In August, ETHEREUM encryption increased by 40 %. This increase is unprecedented. At this pace, the ETH USD is not limited to inch only from its highest levels in 2021, but Crypto ETH can easily rise up to $ 5,000 in the third quarter of 2025. Given all the upscale events about Ethusdt, it is a surprise that the data shows greatly that is unstable for the ethics closed in advance via platforms for different liquid resolution, including Lido.

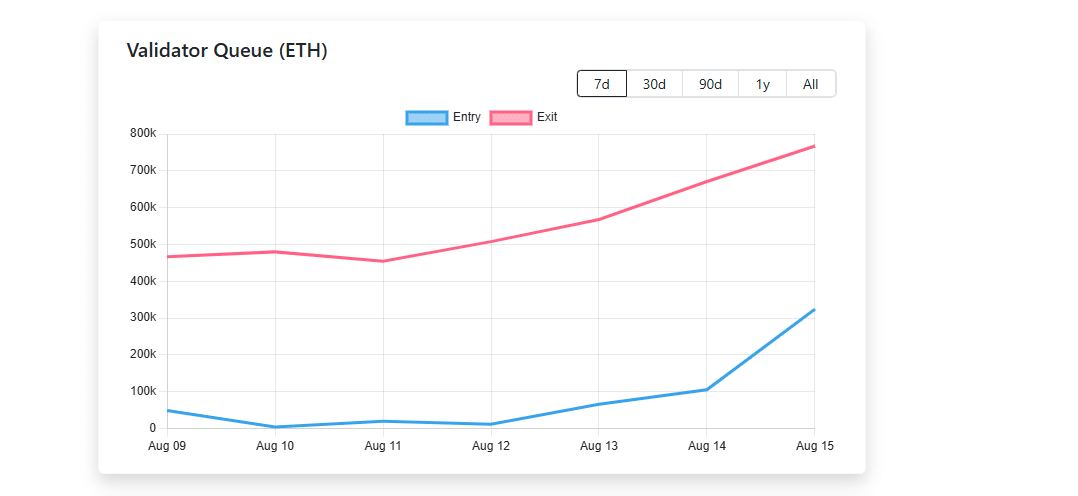

The latest joint reports on X show that the record is 761,000 ETH at a value of $ 3.6 billion at immediate prices has immersed the unstable waiting list. Interestingly, the urgency to cancel the brightness of ETH coincides with the decline in prices, which affects some Top Solana Meme Coins.

1/ Register number from $ ETH In the unstable waiting list:

671k $ ETH = 3.2 billion US dollars

What’s more, the waiting time in the waiting list has reached a record of about 12 days.

Why does that happen? Some reasons: pic.twitter.com/w2daxxome

– Ignas | Defi (Defiignas) August 14, 2025

ETH USD decreases from $ 4,750

From the daily chart of ETH USD, prices fell from about $ 4,750 to less than $ 4,500.

In conjunction with this projection is a rise in trading volume, indicating potential sellers who stand their position, and make gains. Technically, the closure above $ 4,800 is exactly what is required Eth 1.26 % Checks to an altitude of up to $ 5,000, printing a new height ever.

However, if the sellers take over today, less than 4,440 dollars may witness the adverse gains ETH, although the next station is $ 4000. It is psychological support, on the occasion of the previous resistance that crowned the bulls in July 2025.

Discover: Best ICOS Mimi Investment in 2025

The race to cancel Ethereum, what happens?

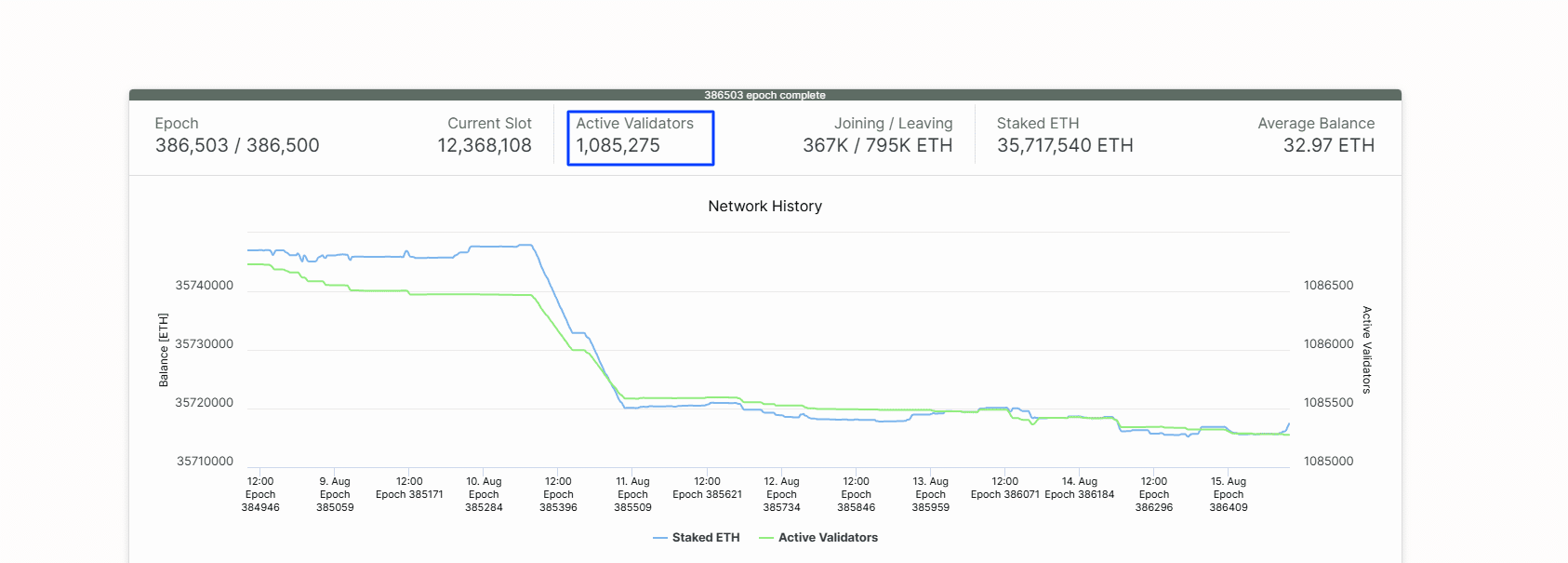

Given the status of Ethusdt case, the movement by UNSTAKE can accelerate the sale. Being a ventilation network, ETHEREUM depends on auditors. There are more than a million honesty, on average, closed more than 32 ETH, helping to secure ETHEREM, and in return, they earn bonuses and fees.

(source: Beachocha.in))

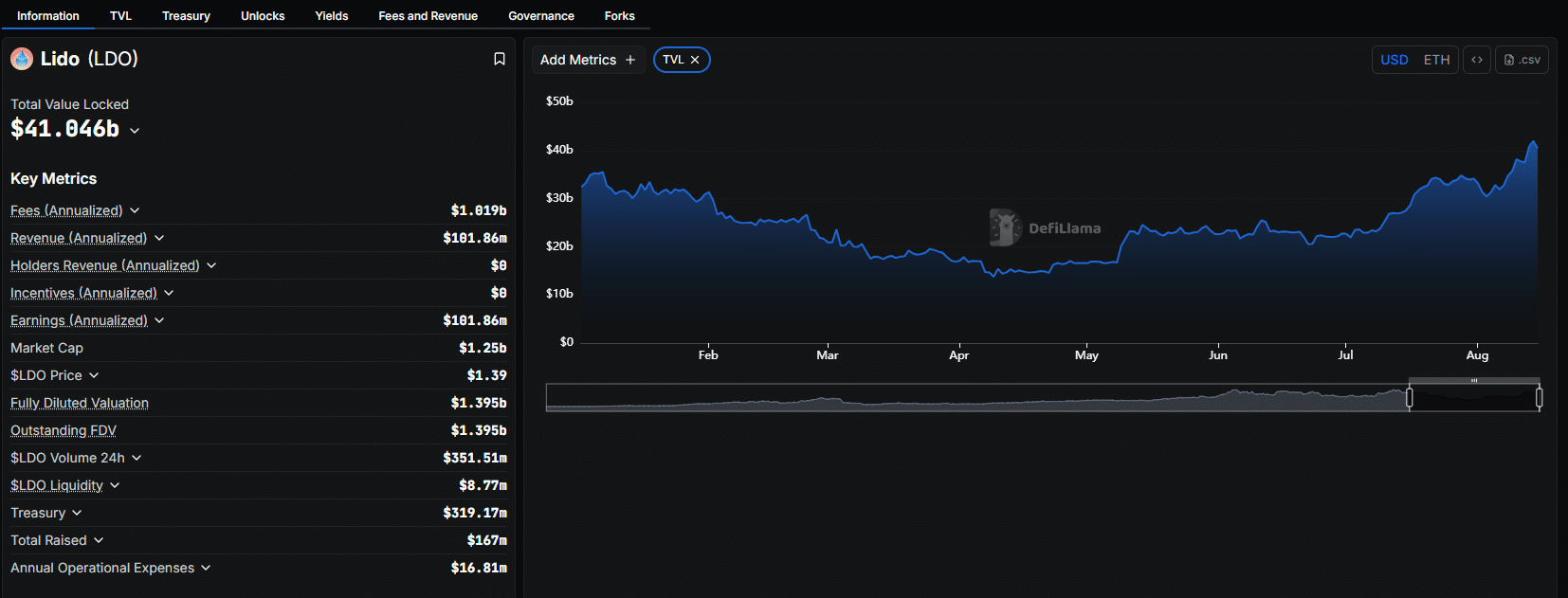

Although at least 32 ETH is needed to run the ETHEREUM auditor, there are other service providers, including Lido Finance and Rocket Pool, and ETH collects from their holders and share the network before distributing rewards.

As of August 15, Lido Finance, one of the Stoke Liquid platform, is among the largest Defi Protocol. According to Dolama, the protocol runs more than $ 41 billion of assets, most of which are ETH.

(source: Devilia))

It has now appeared that there is a urgency between ETH holders

Within a few days, the waiting list increased from less than 2000 ETH to more than 760,000 ETH. As a result of this explosion, the ethereum exit mechanism, which limits the auditor every period.

(source: Audit list))

Before this height, it took about 6.4 minutes until the withdrawal is treated. It now takes more than 12 minutes, which indicates the stress facing Ethereum to destabilize the network.

He discovers: 9+ best highly risk, highly bonus for purchase in 2025

Are profit holders get profit?

Of course, the question is: What is all the withdrawal to withdraw? Looking at this wave, industry experts are convinced that ETH holders are keen to achieve profits and exchange in the assembly.

I have eth, for the month, poor performance versus bitcoin and others Best encryption for purchaseIncluding Solana and Cardano in previous bulls.

With the prosperity of the US dollar prices, those who see this is an opportunity to lock profits. Provided that the prices remain above 4000 dollars, there is a strong incentive to achieve gains.

He discovers: 20+ next to the explosion in 2025

Blame on AAVE?

There is also another possibility that Defi investors, especially in lending protocols such as AAVE, have been reduced.

Galaxy Digital notes that from mid -July, ETH borrowing rates on decentralized financial markets increased, most of them AAV, from less than 3 % to more than 18 % within days.

As a result, users who wanted to borrow and restore any economic incentive to do so because the borrowing rate was high but Mainnet ETH’s revenues were less.

Since this vulnerability was sealed, it caused relaxation of the ETH position, which affects even Justin Sun who had to do so Withdraw $ 600 million from ETH from AAVE.

Currently, the AAVE ETH borrowing rates settled less than 3 % but did not prevent instability.

He discovers: 1000x Crypto: 10+ encrypted codes that can reach 1000x in 2025

The Ethereum Eritanians did not destroy more than $ 3 billion, Eth USD Falls

- Ethereum holders are scrambling for turmoil

- ETH USD decreases from $ 4,750

- The urgency to cancel the surface may be due to taking profits

- Experts also refer to the potential Defi

After ETHEREUM hawks did not destroy more than $ 3.6 billion, ETH USD Falls: What is happening? First appeared on 99bitcoins.