Ethereum is approaching a fundamental moment while pushing to recover the level of $ 2,600, with the aim of freeing themselves from weeks of lateral action. After negotiating in a narrow range since the beginning of May, ETH is now testing the upper limit of its consolidation area, a move that could mark the beginning of a new rise in the second largest cryptocurrency in the world.

Reading Reading

The market participants are looking closely at this level, since a successful breakout greater than $ 2,600 would probably attract the momentum buyers and confirm the renewed force in the Alfain sector. However, the breakout is far from guaranteed. If the bulls are unable to support this move, Ethereum could face a renewed sales pressure, with the price potentially revisiting lower support areas.

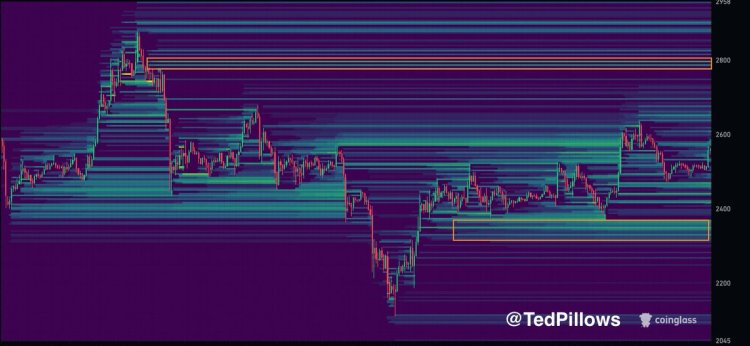

According to marrow data, liquidity clusters are clearly defined at $ 2,800 and $ 2,350. These levels will probably act as magnets in the next few days, depending on how Ethereum responds to current resistance. A clean break towards $ 2,800 would confirm the bullish intent and the wider shoulders Altcoin, while a refusal could strengthen the bearish feeling.

Ethereum’s next move could turn on Altseason

Altcoin remain almost 50% below the historic tops, but the upward momentum is silent. Ethereum, the Altcoin market leader, has consolidated in a well -defined interval between $ 2,400 and $ 2,700 from the beginning of May. This prolonged lateral action has maintained most of the Altcoin sector in a state of indecision. Now, traders and analysts agree: Ethereum must burst to guide the next main move.

The market analyst Ted Cushions identifies two key levels of liquidity for ETH: $ 2,800 on the rise and $ 2,350 on the reverse of the medal. These areas represent the most likely destinations for the short -term price, depending on which part of the range it stops first. If Ethereum pushes over $ 2,800 forcefully, it would probably trigger a renewed appetite at risk and a large -based altcoin rally. On the other hand, a failure less than $ 2,350 could lead to deeper corrections throughout the line.

So far, the bulls have defended the level of $ 2,500 well and a growing open interest suggests that investors are positioning for an expansion. A decisive breakout in both directions will solve weeks of consolidation and determine the short -term tendency. Until then, Ethereum remains the Gatekeeper of the moment of Altcoin: his next move could define the path for the entire market.

Reading Reading

Eth Test Resistance between the structure linked to the range

Ethereum is currently exchanged at $ 2,563, in the balance just below the sign of $ 2,600, a level that has acted as a short -term resistance between June and early July. As shown in the 12 -hour table, ETH was trapped in a horizontal consolidation structure between $ 2,400 and $ 2,700, with no more attempts to break both parties convincingly.

The price remains above the 50, 100 and 200 (SMA) mobile averages, which is a positive sign for bulls. The SMA 100 at $ 2,532 and the SMA 200 at $ 2,206 has offered strong dynamic support during recent Pullbacks, strengthening the current trend structure.

The volume remains moderate, suggesting that the market participants are waiting for a clear breakout before entering with condemnation. A decisive closure greater than $ 2,600 would open the door for a passage to $ 2,800, where large liquidity clusters were identified by the passenger compartment.

Reading Reading

However, the failure to maintain this short -term momentum could reject Eth towards the support area of $ 2,400. The bulls have defended this level several times and a break below it would probably invalidate the upward configuration and increase the risk of a deeper correction.

First floor image from Dall-E, TradingView chart