This article is also available in Spanish.

Ethereum (ETH) continues to lose ground to Bitcoin (BTC) as the latter’s dominance increases, with US President-elect Donald Trump taking office later today. At the time of writing, the ETH/BTC trading pair stands at 0.031, marking a four-year low for the ratio.

ETH/BTC Continues to Fall as Trump Focuses on Bitcoin

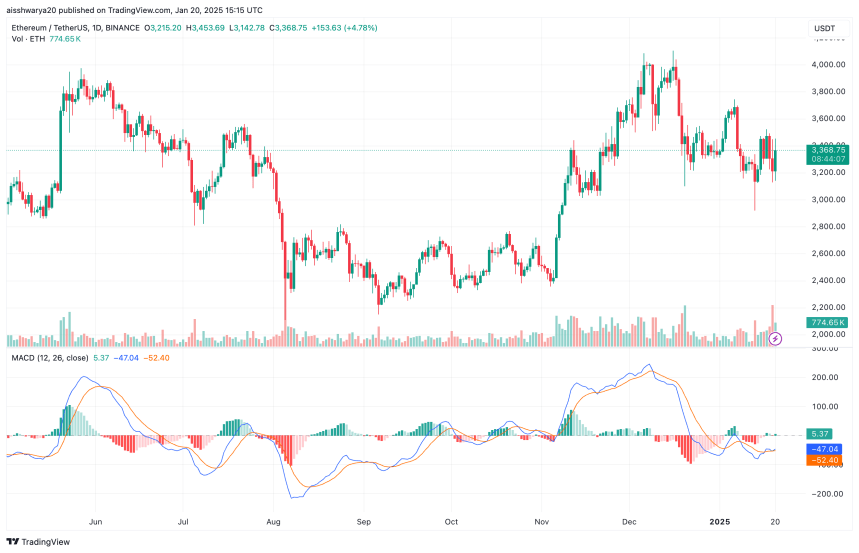

Over the past year, Bitcoin has appreciated an impressive 158%, rising from approximately $41,000 on January 21, 2024 to $107,608 at the time of this writing. The cryptocurrency has consistently reached new all-time highs (ATH) throughout the year. In contrast, Ethereum has generated a modest return of around 35% over the same period and remains 32% below its November 2021 ATH of $4,878.

Related reading

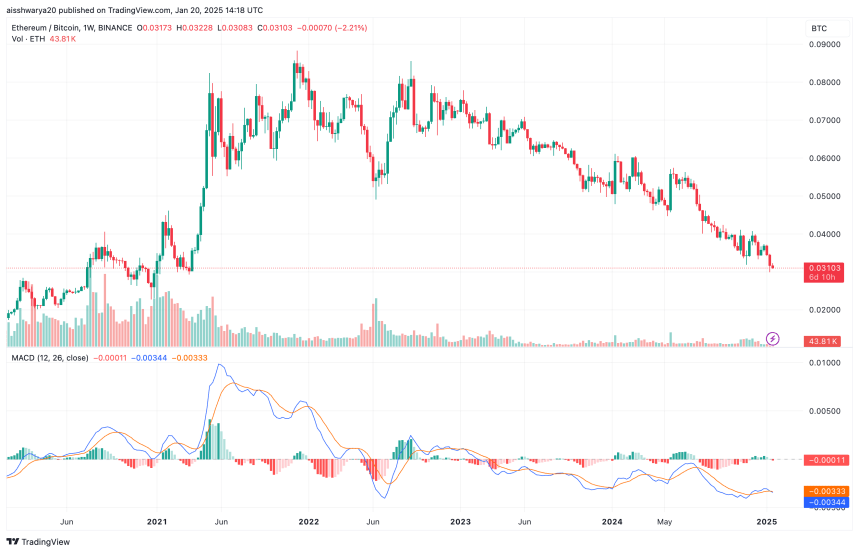

According to the weekly chart below from TradingView, the ETH/BTC trading pair, also called the ETH/BTC ratio in the cryptocurrency industry, has hit a new four-year low. This drop has raised concerns about the likelihood of an Ethereum-led altcoin season.

Currently trading at 0.031, the ETH/BTC ratio has erased all gains accumulated since March 2021. The pair peaked at 0.087 in December 2021, during the height of that year’s altcoin season. Since then, however, Ethereum, the second-largest digital asset by market capitalization, has seen a steady decline versus Bitcoin.

In May 2024, the ratio fell below 0.054, a critical support level that had remained stable in June 2022. Several factors contributed to Ethereum’s underperformance, including Trump’s perceived preference for Bitcoin and increasing competition from part of rival smart contract platforms like Solana (SOL).

Unlike Bitcoin, Ethereum has struggled with adoption. Companies around the world are increasingly incorporating Bitcoin into their balance sheets, reinforcing BTC’s status as a leading digital asset. Furthermore, speculation about the creation of a strategic Bitcoin reserve in the United States has further strengthened the limited supply narrative of Bitcoin, driving its price higher.

In contrast, Ethereum is relatively high issue rate questioned his “ultrasonic money” narrative. Ethereum’s performance in 2024 has also eroded the confidence of some of its largest holders. Specifically, an ETH whale recently sold 10,070 ETH with a loss of $1 million, signaling declining investor confidence.

Will 2025 Change Ethereum’s Fortunes?

Although 2024 was a challenging year for Ethereum in terms of price performance, crypto analysts remain optimistic about the asset’s prospects in 2025. For example, a report from Steno Research predicts that Ethereum could rise to $8,000 this year.

Related reading

Likewise, crypto analyst Daan forecasts that the ETH/BTC trading pair could break above 0.04 during the first quarter of 2025. In December 2024, Ethereum Exchange Traded Funds (ETFs) experienced renewed interest from institutional investors, raising hopes of significant capital inflows into the smart contract platform.

That said, Ethereum must first overcome strong resistance at the $4,000 price level. As of this writing, ETH is trading at $3,368, down 1.3% over the past 24 hours.

Featured image from Unsplash, charts from TradingView.com