Analysts highlight ETH USD Facting to re -test 4,700 dollars – and in the midst of upward pressure – are dark money revolved in Ethereum?

It bought a wallet linked to a 300 million dollar fraud of $ 18.9 million, as ETH erupted at $ 4,700 yesterday.

According to Lookonchain, the encryption address associated with the “Coinbase Hacker” campaign bought 3,976 ETH for $ 18.9 million on September 13.

The infiltrator who stole $ 300 million from #Coinbase Users bought 3,976 others $ ETH(18.9 million dollars) at $ 4,756 an hour ago. https: //t.co/xglj7nrd pic.twitter.com/wrxobukk7k

– Lookonchain (@swearonchain) September 13, 2025

The purchases, which were performed at an average price of 4,756 dollars, came as the ether was paid to a stage of $ 4,700.

Analysts who follow the wallet say the money was transferred through 18.911 million Days before it was converted into ETH. Arkham intelligence Data The Dai Group wallet appears in amounts ranging from $ 80,000 to $ 6 million before switching.

The title was also active recently, with 4863 ETH and 649 ETH in July and about $ 8 million from Solana in August.

Blockchain Zachxbt investigator estimated The broader plan drained at least $ 330 million of victims earlier this year.

2/ Myself and @tanuki42_ I spent time reviewing the dms withdrawals and data collection to obtain a high confidence theft on different chains.

Here is a schedule that we created, which displays $ 65 million stolen from Coinbase users in December 2024 – January 2025.

Our number is likely to be much lower than … pic.twitter.com/zceq5aggyu

Zachxbt (Zachxbt) February 3, 2025

The process, described as a large -scale social engineering campaign, targeted Coinbase users and kept the wallet under the control of a document of analysts on the chain.

The timing of the latest ETH accumulation has strengthened the market recycling speculation in the ether.

Traders noticed that the wallet movements coincided with the renewal of the momentum in the ETH/USD, adding a weight to the narration that the actors with a deep pocket turn into the original.

ETHEREUM Prices Analysis: To what extent can ETH rise if the neckline of $ 4,700 is broken?

Ethereum shows renewable power, with technical signals that indicate a possible outbreak that can send prices about $ 5500.

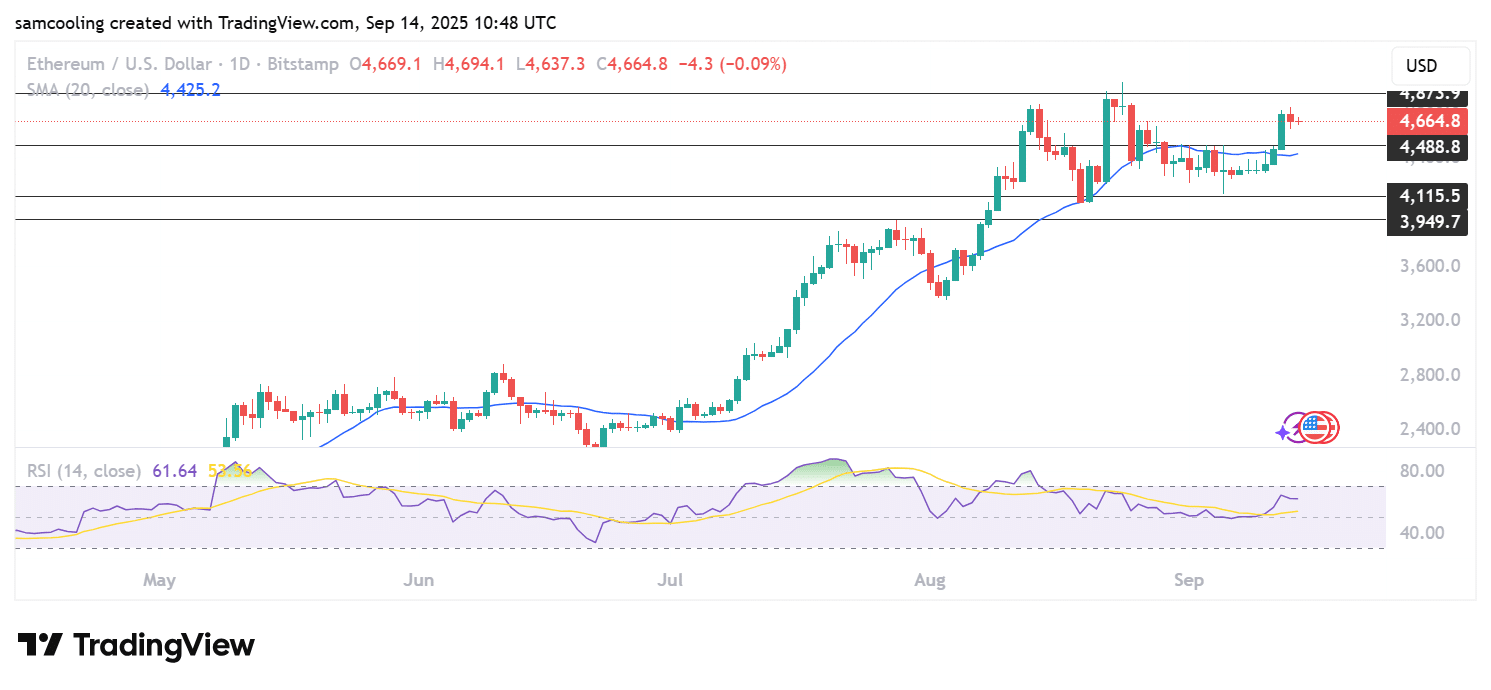

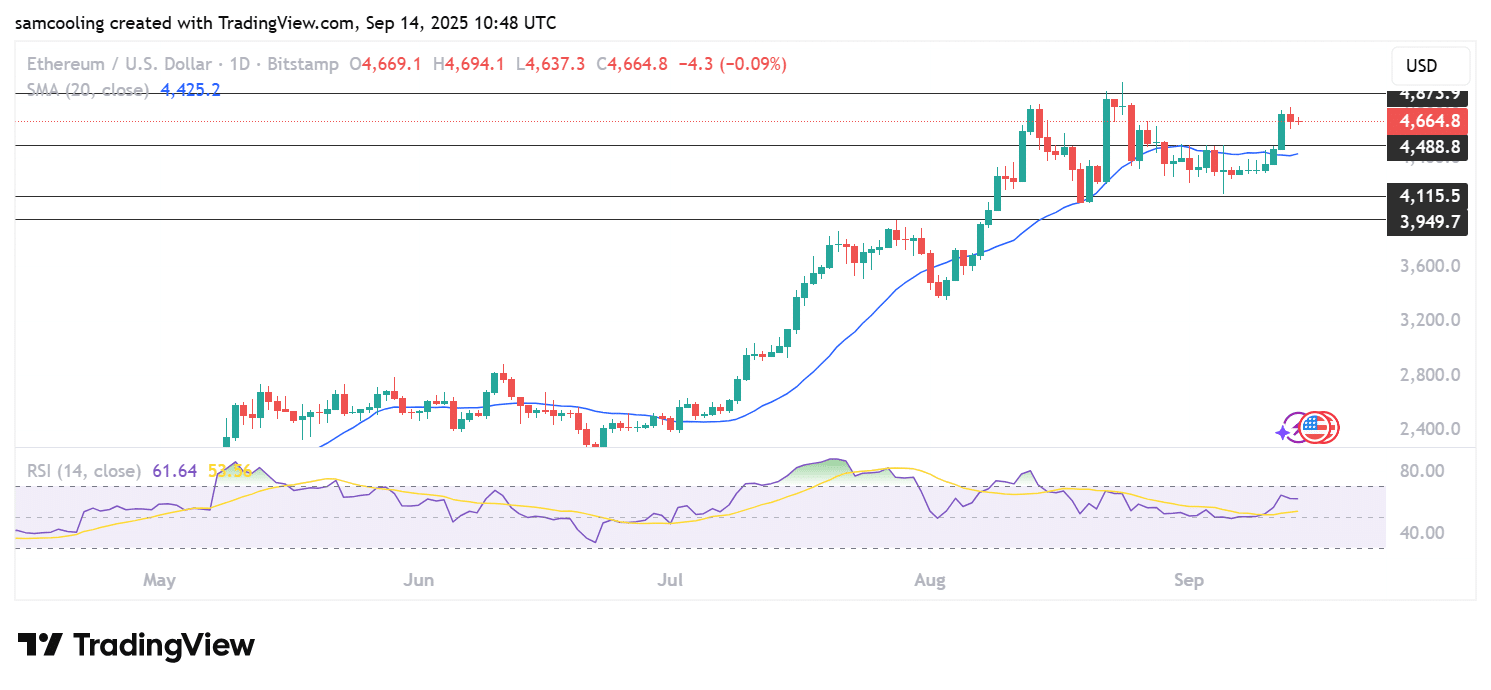

According to Tradingvief DataETH is trading near $ 4,660, holding its short -term moving averages for 4 hours.

((Source – Eth Usdt, TradingView))

50-ema sit at $ 4,462 and 100-ema at $ 4,421, both of which are heading up. This preparation indicates that buyers remain in control despite the simple decline.

Modern sessions have also seen a higher size, supporting the step that raised the ETH from a range of $ 4,300 to the top of 4,650 dollars in a few days.

The broader structure appears to recover after weeks of side work. The short -term candles reveal brief declines followed by a new purchase, a sign of steady demand.

If ETH holds support above 50-ema, momentum may continue. If not, the prices risk slipping to the 4,400-4300 dollars, where both intermediate averages are converging.

Titan of Crypto analyst referred to the ADAM & EVE pattern on the daily chart.

((Source – x))

The composition combines a low “V” shape with a round base, indicating a possible reflection. The neckline is just less than $ 4,700, near the current levels.

The sure collapse above that the neckline would offer a 5500 -dollar -built -up target, in line with historical resistance. This adds a weight to the opinion that Ethereum can be prepared for a more fundamental crowd if the purchase pressure is pressed.

What do you tell us about the next step for Ethereum?

If Ethereum collapses over the neck line, merchants can turn up, with $ 5500 as the next goal. But if this fails, the price may decrease to test how hard the last gathering is.

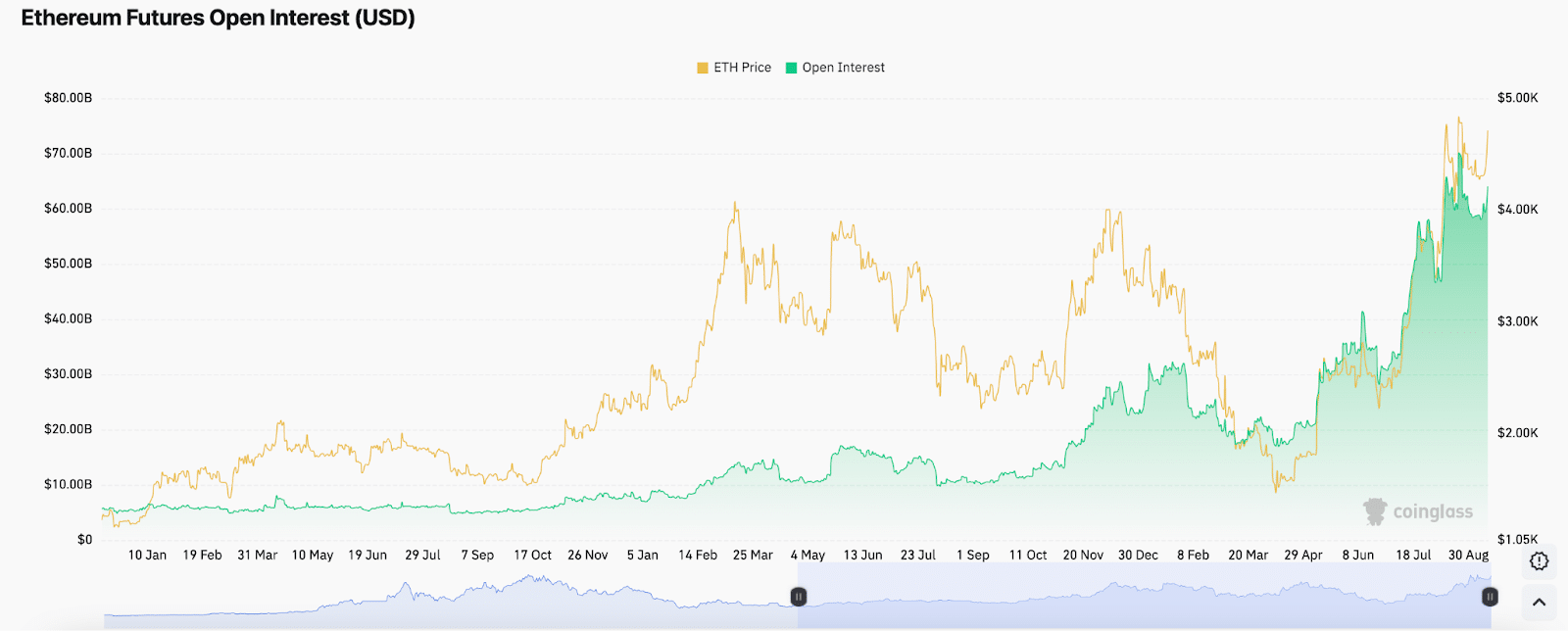

The derivative activity appears high. Coinglass Data Eth Futures puts an open interest near $ 64 billion, while financing rates in the last session hover about 0.01 % via main stock exchanges, fixed, but not excessive.

((Source – Coinglass))

ETF flows improved stain. On September 12, after several days of external flows, Farside Investors reported net flows in ETHNoting the new institutional demand.

He discovers: 9+ best highly risk, highly bonus for purchase in 2025

Post ETH USD PRICE BRICES to re -test $ 4,700: Dark money revolves in ETAREUM? First appeared on 99bitcoins.