Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

Ethereum (ETH) is now exchanged below the crucial sign of $ 2,000, struggling to find momentum after days of sales pressure and consolidation of about $ 1,900. The wider cryptocurrency market remains under a strong bearish control and Eth has lost over 57% of its value, making it increasingly difficult for bulls to stage a recovery.

Reading Reading

With Ethereum now below a multi -year support level, this area could move on to a strong resistance, further complicating any potential rebound. The market is in a highly volatile phase and operators are observing signs of strength or further reduction risks.

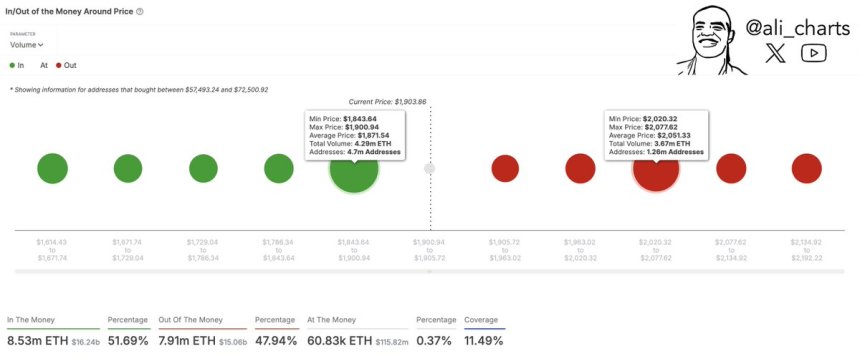

The chain data highlight two levels of key price for the immediate trajectory of Ethereum. $ 1,870 currently acts as a critical support; In the meantime, $ 2,050 are now his most demanding resistance, acting as a great barrier that Eth must recover to confirm a turnaround.

For now, Ethereum remains vulnerable, with an action of the uncertainty driving price. If bulls do not defend current support, Eth could see further declines, but a resistance success could arouse renewed trust in the market. The next few days will be crucial to determine the short -term direction of the hat.

Ethereum deals with the critical test while the bulls struggle to recover $ 2,000

Ethereum is at a crucial turning point, exchanging close to the lowest level from October 2023 since bears maintain control. After weeks of sales pressure and uncertainty, bulls must recover the sign of $ 2,000 as soon as possible to prevent a further disadvantage and restore market trust.

Reading Reading

The wider macroeconomic panorama remains uncertain, with the fears of the commercial war and the global financial instability that weigh heavily on the equity and American share markets. These factors laid the foundations for a potential deeper correction, leaving investors to the limit. However, some analysts believe that a market recovery is still possible in the coming months, in particular if Ethereum can regain key resistance levels.

The high -level analyst Ali Martinez recently shared the chain metrics, identifying $ 1,870 as a stronger level of support than Ethereum. This means that if ETH breaks below this area, a further decline could be imminent. On the positive side, $ 2,050 are now the most demanding resistance of Ethereum, acting as a crucial barrier that the bulls must overcome.

If Ethereum successfully claims $ 2,050, it will signal a strong turnaround, potentially preparing the foundations for a powerful recovery rally. The next trading sessions will be fundamental, since ETH must retain its land or the risk more downloaded, with investors who carefully monitor price actions.

Eth Bulls must contain over $ 1,900

Ethereum is currently negotiation at $ 1,920following Days of consolidation below the crucial level of $ 2,000. Despite attempts to push higherbulls they fought to claim the groundleaving Eth in a vulnerable position.

To confirm a recovery, the Eth must break the score of $ 2,000 and push over the average of 4 hours 200 (MA) and the exponential mobile average (EMA) about $ 2,400. A successful recovery of these levels would signal a renewed momentum for the purchase, potentially placing the stage for a strong rally towards higher resistance areas.

However, if Ethereum cannot recover these levels, the sales pressure could intensify, guiding Eth towards areas of demand about $ 1,750. A break below this level would make even more pressure on the bulls, potentially leading to a further disadvantage and an extensive bearish feeling.

Reading Reading

With the still fragile market conditions, Eth’s short -term direction remains uncertain. Bulls must intervene early to defend the key levels or Ethereum risks losing further soils, making rapid recovery much more difficult. The next few days will be crucial, since traders Eth look for a breakout movement or further downward in response to larger market trends.

First floor image from Dall-E, TradingView chart