In line with the main losses throughout the cryptocurrency market, Ethereum (ETH) decreased by 17.08% last week reaching up to $ 2,104. While the important Altcoin has shown some small earnings in the last 12 hours, the feeling of the general market remains a bearish.

The ETH correction probably went to $ 1,890 – that’s why

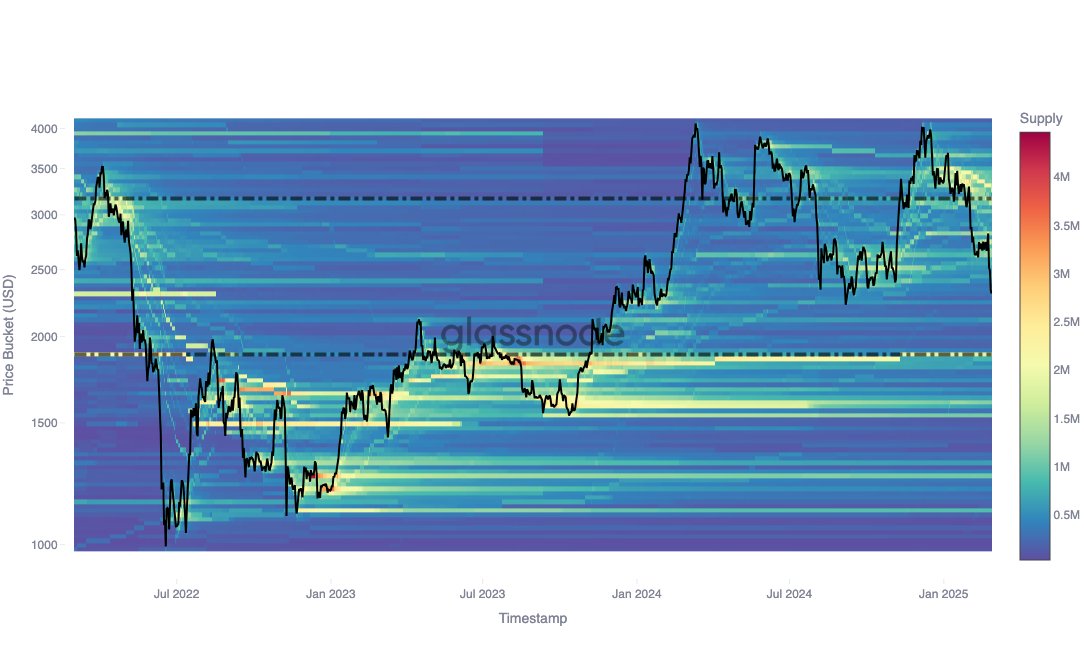

The ETH market is currently browsing with a strong market correction with several analysts who now highlight the potential key support levels. According to the important analysis company on the Glassnode chain, the data of the distribution metrics of the cost bases (CBD) indicate that Ethereum is ready for a decrease at $ 1.890 which represents its next large storage area.

For the context, the CBD is used to identify significant levels of accumulation or distribution of an activity. These identified areas often act as support or resistance and are influential on prices actions. Glassnotes analysts say that the main Eth accumulation area below the current price is $ 1.890 in which investors acquired about 1.82 million ETHs in August 2023.

It is interesting to note that a two -year analysis of the Ethereum CBD shows that some of these investors who have accumulated ETH in August 2023 remain active. In particular, a significant number of them has increased the basis of costs during the cryptocurrency market in November 2024, while it does not perform any distance distribution to the distance, a behavior that indicates a strong trust in appreciating long -term prices.

However, it is worth saying that $ 1,890 is not the immediate support area for the ETH market. Glassnode says that CBD data also highlight $ 2,100 as the next support area if the correction of Ethereum continues.

This level of support contains only about 500,000 et, i.e. significantly lower than the accumulation seen at $ 1890. Even if investors can expect $ 2,100 which offer short -term support before ETH experiences a deeper correction at $, 1890.

Is the accumulation of Eth in the midst of the price price?

In a further analysis of the Ethereum market, Glassnode also reveals that a six -month perspective on the trend of the cost base shows a strong investor activity with basic levels of costs much higher than the current market price, in particular about $ 3,500.

In particular, this cost base showed a gradual decline by increasing concentration. This development indicates that instead of starting a sale, investors are actively absorbing the market offer while prices decrease in anticipation of long -term earnings.

At the time of writing writing, Ethereum exchanges at $ 2,250 following a 3.84% gain in the last day. In the meantime, his strong decline of last week moves the monthly losses to about 30.48%. However, its market activity has increased by 7.74% and is now evaluated at $ 29.91 billion.