Este Artículo También Está available en español.

In a four -hour table just shared of the trading doge/USDT on Binance, the cryptocurrency analyst Carlos Garcia Tapia warns the potential disadvantage for dogecoin with the approach of weekend trading. “If the bears break this scheme, it will become ugly … above all because the weekend is coming”, warns Tapia.

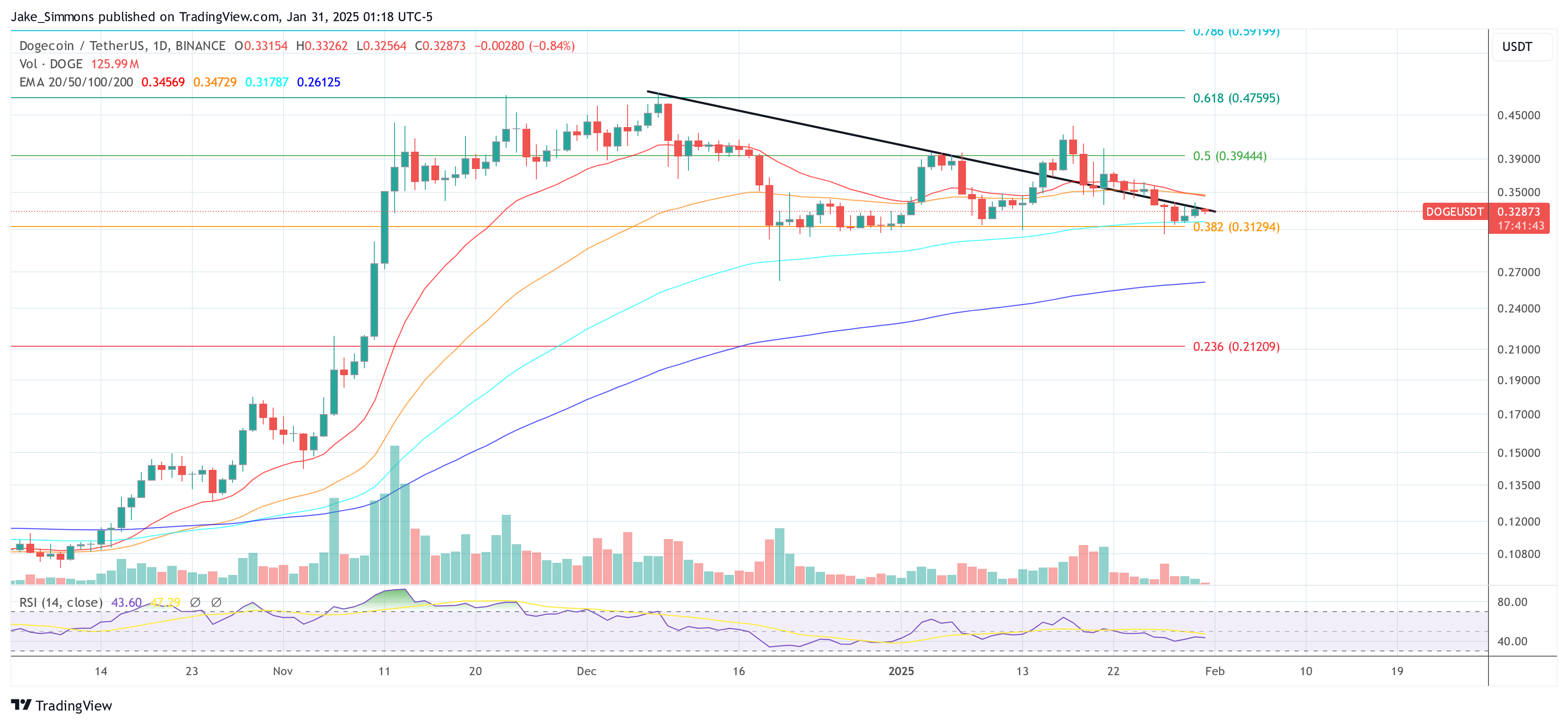

Dogecoin Price Crash coming?

Its graph published through X depicts an ascending cuneo formation that runs through a confluence of resistance between $ 0.338 and $ 0.343, as well as a remarkable support area in the $ 0.31 region.

The graph highlights the highest minimum (marked as “ll” on the graph) that form the lower limit of an ascending wedge. In the meantime, the aerial resistance (a rectangular area of about $ 0.338- $ 0.343) has repeatedly limited the movements of the prices upwards. This wedge seems to compress prices, often a configuration for a remarkable exhaustion or breakage.

A horizontal resistance area about $ 0.34 stands out. Doge’s price attempted multiple short -term moves above this level, but has not been able to guarantee a confirmed breakout, suggesting that the sellers are firmly defending that area.

Reading Reading

On the negative side, a green box that lasts about $ 0.310 marks an area in which the purchase interests are historically collected. Below that level, the graph refers to a lower support marker near $ 0.262, indicating a more substantial potential drop if the Cuneo model breaks decisively.

The analyst specifically indicates next weekend as a joker. Historically, the lowest commercial volumes on Saturdays and Sundays can exacerbate volatility. If dogecoin cannot hold its increasing trend line, generally close to $ 0.328- $ 0.330 – and liquidity takes off, the price could quickly test the lower support around $ 0.310 or potentially slip towards the $ area 0.262 If the moment of sale accelerates.

Reading Reading

While a breakout higher than $ 0.343 could invalidate this bearish configuration, the precautionary note of Tapia underlines the meaning of a potential break from the formation of Wedge. The action of weekend prices often differs from the midweek models due to the reduced participation, which means that a strong move in both directions could take place more quickly than usual.

Doge must contain $ 0.31

The daily graph supports Tapia’s thesis. There, Dogecoin (Doge) is located under the intensification of the downward pressure while the action of the price embraces a persistent trendy trend line. After hitting a local maximum in December, Doge retired under the medium -sized exponential mobile (Ema). The 20 -day EMA (currently at around $ 0,3457) and the Ema at 50 days (near $ 0,3473) both have curved lower, signaling a short -term moment.

A look at the graph reveals that Doge is now slightly above the level of retracement of fibonacci of 0.382, calculated about $ 0.313. This FIB area has acted as a more crucial support from mid -December, but any daily decisive closes under it could accelerate the sale. The traders keep an eye on the 100 -day hema (about $ 0,3179), which is inserted just above this level of FIB.

If the price fails to defend the area between $ 0.313 and $ 0.317, the eyes will turn to the AMA of 200 days at about $ 0,2613 as a long -term critical support. If this level also stops towards the downside, FIB 0.236 at $ 0.212 could quickly become a reality.

First floor image created with Dall.e, graphic designer by tradingview.com