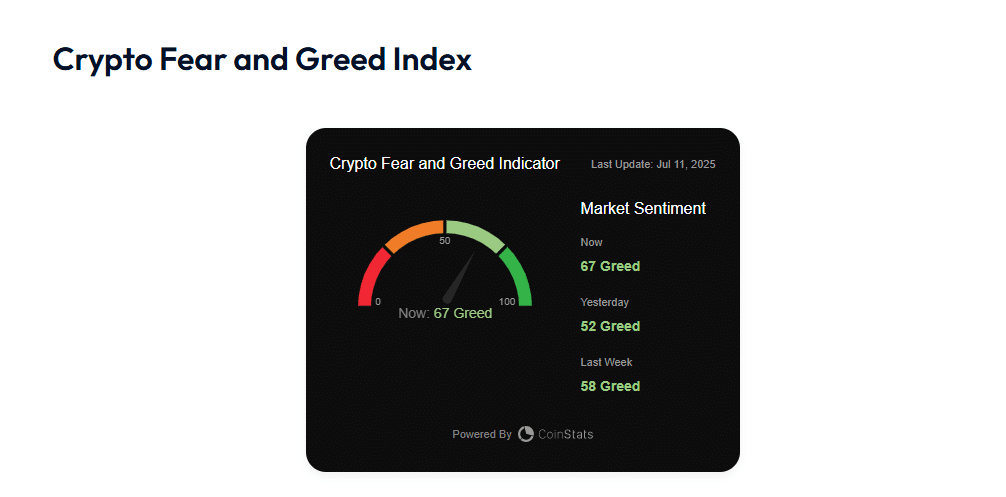

Q2 2025 delivered a decisive message: after a turbulent phase, Crypto returned to the top! The cryptocurrency sector recorded a robust return of 21.72%, exceeding each equity index of the United States with a large margin.

The cryptocurrency market has left us actions in the dust. Second Report on the 99 Bitcoins cryptocurrency market Published on 10 July 2025, “Most of the US equity indices remained below 15%in the earnings of a quarter of date (QTD), only the S&P 500 information technology sector stood out with an increase of 18.4%; the wider S&P 500 gained only 7.37%. In contrast, the cryptographic market overlap them all with a strong yield of 21.72%.”

It is interesting to note that the cryptocurrency industry saw a 18% drop in the first quarter of 2025. Therefore, the rebound of Q2 is a remarkable recovery. The cryptocurrencies of the second quarter of 2025 exceed its performance in previous years, reversing a drop of 14.44% in the second quarter of 2024.

Find out: 9+ Best High Risk and High Senza Cryptocurrencies to Buy in July 2025

So what did Crypto’s superturformance led?

What helped to push Bitcoin’s domain to a maximum of four years of 63%? The interest of institutional investors has distinguished itself. While retail traders have shifted attention to Altcoin, the institutions favored Bitcoin.

According to the interest of investors of the 99 bitcoins report for the cryptovatura collected in the second quarter. “In April, the mentions relating to the Blockchain in the Secco documents reached a maximum record of 5,830, probably due to the pro-Cripto approach of the Trump Administration,” says the report.

In addition, the United States government has provided so necessary regulatory clarity, approving key laws and executive orders that widely support the cryptocurrency market. In particular, the removal of the IRS reporting rules for the DIFI platforms and relaxed requirements for banks that commit themselves in cryptocurrency activities have increased trust throughout the sector.

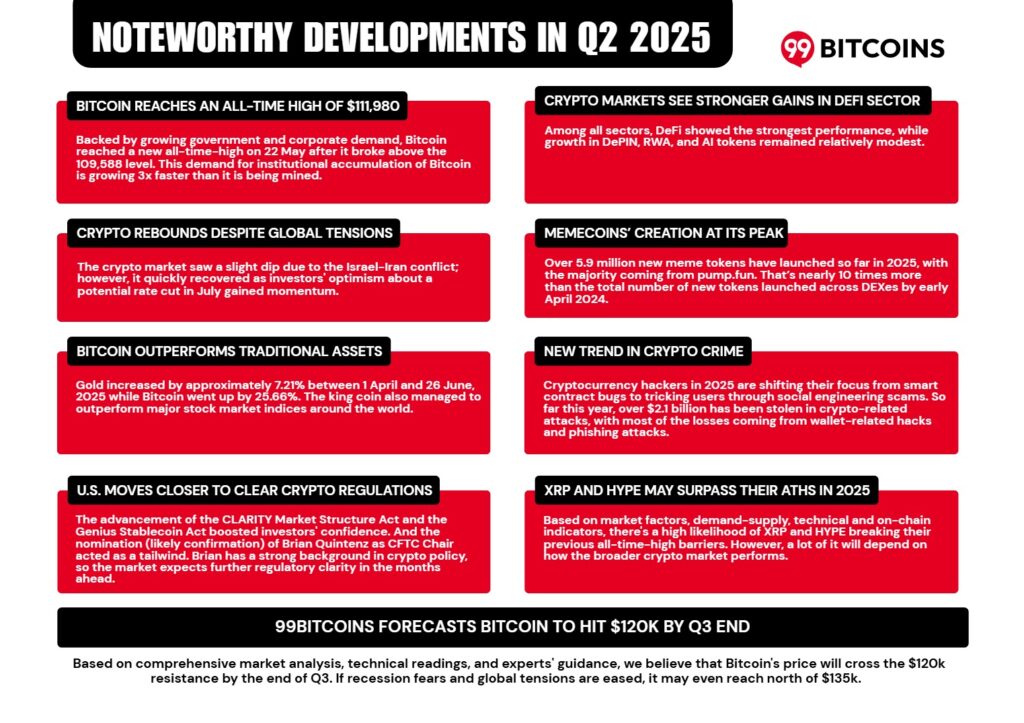

After hitting a minimum in March 2025, the crypto fear and the greed index bounced into the territory of “greed” for over 60 days, supported by positive political signals.

Just yesterday, Bitcoin -The most precious crypto in the world, pushing over $ 117,000, only for buyers who accept aggressively today, raising BTC ▲ 6.76% to a historic maximum of $ 118,409. The index of fear and greed of 99 bitcoins shows a reading of “67”.

Read more: Bitcoin hits Ath without Fomo, Bitcoin Hyper collects $ 2.3 million

Chris Wright, Head of the 21shares global marketing. “We believe that Bitcoin Etfs will attract 50% more afflusions this year compared to last year,” he said. “This would entail net influents of about $ 55 billion in 2025, which represent an increase of about $ 20 billion years on an annual basis. If this continuous trend, the total activities subject to management could almost double from just over $ 110 billion currently, to over $ 200 billion by the end of the year.”

Stablecoins steal the spotlight

The web3 sector has seen an increase in job opportunities for June 2025. While Ripple, Arbitrum Foundation, Stellar and Ava Labs are among the companies that actively recruit for various roles, Okx and Kraken have announced an expansion of their web3 teams. “The hires like this are typical during the bull markets and reflect a strong belief in the growth potential of the sector,” says the report.

But Stablecoins guided the question at the sector. According to the report, 81% of small and medium -sized enterprises (SMEs) who familiar with Crypto are interested in using Stablecoins for daily operations.

In addition, the number of Fortune 500 companies that plan to use Stablecoins has Triple since 2024.

Circle successful IPA- in which the price of the company’s shares risen to 168% to the debut- is the appetite and exposure related to the Stablecoin test.

DISCOVER: 16 Next Crypto to be exploded in 2025: forecasts and analysis of the expert cryptocurrency

The surge of 21.72% of Post Crypto in Q2 2025 leaves Wall Street behind it appeared first out of 99 bitcoins.