Ethereum resumed $ 2,800 during the past day, since the chain data show that whales made enormous withdrawals from exchanges.

Ethereum Exchange Deconflow has increased after a price crash

According to data from the market platform Intheblock market, investors reacted to the last collapse of the price of Ethereum making deflowers from exchanges.

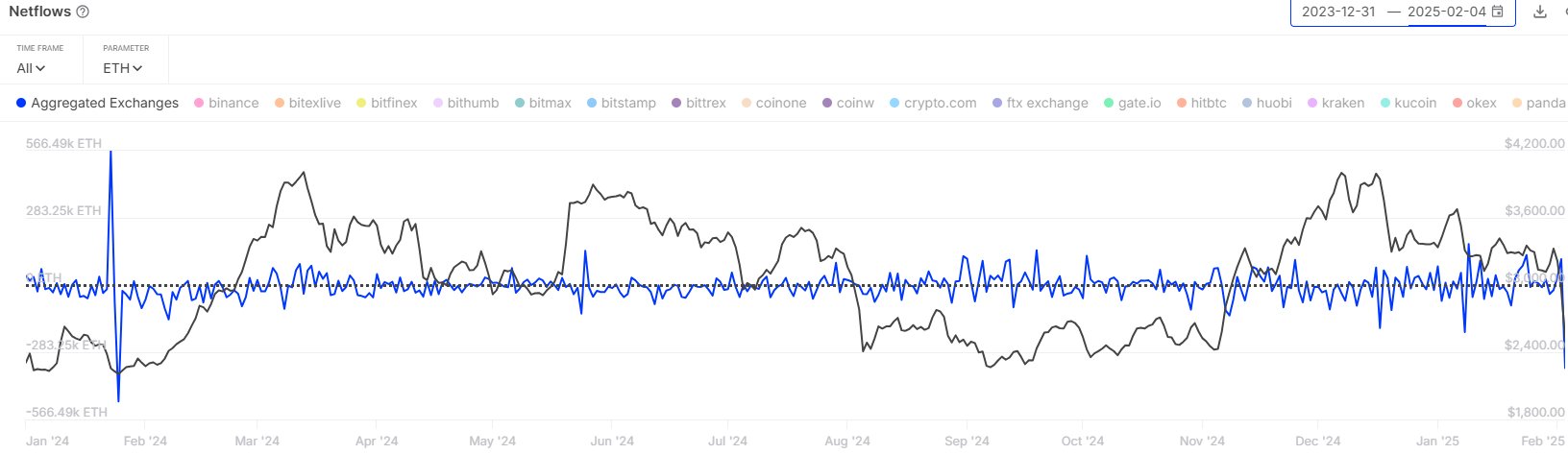

The indicator of relevance on chain here is the “Exchange Netflow”, which keeps trace of the net amount of the cryptocurrency that is entering or leaving the wallets associated with all centralized exchanges.

When the value of this metric is positive, it means that the owners are depositing a net number of coins in these platforms. As one of the main reasons why investors move to exchanges is for sales purposes, this type of trend can be a bearish sign for the price of the activity.

On the other hand, the indicator being negative suggests that the deceased exceeds the afflusted and a net number of token is moving from exchanges. This trend may indicate that investors are accumulating, which is something that can naturally be bullish for Eth.

Now, here is a graph that shows the trend in the exchange of Ethereum Netflow in the last year:

As is visible in the upper graph, Ethereum Exchange Netflow observed a massive negative peak yesterday after the accident of the activity price occurred.

In total, investors withdrawn 350,000 ETHs (for a value of about $ 982 million to the current token exchange rate) from exchanges in this madness of flow. “This is the highest amount of net exchange samples since January 2024!” Note the analysis company.

Given the times of the deceased, it would seem likely that they were made by the whales who tried to buy Ethereum at cheap post-crash prices. The accumulation of investors in turn helped the cryptocurrency to reach a fund and recover.

Netflow exchange could now be to keep an eye on in the next few days, since the imminent trend could also affect the ETH price. Of course, a continuation of the deceased would be a positive sign, while an increase in the afflusted could write a bearish result.

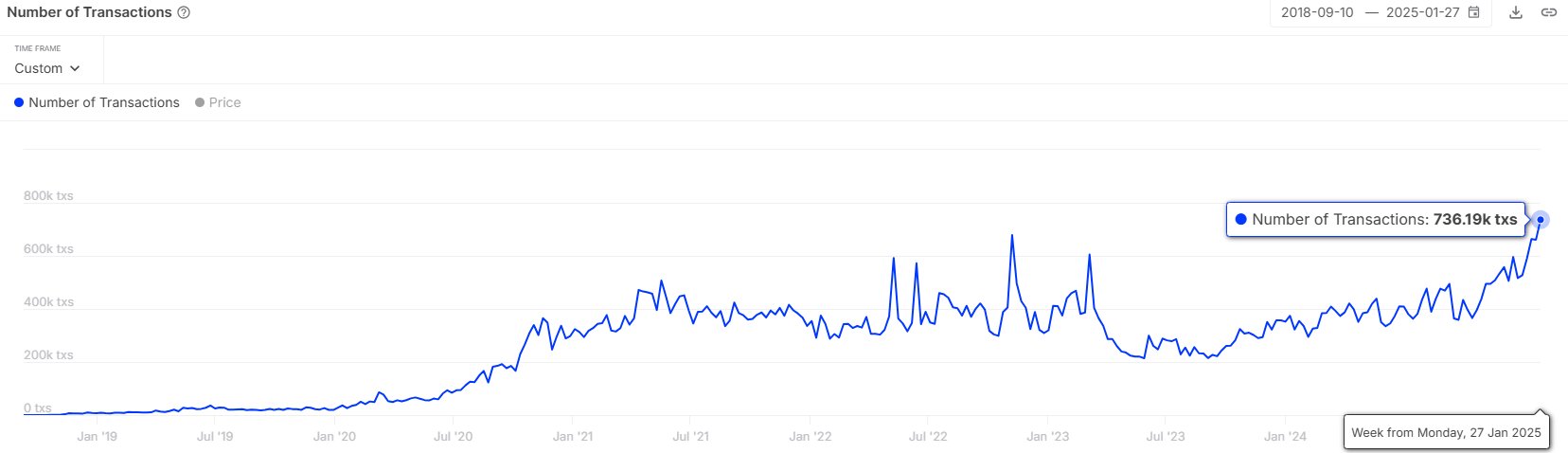

In some other news, the number two of Stablecoin for market capitalization, USDC, has seen its counting of recently scattered transactions, as under the Inttheblock pointed out in another x post.

“The USDC is becoming increasingly popular, with the number of daily transactions increasing over 119% in the last year!” The analysis company says. Stablecoins can end up acting as a fuel for volatile activities such as Ethereum, therefore a greater activity relating to them can be a good sign for the market.

Eth price

At the time of writing, Ethereum is floating about $ 2,800, down by more than 11% in the last seven days.