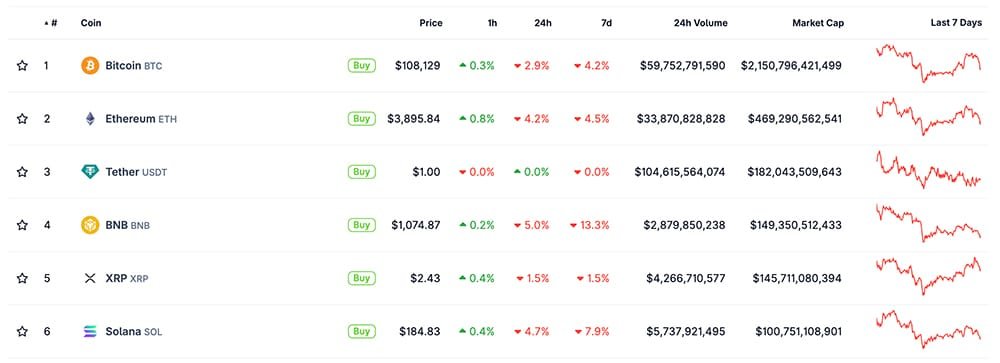

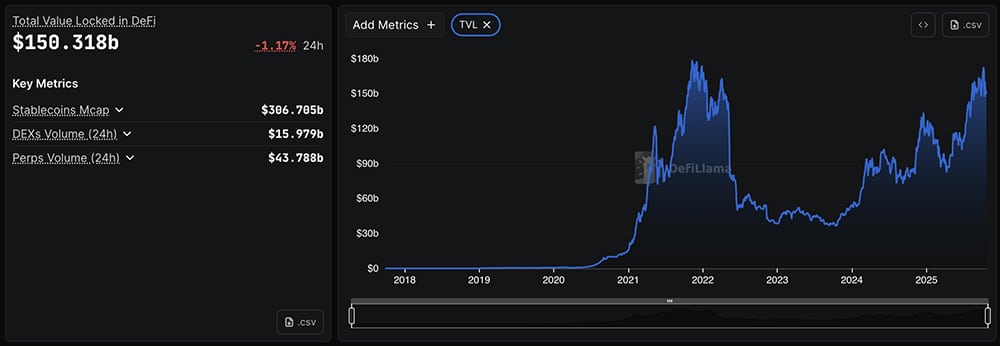

In today’s latest cryptocurrency news, Bitcoin (BTC USD) price is down 3% even as the US stock market pumps, yet the Fed’s crypto angle remains solidly bullish. The BTC USD setback comes even as data shows strong on-chain participation and liquidity.

Institutional signals and political developments suggest that the correction may be a healthy pause, not the end. As we watch most of today’s cryptocurrency news headlines, the interaction between Bitcoin price movements, the behavior of the BTC/USD pair, and the Fed’s cryptocurrency policy gives a strong bullish signal.

(source – Koenjiku)

Bitcoin price and BTC USD dynamics: late now, ready to go

Although the US stock market is moving forward, the price of Bitcoin (BTC USD) appears to be lagging, but this could be a bullish setup. The price of the BTC USD pair is around $108,000 at the time of writing this article.

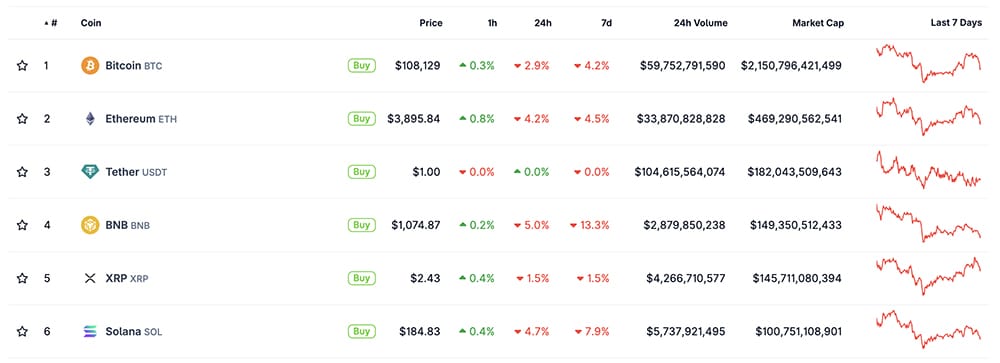

Meanwhile, DeFiLlama reported that the total value locked (TVL) in DeFi protocols is around $150.3 billion. It is down a bit, but still looks strong despite the current market movement. Also, the market cap of stablecoins is still above $300 billion.

(source – Devillama)

Historically, when BTC USD lags stocks early in the cycle, the corrective phase is often preceded by a massive pump. In this context, this current decline may be the calm before the breakout.

According to Arkham, Blackrock moved its Bitcoin holdings off-chain, leading to fear. However, institutional inflows and the timing of large holdings moving to exchanges may offload them and allow more people to join the accumulation process rather than sell outright. With today’s cryptocurrency news strongly pointing to BTC USD lag as a potential buy signal, the setup remains compelling.

(source – Arkham)

Discover: 16+ new and upcoming Binance listings in 2025

Today’s Biggest Crypto News: Fed Crypto Conference

The cumulative effect of the Fed’s cryptocurrency policy signals and institutional accumulation is difficult to ignore. Today’s upcoming Federal Reserve (FED) Cryptocurrency Conference addresses payments innovation, token assets, and stablecoins. This is a strong bullish wind for BTC USD and the cryptocurrency market as countries finally recognize the power of cryptocurrencies.

Only in:

The Federal Reserve is hosting a large cryptocurrency-focused meeting tomorrow.

Insider confirms there’s a big announcement coming – expect extreme volatility.

Giga bullish signal for #Bitcoin And encryption! pic.twitter.com/XN89Ipufc0

– 0xNobler (@CryptoNobler) October 20, 2025

On an institutional level, particularly in relation to Blackrock’s outflow, off-chain moving behavior of cryptocurrencies is often associated with strategic rebalancing before major policy or market inflection points. Such a move reinforces the idea that the institutional wave is in order and may support further rise in the BTC USD price.

break:

BlackRock sells $100.7 million worth of… $ Bitcoin pic.twitter.com/N3ppZkEphT

— Crypto Rover (@rovercrc) October 21, 2025

In the context of today’s cryptocurrency news, the combination of policy clarity across the Fed’s cryptocurrency theme, as well as on-chain liquidity and accumulation, suggests we may be in a pivotal moment, rather than a fading phase. The setup favors a bullish outcome for the Bitcoin price.

While the price of Bitcoin (BTC USD) is down 3% in the short term, indicators such as those of DeFi TVL, stablecoin liquidity, institutional positioning, and the Fed’s key crypto conference point to strong bullish momentum on the backend.

The lag in the BTC USD price may be a pause, not a result. Be prepared for a major breakout and a period of endless money glitches.

Discover: 10+ Next Cryptocurrencies to 100X in 2025

Join the 99Bitcoins News Discord here to get the latest market updates

AVNT price rises 48% but analysts say BIO protocol is the next 100X crypto

The hunt for the next 100x cryptocurrency rally has intensified as the AVNT cryptocurrency posted a stunning 48.6% surge amid a surge in volume and renewed hype. While Avantis’s rise is making headlines, analysts are turning their sights towards the BIO protocol, claiming that it could be a real 100x opportunity hiding in the bushes.

With Avantis cryptocurrency riding the wave of core chain derivatives momentum and BIO boosting the DeSci narrative, the smart money may be changing directions. For investors looking for asymmetric upside and FOMO movements, this clash of narratives could define altcoin season.

Read the full story here.

Solana Labs Aims for Perp DEX Wars: But Justin Sun’s Chinese DEX Plan Is the Secret Chip

The Solana Dix ecosystem is on fire again, and not just from the west. While Solana Labs is quietly building Percolator, a next-generation decentralized perpetual exchange to rival Hyperliquid crypto and Aster dex, Justin Sun’s SunPerp is making bold moves east.

Backed by the TRON cryptocurrency and backed by a massive $200 million trader recovery fund, SunPerp’s rapid multi-chain expansion and focus on the Chinese market have turned it into a stealth player that few expected.

Together, these launches represent a new phase in the global battle for decentralized derivatives dominance, one that could define the future of cross-chain leveraged trading.

Read the full story here.

Cryptocurrency news today, October 21: Bitcoin price fluctuates as BTC/USD falls nearly 3% | Today’s Fed Cryptocurrency Conference Due to Infinite Money Glitch? appeared first on 99Bitcoins.